Greenlight Kids & Teen Banking Software

Company Name: Greenlight Financial Technology, Inc.

About: Greenlight is the smart debit card for kids that parents manage from their phones.

Headquarters: Atlanta, Georgia, United States.

Greenlight Kids Teen Banking Overview

What is Greenlight Kids Teen Banking?

Greenlight is a debit card and banking app designed for kids and teens. It comes with an educational investing platform for the whole family. The app has two different experiences for kids and parents. Kids can learn to save, earn, invest, spend, and give with parent approval on every transaction. Parents can manage chores and allowances, set parent-paid interest rates, invest for their kids' futures, and choose the exact stores where their kids spend.

Features

- Kids and teens can track balances in Save, Earn, Invest, Spend, and Give accounts

- Parents can invest for college or any other goals with an easy, flexible platform

- Kids can receive money from friends and family

- Parents can send money instantly and receive real-time alerts of kids' spending activity

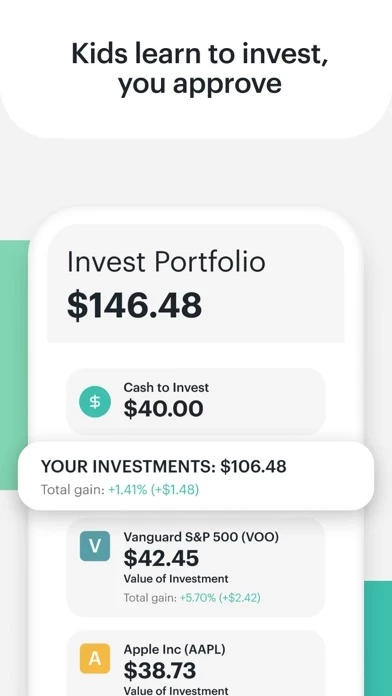

- Kids can learn to invest in stocks of their choice and research their favorite companies

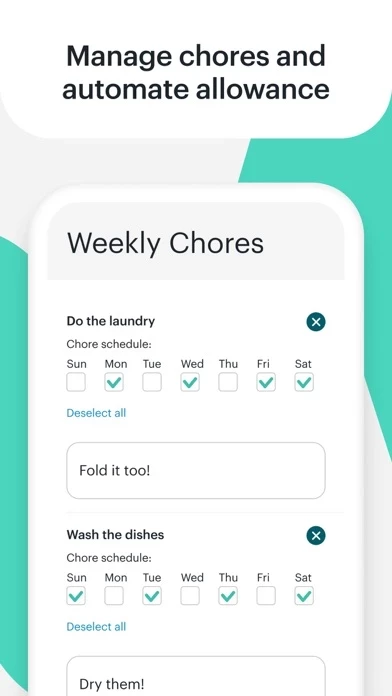

- Parents can manage chores, approve kids' investments, automate allowances, put limits on spending, and set parent-paid interest rates

- Kids can set savings goals and set up direct deposit for their paychecks

- The app supports Apple Pay, Google Pay, and Samsung Pay

- The app comes with an EMV chip and parent-controlled PIN for safety

- The app has automated blocked categories for unsafe spending

- The app uses several security features to help protect accounts from unauthorized access

- Funds available through the Save, Earn, Give, and Spend functionality are FDIC-insured through the partner Community Federal Savings Bank

- Funds available through the Invest functionality are not FDIC-insured but may be SIPC-insured through the partner DriveWealth, LLC

- The support team is available 24/7

- The app is not a bank but facilitates banking services through Community Federal Savings Bank, Member FDIC

- Investment Advisors, LLC, an SEC Registered Investment Advisor, provides investment advisory services to its clients.

Official Screenshots

Greenlight Kids Teen Banking Pricing Plans

| Duration | Amount (USD) |

|---|---|

| Billed Once | $6.76 |

| Monthly Subscription | $5.49 |

**Pricing data is based on average subscription prices reported by Justuseapp.com users..

Product Details and Description of

Greenlight is the debit card and banking app for kids and teens, complete with an educational investing platform for the whole family. With the Greenlight app, kids and parents have companion apps with two different experiences. Kids learn to save, earn, invest, spend and give — with parent approval on every transaction. Parents can choose the exact stores where their kids spend, manage chores and allowances, set parent-paid interest rates and more. Parents can also invest for their kids’ futures — college, first car or any other goals. Kids can’t spend what they don’t have. No overdraft fees. No overspending. No surprises. PARENTS CAN: - Invest for college — or anything else — with an easy, flexible platform - Send money instantly - Receive real-time alerts of kids’ spending activity - Turn card on or off from the app - Manage chores - Approve kids’ investments - Automate allowances - Put limits on spending - Set parent-paid interest rates - Manage access and budgets for ATM withdrawals KIDS AND TEENS CAN: - Track balances in Save, Earn, Invest, Spend and Give accounts - Receive money from friends and family - Manage their own budgets - Learn to invest in stocks of their choice and research their favorite companies - Set savings goals - Set up direct deposit for their paychecks - Use Apple Pay, Google Pay and Samsung Pay SAFETY FIRST. AND SECOND. AND THIRD - Greenlight comes with an EMV chip and parent-controlled PIN - No cash back at the register to curb unmonitored spending - Automated blocked categories for unsafe spending - Greenlight uses several security features to help protect your accounts from unauthorized access - Funds available through the Save, Earn, Give and Spend functionality are FDIC-insured, through our partner Community Federal Savings Bank - Funds available through the Invest functionality are not FDIC insured but may be SIPC insured through our partner DriveWealth, LLC. Our Support Team is available to help 24 hours a day, 7 days a week Your California Privacy Rights: https://www.greenlight.com/privacy/#your-california-privacy-rights Do Not Sell My information: https://www.greenlight.com/data-request/Greenlight Greenlight is a financial technology company, not a bank. The Greenlight app facilitates banking services through Community Federal Savings Bank, Member FDIC. The Greenlight card is issued by Community Federal Savings Bank, Member FDIC, pursuant to license by Mastercard International. Investment Advisors, LLC, an SEC Registered Investment Advisor provides investment advisory services to its clients. Investing involves risk and may include the loss of capital. We only use the Value of Investment within the app store screen to show how the app works. It does not represent real customer investments or accounts.

Top Reviews

By Mommy's theft

Great customer service!

Our kids received these cards for Christmas and they are loving the independence it brings! I had an issue where my child’s phone number had changed and was now my other child’s number and I couldn’t find a way to change this on the app so I emailed customer service and they respond the next day and got the info to change the info in the system. Very friendly, very thorough, very fast service!! Would recommend this to everyone!! Now my daughter can stop trying to buy things with handfuls of change she finds lol she can give the change to us and we put the amount on her card!!! Edit- we have had these cards for over a year now! Loving them even more with the new savings options!! Our kids can see how close or far they are from a special savings goal. PLUS now we can give their grandparents links to send them money straight to their cards for gifts!! No more lost birthday money!! We had old savings accounts for them at a bank but they aren’t even used now. The kids love being able to manage their own money at a glance in the app! Have used customer service a couple more times and have still been helped promptly and they are extremely nice!!

By NaiTheCutieTheOnly1

A 9 year-old that loves shopping

Well I’m nine years-old and my mom got me this card. So the only reason why I have this card is because my uncle had recently not really but like 1 year ago he had made my cousins which are his children these nice cards and then he made my twin cousins one and then he made their older sister one. So I basically was a little bit jealous that they had a debit card with no money, but I realized that if I asked my mom for one it would be more likely that she puts the money that I get on Chinese New Year from my dad. So then I kept begging her until one day she did it and you guys sent me a message to join my mom, but she wanted it to be a surprise, but it still was because I don’t have my notifications on so I looked at my messages and saw it. Then I was so excited and when it got mailed my mom gave it to me and I put it in my wallet, but she still hasn’t put in the money because I recently just have gotten it. I recommend this debit card for kids that like to explore and learn how to count money. Also my 5 year-old cousin has one of these and hasn’t spent a thing. I highly suggest everyone trying this debit card for kids. Thanks Greenlight!!! -Nathalie-Stefania-Loo-Ramirez

By Nunyabuznes

Great Customer Service

I just signed up for Greenlight however I confused it with another service that had feature I really thought would benefit my child. I am always nervous when canceling required a phone call, because it usually includes some really pushy attempts to make you stay. My husband was on the phone with one company over two hours trying to cancel. It’s scarred us for life! (Haha) So I braced myself and called Greenlight to cancel. After one man took my general information and then told me he was transferred me to the cancellation department, I automatically thought, oh great here we go. My defenses went up and I was ready to battle. Turns out Greenlight plans to add the feature I wanted in a couple months and was willing to give me discount in order to stay and have the opportunity to compare the two services. Being in defense mode, I wasn’t open to staying.... and I will say the guy on the phone was not remotely pushy and was super nice. The second I hung up I asked myself why I didn’t stay. I have had so many horrible customer service experiences, especially when trying to cancel a service it actually caught me off guard to have nice genuine customer service.