Taxfix Présentation

- Pour 29,90 €, nos experts vérifient votre déclaration, elle est ensuite envoyée automatiquement sur impots.gouv.fr via l'application.

-Notre chaleureuse équipe d'experts sont à votre service et se feront un plaisir de vous accompagner ainsi que de vous aider à tout moment.

- Taxfix, c'est la seule déclaration qui identifie pour vous toutes les réductions, déductions et crédits d'impôts.

Captures d'écran officielles

Détails du produit et description de

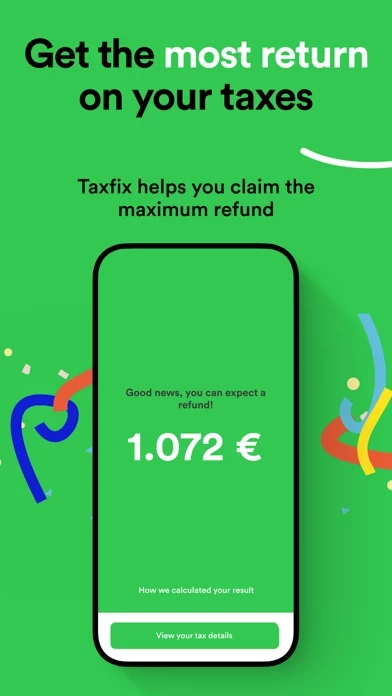

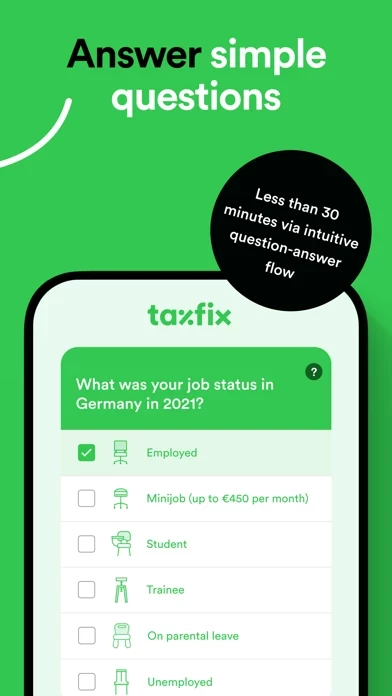

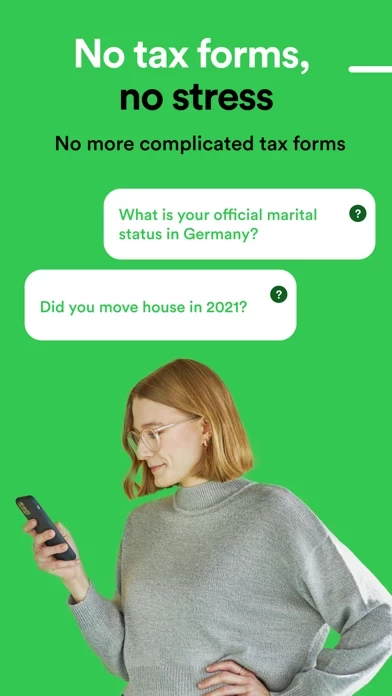

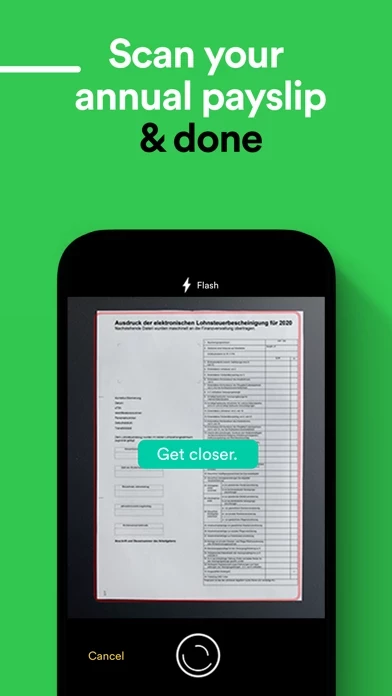

The #1 app to file your tax return conveniently and in under 30 minutes! On average, taxpayers receive a refund of €1,072. Imagine a world where doing taxes isn't complicated. No degree in tax law needed, no paper trail – just effortless, risk-free, and fast tax filing. With l’application, all this is possible. Download the App now and take control of your financial wellbeing! Whether you're an employee, trainee, student, pensioner, or expat, you can now take your taxes into your own hands! // Step by step Our app collects important info in a simple, conversational way – much like an interview. The intelligent question flow ensures that you only answer questions relevant to your case. // No tax expertise required You don't need tax knowledge to answer our questions. If you are unsure about something, the info boxes within the app offer assistance at any point. // Simply photograph your documents Upload photos of your annual payslip (Lohnsteuerbescheinigung) and a document to confirm your identity. To save you effort, we automatically transfer all relevant data from your annual payslip to the corresponding fields of your tax return. // Risk-free calculation Compared to the classic paper-form tax return, l’application's calculation offers a distinct advantage: It's completely risk-free! Have your refund calculated free of charge and then decide whether you would like us to submit your tax return to the tax office. // Paperless transmission Your tax return gets filed electronically, using the tax authorities' official ELSTER interface. Thanks to the paperless transmission to your local tax office, you don't need to print or sign anything. It’s a completely contactless transaction. // Fair pricing policy Downloading, using the tax app and calculating your tax refund are all free. For a flat fee of €39.99, or €59.99 for married couples and civil partnerships, you can submit your tax return directly to your local tax office. // Fast & efficient Did you know that taxpayers in Germany can look forward to an average refund of €1,051? Or that you're able to file your tax returns retroactively for up to four years? This would amount to a combined average tax refund of over €4,000. With l’application, you can complete a tax return in approx. 22 minutes! So –what are you waiting for? We created l’application to support as many taxpayers as possible in claiming their well-earned tax refunds. Our app always works to your advantage – any lump sums or deductions that apply are automatically considered! // Instant Refund l’application GmbH (Köpenicker Str. 122, 10179 Berlin) enables interested clients to receive 50% of the expected tax refund in advance as a loan through the credit institution CB Bank GmbH. Half of the refund will be paid immediately, provided that the receiving bank offers SEPA Instant Credit Transfer. The loan contract comes into effect in case of a positive credit check with CB Bank GmbH. The mediation of the loan contract is free of charge. Details of the loan agreement: - Term: 12 months, early repayment is possible at any time. - Effective annual interest rate in % p.a.: 0%. Sample calculation: Calculated tax refund for 2021 tax return: EUR 1,000 Net loan amount: EUR 500 Debit interest in % p.a. of the net loan amount, tied for the entire term: 0% Effective annual interest rate in % p.a.: 0 Term: 12 months Please note: To guarantee the best possible quality of our service, l’application currently only focuses on certain tax cases. For this reason, our tax app does not yet support the following groups of people or income at the moment: - Self-employment & freelancers - Private pensions - Income from renting and leasing - Income from forestry and agriculture - Year-round limited tax liability - Double income (= from more than one country at the same time) - Income from abroad during your stay in Germany (except for interest and dividends, subsequent salary for previous activities abroad, and V + V / L + F from EU / EEA)

Haut Avis

Par Marinthewind

Great app

I was able to file my german tax declaration in half an hour while lying on my bed! Super easy to use and to understand!

Par Green*49

Easy, reliable

Very easy to use, reliable. And I was surprised to see how fast it was! I will use l’application again.