Fidelity Investments Software

Company Name: Fidelity Investments

About: FIS is a global leader in financial services technology.

Headquarters: Jacksonville, Florida, United States.

Fidelity Investments Overview

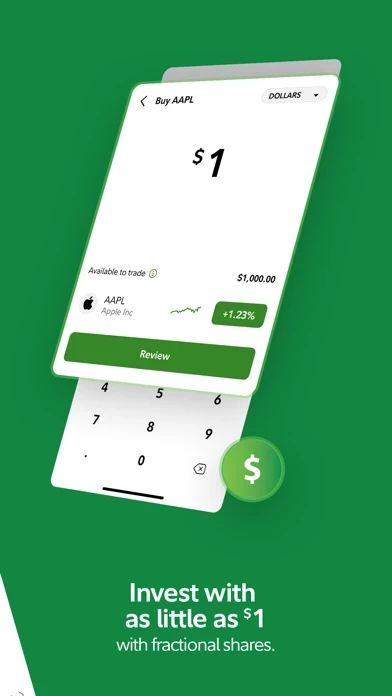

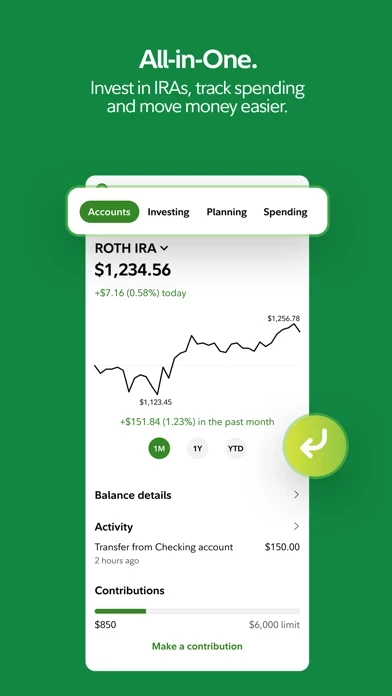

What is Fidelity Investments? The Fidelity app is an award-winning financial app that provides access to industry-leading research, market insights, and educational resources to help users make informed decisions with their money. The app offers commission-free trades for US stocks and ETFs, no account fees or minimums, and fractional shares for as little as $1. Users can deposit checks, pay bills, track spending, and more, all backed by Fidelity's 75 years of financial expertise. The app also offers 24/7 customer support, alerts and notifications, and enhanced accessibility features.

Features

- Commission-free trades for US stocks and ETFs

- No account fees or minimums

- Fractional shares for as little as $1

- Deposit checks, pay bills, and track spending

- Industry-leading research and market analysis

- Advanced chart indicators for technical analysis

- Real-time quotes and market monitoring

- Educational resources including podcasts, articles, and videos

- Customizable alerts and notifications

- 24/7 customer support with state-of-the-art security

- Enhanced accessibility features including voiceover and dynamic type.

Official Screenshots

Product Details and Description of

Secure your financial future with Fidelity’s award-winning app. Get access to industry-leading research, timely market insights, and dynamic educational resources, to help you make informed decisions with your money. Getting started is easy with no account fees or minimums to open a retail brokerage account, commission-free trades for US stocks and ETFs, and fractional shares for as little as $1. Deposit checks, pay bills, track spending, and more, all backed by 75 years of Fidelity’s financial expertise. Here’s how to get started: - Create an account - Add funds - Make your first investment Looking to manage your workplace benefits like a 401(k) or HSA? Download our NetBenefits® app in the “More by Fidelity Investments” section below. What’s inside the Fidelity app: Powerful trading tools - Trade stocks, options, ETFs, and mutual funds using industry-leading research and market analysis. - Use advanced chart indicators for on-the-go technical analysis. - Monitor markets with real-time quotes. Cash management - Trade, transfer, deposit checks, and pay bills. - Schedule transfers and automate investments. Financial learning at its best - Build your confidence with podcasts, articles, videos, and more. Alerts and notifications - Receive timely, customizable alerts to help you manage your money. - Set price triggers so you never miss an entry or exit on your investments. 24/7 Customer support - Get state-of-the-art security in 2-factor authentication and voice biometrics. - Tap to chat with a Virtual Assistant 24/7. Accessibility - Use enhanced voiceover and dynamic type. To learn more, go to https://www.fidelity.com/mobile/overview. Additional information Options trading entails significant risk and is not appropriate for all investors. Certain complex options strategies carry additional risk. Before trading options, please read our Characteristics and Risks of Standardized Options risk disclosure document. Supporting documentation of any claims, if applicable, will be furnished upon request. $0.00 commission applies to online U.S. equity trades, exchange-traded funds (ETFs), and options (+ $0.65 per contract fee) in a Fidelity retail account only for Fidelity Brokerage Services LLC retail clients. Sell orders are subject to an activity assessment fee (from $0.01 to $0.03 per $1,000 of principal). There is an Options Regulatory Fee that applies to both option buy and sell transactions. The fee is subject to change. Other exclusions and conditions may apply. See Fidelity.com/commissions for details. Employee equity compensation transactions and accounts managed by advisors or intermediaries through Fidelity Clearing & Custody Solutions® are subject to different commission schedules. Zero account minimums and zero account fees apply to retail brokerage accounts only. Expenses charged by investments (e.g., funds, managed accounts, and certain HSAs) and commissions, interest charges, or other expenses for transactions may still apply. See Fidelity.com/commissions for further details. System availability and response times may be subject to market conditions. Images included here are for illustrative purposes only. StockBrokers.com 2022 Online Broker Review, January 2022: Fidelity was ranked No. 1 overall out of 15 online brokers evaluated in the StockBrokers.com 2022 Online Broker Review. Investopedia, January 2022: Fidelity was named the #1 online broker and best broker for low costs among 23 brokers reviewed. Fidelity was named NerdWallet's 2022 winner for Best Online Broker for Beginning Investors, Best Online Broker for IRA Investing and Best App for Investing. Results based on evaluating 16 brokers per category. ©2017-2022 and TM, NerdWallet, Inc. All Rights Reserved. Fidelity, Fidelity Investments, and the Pyramid design logo are registered service marks of FMR LLC Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917 762430.38.1

Top Reviews

By Chief Illiniwek Fan!

I can’t imagine a better financial service!😊

I have been a very happy Fidelity customer for 35 years. I tried the big brokerage companies that offer personal service. What did I find out? They grew rich and I barely broke even, even in booming markets. Fidelity gives me the tools and the information I need to make the best financial decisions. My money has grown exponentially so that I can withdraw funds to pay big bills and still see huge gains to my portfolio. It isn’t rocket science. Research the highest yielding funds over the long and short term at the risk level you are comfortable with. Fidelity’s research is sooo darn easy that I can find and print off the research in minutes. I rebalance my funds, drop the dogs, invest in some new winners. It really is that easy. Need money transferred to your bank account? Click, click, you are done. Fees are extremely low too. Need help? Call the 800 number and their very knowledgeable Representatives will assist you quickly and cheerfully. Now I am the one making the money, not my broker. I have taught all of my children to invest with Fidelity and they are light years ahead of their peers financially.

By Tinohuggins

mr.

Every representative of Fidelity that I have ever had the privilege of being helped by has been very friendly, very willing to explain, help, and see to it that I understand the answer that is given me to the question I have asked. Bottom line, the Representatives of Fidelity are honorable, class act employees. Also, even though I read little of it, a library of helps for Fidelity clients is sent out several times a month. I am new at all of this and what I have written is likely very elementary to the Giants who regularly attend this field of knowledge. I'm just very thankful to have been advised to join what to me seems to be a solid and trustworthy business organization that believes that doing right makes right and ends right. Leadership, in my view is often the real difference between success and failure; leadership is most often the whole difference. So, there must be great leadership running Fidelity. Again, at least in my view, leadership is the difference. Especially when God is intentionally and purposefully at the Top in the hearts and minds of those at the helm! Hopefully, that's the case at Fidelity. God bless!!! Tino Huggins

By Compulsive checker of commerce

Excellent platform

First and foremost I can easily buy and sell shares of stocks using the Fidelity platform and now there is no charge to trade . I also appreciate whatever money that is on hold waiting to be invested is automatically placed in an interest earning account that is significantly higher than what I can receive from my regular savings account in my bank . Everything has been very easy and clear from trading to moving money into my brokerage accounts with Fidelity. I use my Fidelity credit card frequently because 2% of that amount automatically goes right into my brokerage accounts at Fidelity per my instructions . There is always personal assistance I can speak to directly if I desire to do so . And lastly there are all kinds of webinars to further my knowledge about trading in general that I can take whenever I have the time to do so. I trust this platform and consider it excellent in executing my trades . I am really a beginner in my second year of trading myself and I love it .