Qapital: Set & Forget Finances Software

Company Name: Qapital, Inc.

About: Qapital empowers people to maximize their happiness by saving, spending, and investing with goals in

mind.

Headquarters: New York, New York, United States.

Qapital Overview

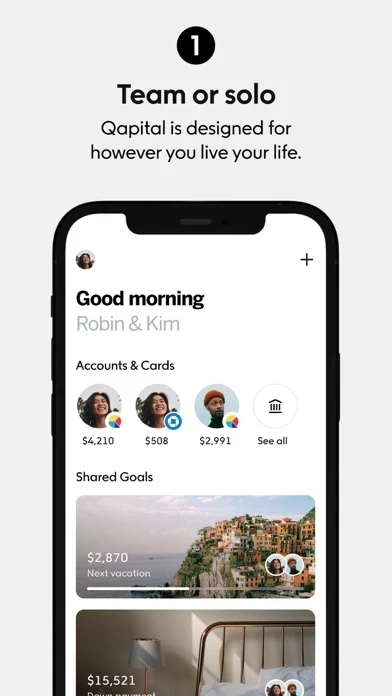

What is Qapital? Qapital is a money management app that uses behavioral science to help users reach their financial goals without changing their lifestyle. The app offers checking, saving, and investing tools that automate the process of saving and budgeting. Qapital's approach works for both individuals and couples, and users can keep their existing bank accounts.

Features

- Payday Divvy: Automatically divides up your paycheck between short- and long-term goals, bills, and discretionary spending.

- Spending Sweet Spot: Helps you adjust your spending week by week while still saving automatically toward your goals.

- Smarter checking: Offers an FDIC-insured checking account with instant access to savings balances, free transfers from savings goals, a Visa debit card that works with Apple Pay and Google Pay, direct deposit with early access to your paycheck, and bill pay.

- Smarter spending: Helps you make sense of your weekly spending habits and discover where you can save.

- Smarter saving: Lets you set savings goals and use smart rules to save toward them automatically. Offers integration with the Apple Health app to save money toward goals when you reach fitness targets.

- Smarter shared finances: Designed for couples, Qapital Dream Team lets you save toward shared goals and see each other's transactions without giving up individual accounts.

- Smarter investing: Qapital Invest offers a simple way to invest by letting you set goals, pick a portfolio and timeline, and leave the rest to the app.

Official Screenshots

Qapital Pricing Plans

| Duration | Amount (USD) |

|---|---|

| Billed Once | $6.00 |

| Monthly Subscription | $6.00 |

**Pricing data is based on average subscription prices reported by Justuseapp.com users..

Product Details and Description of

Your goals, our scientific approach to helping you take charge of your finances… it’s a winning combination that’s already helped more than 2 million people start their journey toward money happiness. Using behavioral science, we’ve developed a smarter money app that helps you reach your financial goals without changing the way you live. The best part – our approach works just as well for couples as individuals. And because we know just how hard (and boring) it is to stick to saving and budgeting plans, this app’s checking, saving and investing tools do the heavy lifting for you – automatically. ***** this app is built on the idea that money happiness is personal. That’s why this app puts your Goals front and center, then helps you plan your spending, saving and investing around them. And you don’t need to give up your existing bank account. 1. Stop budgeting, start Qapitalizing Let’s face it, traditional budgeting simply doesn’t work for most people. Life gets in the way, or we see something we suddenly can’t live without – we’ve all been there. this app replaces spreadsheets with scientifically designed money tools that help you take charge of your entire financial universe. 2. Pay yourself first with Payday DivvyTM The this app effect starts the moment you get paid – Payday Divvy automatically divides up your paycheck between short- and long-term goals, bills and discretionary spending (don’t worry, your money is always available to cover unforeseen expenses). 3. Build successful money habits that last Big picture in place, this app gets to work on the details. Spending Sweet Spot makes it easy to adjust your spending week by week while still helping you save automatically toward your Goals. And it all works by leveraging the habits you have – rather than expecting you to start new ones. Smarter checking: Our FDIC-insured checking account gives you instant access to savings balances, instant free transfers from savings Goals, a Visa® debit card that works with Apple Pay & Google Pay, direct deposit with early access to your paycheck, and bill pay. All without any of the hidden fees regular banks saddle you with. Smarter spending: Our smart money manager will help you make sense of your weekly spending habits. Discover how you spend, and you'll learn where to save. Smarter saving: Set your savings Goals then use our smart Rules to save toward them automatically. And use our integration with the Apple Health app to save money toward your Goals when you reach your target for Walk or Run Distance, Steps, or Workouts. You can also customize your own Rules with our IFTTT integration (we have a few to get you started). All FDIC-insured up to $250,000. Smarter shared finances: Designed for the way couples manage money together today, this app Dream TeamTM lets you save toward shared Goals and see one another’s transactions without giving up your individual accounts. Smarter investing: this app Invest is investing for people who like the idea of investing but don’t really know where to start. Set your Goals, pick a portfolio and a timeline, and then leave the nitty gritty to us. Smart. this app, this app INVEST and the this app and Q logos are registered trademarks of this app, LLC. Copyright © 2022 this app, LLC. All Rights Reserved. this app is not a bank. Banking services provided by Lincoln Savings Bank, Member FDIC and other partner banks. this app Visa® Debit Card issued by Lincoln Savings Bank, Member FDIC. this app Invest LLC (“this app Invest”) is an SEC Registered Investment Adviser. The information provided herein is for informational and general educational purposes only and is not investment or financial advice. Investing involves risk; you may lose money, including loss of principal. Brokerage services provided to this app Invest clients by Apex Clearing Corporation, an SEC-registered broker-dealer and member FINRA/SIPC. Investments are not FDIC insured but protected by SIPC.

Top Reviews

By rjfskelt04

My 6 week experience with Qapital

I had been thinking about a way to be able to save money exactly this way I had really wished my bank did something like this but unfortunately they do not. So I came across this app and it sounded great. I was very skeptical bc this is my money we are talking about! I did a lot of research for a good year before I felt comfortable enough to finally download the app and give it a chance. I am really glad I did bc it’s been almost 6 weeks and I’ve already saved 363$! I started this savings for extra spending money for my upcoming anniversary trip to Las Vegas, at this rate by the time we go in a few weeks I should have at least 500$ extra to take with me! I am not good at saving at all so this has been awesome for me. I couldn’t of been able to save like this on my own so I’m very happy with the app so far! Only thing I would change but isn’t really a big deal is that they would take the money out at the time of transactions and not in batches a few times a week which like I said isn’t a big thing but I would change that if I could other than that I give it 5 stars so far! Hopefully that doesn’t change in the future but so far so good! 👍 Update: So I’ve been using this app for about 6 months now and I’m loving the app it has been a lifesaver for me!

By Broke College Vet

Natural saver *long post*

Read some reviews from ppl who aren’t typical savers so I figured I leave one from my natural saving perspective. I love this app because it’s exactly what I needed and very simple, user friendly. I love that you can set up your goals with a visual picture (similar to a vision board), really makes you want to save towards your goals more every time you open the app. I also love all the options at hand for HOW you want to save and how much. I have complete control over this which was very important to me because I know how important it is to save (no matter how little) when you can, especially when your finances fluctuate as much as mine do because I’m a student-veteran in college. Another thing is the transferring, I have an emergency fund I set up and it works as such, life throws lemons so I have my lemonade stashed in this app. The only CON/Downfall is that your money is not gaining interest while it’s sitting there. So if you just need an app to get you into the HABIT of saving again cause you’ve fallen off the consistency train, this is perfect but if you’re looking to save with some interest, stick to your bank and just get some discipline. I personally save my money through this app and then transfer the money to my accounts. Good luck and enjoy everyone!!

By Phoenix_To_LA

Just started using Qapital

Just recently started using this app after some online research and reading user reviews. So far I really like the app and have saved over $50 in a couple of weeks. I am using this app along with Acorns and Digit so I have a few side savings spread across those apps. I started off with "set it and forget" sum and the "rounding up" feature, just to test how much I could save with just my spare change. You'd be surprised at how much you can rack up. I have a specific saving account set in this app for a trip my boyfriend and I are planning. Once we go on that trip I'll set up a new saving account in the app. I also like that the app gives you notifications on your savings. You can also see a more detailed breakdown within the app. I really like this app because I can be very hard to save when you have a lot of expenses. This is a nice way to set up a savings that does the work for you. And honestly you don't even notice or miss the change the app puts away for you. Definitely worth trying this app if you want to save money, even if it's just using the round up feature. this app proves that anyone can save some money on the side no matter your income.