N26 — Love your bank Software

Company Name: N26 GmbH

About: N26 offers mobile banking solutions to customers in the European Union through its subsidiary.

Headquarters: Berlin, Berlin, Germany.

N26 Love your bank Overview

What is N26 Love your bank? N26 is a mobile bank that allows users to manage their finances on the go. It offers a range of features such as no hidden fees, real-time alerts, cheap international transfers, and the ability to save and budget easily. N26 is a fully-licensed bank and offers reliable customer support.

Features

- Fast account opening process

- Virtual or physical debit Mastercard

- No hidden fees, including no ATM fees, no minimum account balance, and no foreign transaction fees

- Real-time alerts for every incoming and outgoing transaction

- Instantly lock or unlock your card, reset your card PIN, set spending and withdrawal limits, and enable or disable international payments, online transactions, and contactless payments

- Cheap international transfers with Wise

- Effortlessly organize your money in Spaces sub-accounts or spend and save together with up to 10 others in Shared Spaces

- Statistics to track your spending in real-time

- Send and receive instant bank transfers within the SEPA area

- Free ATM withdrawals or try CASH26 to withdraw or deposit cash at 15,500+ retail stores in Germany, Austria, Italy, Spain, and Greece

- Exclusive offers from brands through N26 Perks

- Fully-licensed bank with German Deposit Protection Scheme protection up to €100,000

- 24/7 customer support via live chat or phone

- Offers a range of accounts for personal use and for freelancers and the self-employed

- Offers overdraft, credit, savings, EasyFlex Savings, and insurance products

- Featured in international publications such as TechCrunch, WIRED, The Financial Times, Forbes, Die Zeit, Süddeutsche Zeitung, Spiegel, BILD, and FAZ

- Over 298,000 five-star reviews worldwide.

Official Screenshots

Product Details and Description of

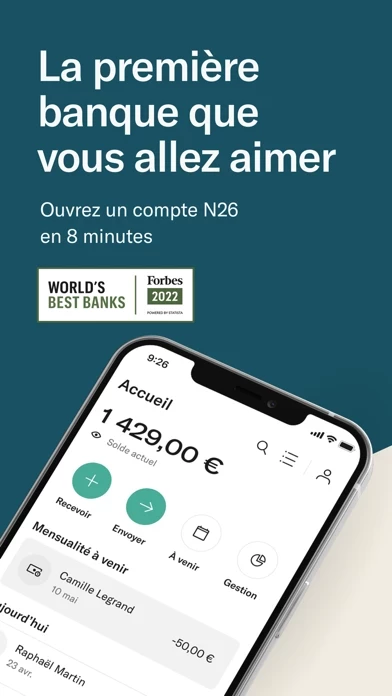

** Listed in Forbes’ World’s Best Banks 2022 ** Want to have full control of your money with just one app? Meet N26, Europe's first 100% mobile bank. Say goodbye to hidden bank fees, long queues, and endless paperwork! Over 7 million customers in 24 countries trust N26 to save, spend, and manage their finances on the go. Here’s why you’ll love N26: GET STARTED FAST Download the N26 app and open your bank account in 8 minutes—right from your phone. Get a virtual or physical debit Mastercard, add it to Apple Pay, and start spending with your bank card before it arrives in the mail. NO HIDDEN FEES Enjoy no ATM fees, no minimum account balance, and no foreign transaction fees. Go premium to get free ATM withdrawals worldwide. REAL-TIME ALERTS Receive instant push notifications for every incoming and outgoing transaction. You’ll always know what’s happening in your account. YOU’RE IN CONTROL Instantly lock or unlock your card, reset your card PIN, set spending and withdrawal limits, and enable or disable international payments, online transactions, and contactless payments in your N26 app. CHEAP INTERNATIONAL TRANSFERS Send money overseas in 38+ currencies with Wise (formerly TransferWise) in your N26 app. Get the real market exchange rate every time. SAVE AND BUDGET EASILY Effortlessly organize your money in Spaces sub-accounts, or spend and save together with up to 10 others in Shared Spaces. Want to budget better? Use Statistics to track your spending in real time, broken down into helpful categories. PAY EFFORTLESSLY Send and receive instant bank transfers within the SEPA area—your money will arrive in seconds. Need cash? Enjoy free ATM withdrawals, or try CASH26 to withdraw or deposit cash at 15,500+ retail stores in Germany, Austria, Italy, Spain and Greece. N26 PERKS Unlock exclusive offers from brands you love. SAFE AND SECURE N26 is a fully-licensed bank, and your money is protected up to €100,000 by the German Deposit Protection Scheme. Shopping online? Enjoy peace of mind with 3D Secure 2-factor authentication. RELIABLE CUSTOMER SUPPORT Our N26 Specialists are here to help, 24/7. Reach us via live chat, or give us a call on the N26 premium customer hotline. FIND THE BEST ACCOUNT FOR YOU: For personal use: — N26 Standard: the free digital bank account for your everyday — N26 Smart: the bank account with a colorful Mastercard and powerful tools to spend and save with confidence — N26 You: the premium bank account with a colorful Mastercard, free withdrawals abroad, and travel insurance — N26 Metal: the exclusive bank account with a metal Mastercard, priority support hotline, free withdrawals abroad, and an insurance package For freelancers and the self-employed: — N26 Business Standard: the free everyday business account with 0.1% cashback — N26 Business Smart: the business account with a colorful Mastercard, extra sub-accounts, and intelligent budgeting tools — N26 Business You: the premium account with a colorful Mastercard, travel insurance, and free withdrawals abroad — N26 Business Metal: the exclusive account with 0.5% cashback, a metal Mastercard, free withdrawals abroad, and an insurance package N26 Products include: — N26 Overdraft: Get approved in minutes for an overdraft up to €10,000 (available in Germany, Austria) — N26 Credit: Get a credit loan of €1,000 to €25,000 with zero paperwork (available in Germany, France) — N26 Savings: Open a fixed-term savings account and earn up to 1.15% interest (available in Germany, Austria) — N26 EasyFlex Savings: Earn competitive daily interest on your savings without locking it away (available in Germany) — N26 Insurance: Purchase on-demand insurance in your app to protect what you love (available in Germany) N26 has been featured internationally by TechCrunch, WIRED, The Financial Times, Forbes, Die Zeit, Süddeutsche Zeitung, Spiegel, BILD, FAZ, and many more. N26 has over 298,000 five-star reviews worldwide. Imprint & Cookie Policy: n26.com/app

Top Reviews

By Zayzay23

Had a hard time with ACH Bank transfers then..

Had a hard time with ACH Bank transfers then I finally figured out a way to add money to this checking account! I added my N26 routing and account number (bank info) to my ApplePay and transferred funds to my ApplePay account so I can transfer into my N26 checking account and it was a success! Pros: This checking account is unique as it lets you created spaces for vacation, savings ect and lets you keep money in your primary space and set aside money in another space. Well organized and have no seen a option like this for a bank account before.. I’m sure it will become useful to me. Cons: It took me atlease 3 months to figure out how to find this account. I still don’t know how to find money directly from my FNBT checking account without going through a 3rd party (PayPal, ApplePay) idk maybe I didn’t read the fin print and it was made this way..

By MrSkype

Very easy and fast account opening for the US (only took 5mins!!!)

App is very easy and Debit Card came very fast. Account opening process is unbeatable with no admin and no headaches and ultra-quick! Congrats to N26 team! Account is opened within the app in a snap and it will verify your ID and you’re ready to go. Linking your external bank accounts to N26 is also very easy as well as moving money works like a charm. Can’t wait to see more what’s coming. Apple Pay doesn’t work yet but should be up soon after beta mode is over (was told ETA end of August for US accounts). Some features like check and cash deposits should be added and hope that will come in due course. Based on fees N26 is better than Revolut with no foreign transaction fees and no account fees.

By Vinischeuer

Great, straightforward banking!

Exceptional app. Love the banking experience, the 2 free ATMs a month which I found to be just perfect for me, I don’t use ATMs that much but when I do, I love that N26 will take care of those fees for me. The app is made to perfection and it also helps you put some money aside without the conventional Savings account. With spaces you can put money aside for whatever reason and I love that after you send money into a “space” that money will be taken out of you “current balance” section and it will only show up at the respective “space” you sent it to, making it less likely for you to spend that money. I also love that my direct deposit comes up to two days earlier, love that. Weds are the new Fridays for me!