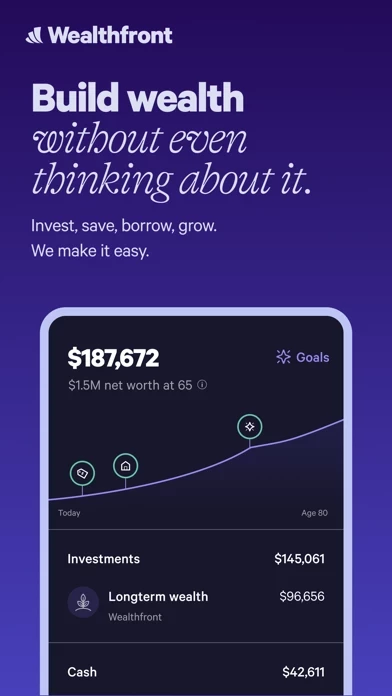

Wealthfront: Save and Invest Software

Company Name: Wealthfront

About: Wealthfront is a next-gen banking service that helps in managing the money for both the short term

and long term.

Headquarters: Palo Alto, California, United States.

Wealthfront Overview

The APY for the Wealthfront Cash Account represents the weighted average of the APY on the aggregate deposit balances of all clients at the program banks.

The cash balance in the Cash Account is swept to one or more banks (the "program banks") where it earns a variable rate of interest and is eligible for FDIC insurance.

Wealthfront uses more than one program bank to ensure FDIC coverage of up to $1 million for your cash deposits.

Neither Wealthfront Brokerage nor any of its affiliates are a bank, and Cash Account is not a checking or savings account.

Any links provided to other server sites are offered as a matter of convenience and are not intended to imply that Wealthfront Advisers or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise.

Cash Account is offered by Wealthfront Brokerage LLC ("Wealthfront Brokerage"), a member of FINRA/SIPC.

With a Wealthfront Cash Account, you earn 0.35% APY on your everyday cash and enjoy checking features.

For more information on FDIC insurance coverage, please visit Customers are responsible for monitoring their total assets at each of the program banks to determine the extent of available FDIC insurance coverage in accordance with FDIC rules.

Portfolio Line of Credit is a margin lending product offered exclusively to clients of Wealthfront Advisers by Wealthfront Brokerage LLC.

Official Screenshots

Product Details and Description of

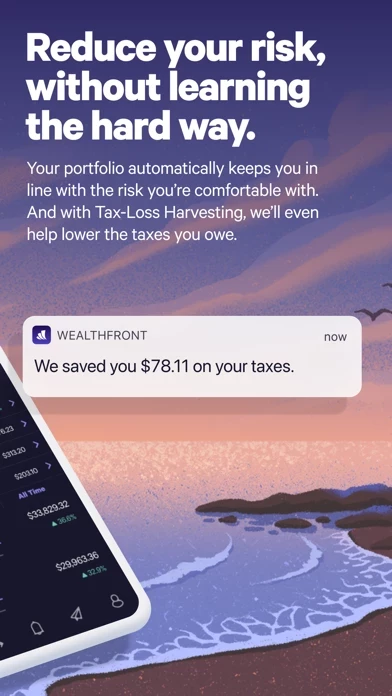

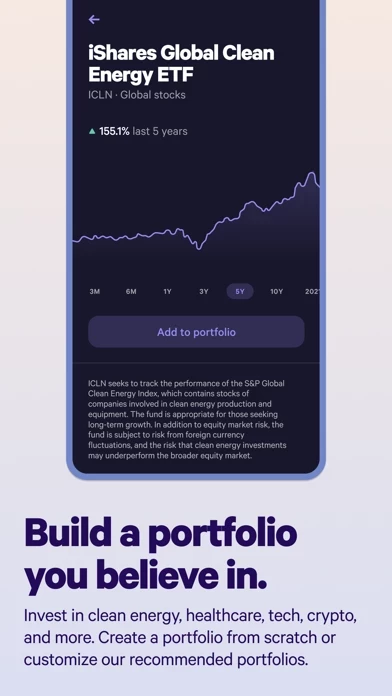

AUTOMATE YOUR INVESTMENTS Answer a few questions, and we’ll recommend a diversified and automated portfolio that’s personalized for you. We’ll handle the trades, reinvest your dividends, and work to lower your taxes automatically. CUSTOMIZE YOUR PORTFOLIO Start with our Classic portfolio or our Socially Responsible portfolio, built for positive impact investing. You can edit your investments or allocations at any time. Explore hundreds of funds across categories like social responsibility, clean energy, healthcare, tech, cannabis, and even crypto. TURN CASH INTO WEALTH Banking features make it easy to spend, save and organize your cash. And with direct deposit, we can split your paycheck and move money for you automatically. Take care of everyday cash needs with mobile checks, bill-pay, and thousands of free ATMs nationwide. In addition to free unlimited transfers, we never charge overdraft fees or account fees of any kind. BORROW EASILY AT A LOW RATE Get cash quickly with a Portfolio Line of Credit without the hassle of an application or credit check. Borrow what you need without selling investments or disrupting your long-term goals. YOUR WEALTH IN ONE PLACE Get a big-picture view of your finances and make sure you’re on track now and into retirement. Say goodbye to multiple apps, and take the guesswork out of building wealth. The clean energy chart is not based on client performance and is solely provided for illustrative purposes and is not a solicitation or recommendation. Cash Account is offered by this app Brokerage LLC (“this app Brokerage”), a member of FINRA/SIPC. Neither this app Brokerage nor any of its affiliates are a bank, and Cash Account is not a checking or savings account. We convey funds to partner banks who accept and maintain deposits, provide the interest rate, and provide FDIC insurance. We’ve partnered with Green Dot Bank, Member FDIC, to bring you checking features. Checking features for the Cash Account are subject to identity verification by Green Dot Bank. Green Dot Bank operates under the following registered trade names: GO2bank, GoBank, Green Dot Bank and Bonneville Bank. All of these registered trade names are used by, and refer to, a single FDIC-insured bank, Green Dot Bank. Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage. this app products and services are not provided by Green Dot Bank. Green Dot is a registered trademark of Green Dot Corporation. ©2021 Green Dot Corporation. All rights reserved. Other fees apply to the checking features. Fee-free ATM access applies to in-network ATMs only. For out-of-network ATMs and bank tellers a $2.50 fee will apply, plus any additional fee that the owner or bank may charge. Other eligibility requirements for mobile check deposit and to send a check may apply. See the Deposit Account Agreement for details. Investment management and advisory services are provided by this app Advisers LLC (“this app Advisers”), an SEC registered investment adviser. Nothing in this communication should be construed as tax advice, a solicitation or offer, or recommendation, to buy or sell any security. Links provided to other server sites are offered as a matter of convenience and are not intended to imply that this app Advisers or its affiliates endorses, sponsors, promotes and/or is affiliated with the owners of or participants in those sites, or endorses any information contained on those sites, unless expressly stated otherwise. All investing involves risk, including possible loss of money you invest, and past performance does not guarantee future performance. See our Full Disclosure for important details. this app Advisers and this app Brokerage are wholly owned subsidiaries of this app Corporation. © 2021 this app Corporation. All rights reserved.

Top Reviews

By Letisha Smith

Great for account linking

These days I’m hesitant with which apps I choose to share my income info. (As they say, if the product is free then you are the product. ) Yet, I chose to bank with this app for their high yield savings account with an APY ranging from 1.8-2.5 %, which is great compared to my previous banks .03%. I then linked my other retirement accounts & downloaded the app to use their PATH feature, which helps me understand how my different income streams & retirement accounts influence when I can retire. I also have > 100k in student loans and like that these accounts can also be linked & every time that I pay more than the minimum loan amount it’s nice to see how this effects my net worth & when I can ultimately retire. Keeping track of my account balances with the this app app allows me to immediately see the small impact of my decisions to spend v save income—or use money to pay down debt.

By Justareviewhere

Saving for my generation

Forget financial planners and traditional banks. This is how future generations will want to do business. By cutting out the physical locations and Human Resources, this company is able to offer the best options for savings possible. Fees are extremely low and I’ve watched my money grow over 3 years in this app. At tax season you can just upload your form into TurboTax making taxes super easy to do. this app also has features to save you lots of money on taxes. I withdrew 70k at one point and it was quick and easy. I had a question and I was able to contact customer service on the phone and get a quick smart response. Not an operator from who knows where reading a script. The humans are there if you need them (and they’re super smart!) but mostly this thing is run by robots. And I think that’s a good thing.

By Fischyeti

Awesome way to save and invest!

I love this app. Intuitive and informative. Looking at my investments now and then is a nice little bump of pleasure. Well as long as the market is doing well. It also lets me review my retirement plan and tweak the scenarios. Being able to link all of my accounts in one place is great. A few minor quibbles, like it says my retirement is in good shape but also has a suggested savings rate and I’m not sure if it in good shape without saving as much as they recommend or IF I save as much as they recommend. Or maybe I already am? Also the links to the other banks don’t already update but that could be the problem of the other institutions. Maybe a feature to notify you when a link hasn’t connected after a given window of time. I’m older and don’t take for granted that I’ve been able to save some money but this app is still great - or better really - for younger people to start investing early and take advantage of the magic of compound interest! Wish I had started earlier but at least I’ve had a 401k for the past few decades. Get the app. Start investing what you can afford. It’s one of the best gifts your present self can give to your future self. (And keep fairly healthy habits) :)