Payactiv Software

Company Name: PayActiv Inc.

About: PayActiv offers a holistic financial wellness platform for employees.

Headquarters: San Jose, California, United States.

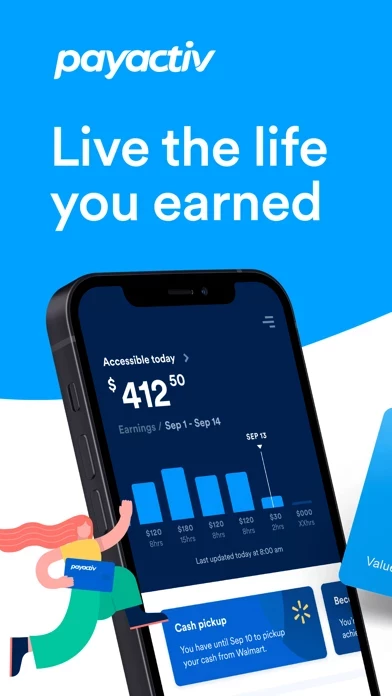

Payactiv Overview

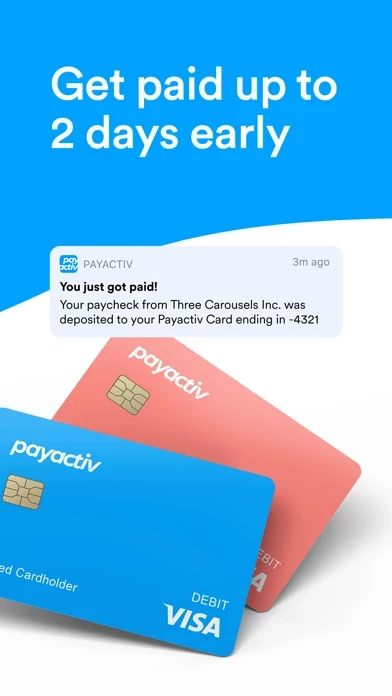

Beginning with your second direct deposit of at least $5 from the same source, Central Bank of Kansas City (CBKC) will post the funds to your Payactiv Visa Prepaid Card when we receive it, rather than on the effective date.

Create a Payactiv account and enjoy faster access to their pay along with the convenience of the Payactiv Visa® Card.1 With top-notch security and spend guidance at your fingertips to start saving immediately, it’s your earnings, spending, and savings with you in control.

1The Payactiv Visa® Prepaid Card is issued by Central Bank of Kansas City, Member FDIC, pursuant to a license from/by Visa U.S.A., Inc.

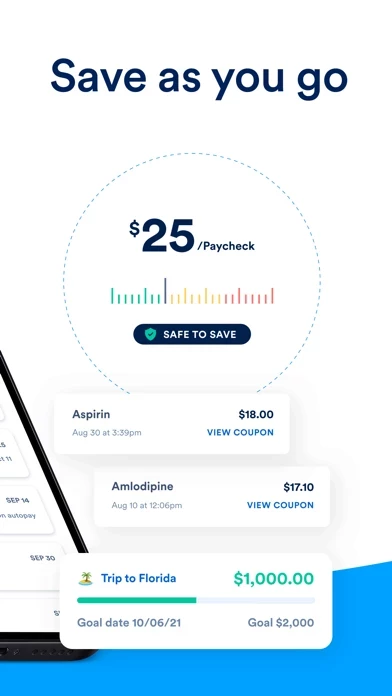

Official Screenshots

Payactiv Pricing Plans

| Duration | Amount (USD) |

|---|---|

| Billed Once | $1.89 |

| Weekly Subscription | $19.99 |

**Pricing data is based on average subscription prices reported by Justuseapp.com users..

Product Details and Description of

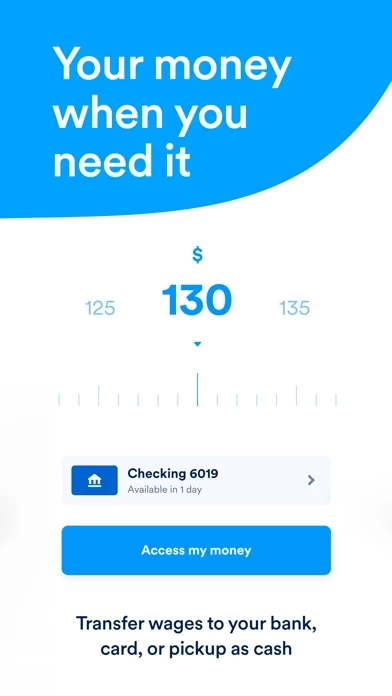

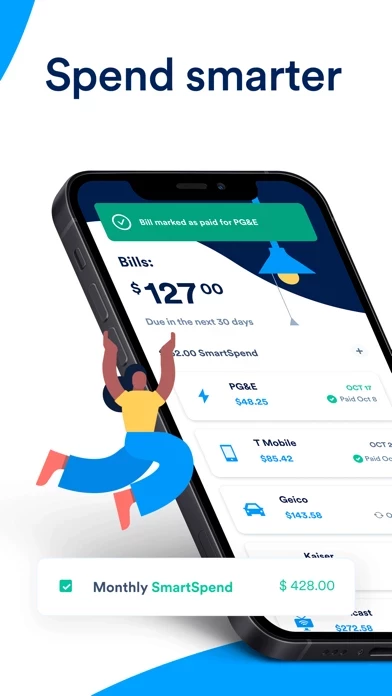

Smart saving, spending, earning, and discounts—together. Get paid as you earn with employer participation Get the wages you’ve earned from hours you’ve already worked directly into your bank account or this app card. Use it to pay bills, get a ride, and pick up cash at Walmart. No loans, no interest–just your money, in your hands. Banking for real life for everyone Create a this app account and enjoy faster access to their pay along with the convenience of the this app Visa® Card.1 With top-notch security and spend guidance at your fingertips to start saving immediately, it’s your earnings, spending, and savings with you in control. Faster access to your money • Up to 2 days early deposit of your paycheck2 • Up to 4 days early deposit of government payments2 • Immediate access to wages earned today3 Easy, free, instant mobile payments • Receive and send funds to other members • Send funds by phone number • Money is available immediately SmartSpend and SmartSave to stay on track with your goals • Always know what’s safe to spend • Track your spending habits at a glance • Be alerted of low balance • Auto transfer from earned wages3 Grow savings with real-time insights on what’s possible • Automated insights on what’s possible to save • See your savings grow with each paycheck • Get financial advice for near- and long-term plans • 1-1 phone service with trained financial coaches Banking without the hidden fees • No minimum balance requirements • No overdrafts • No monthly or inactivity fees • Surcharge-free withdrawals at 37,000+ MoneyPass® ATMs • Free integrated bill pay • Cash withdrawal at tellers in participating banks Convenience and security, you can count on • Use the card with Google Pay or Apple Wallet • Touchless payments at stores • FDIC insured • Protected by Visa’s Zero Liability protection • Lock or replace lost or stolen cards • 24/7/365 support in English and Spanish Designed with purpose • Made from 98 percent upcycled plastic • Uses plastic waste that might otherwise end up in a landfill • Comes in 3 color choices For more information visit www.this app.com ----- 1The this app Visa® Prepaid Card is issued by Central Bank of Kansas City, Member FDIC, pursuant to a license from/by Visa U.S.A., Inc. Certain fees, terms, and conditions are associated with the approval, maintenance, and use of the Card. You should consult your Cardholder Agreement and the fee schedule at this app.com/card411. If you have any questions regarding the Card or such fees, terms, and conditions, you can contact us toll-free 24/7/365 at 1 (877) 747-5862. 2 Many (but not all) employers, government benefits providers, and other originators send direct deposits early with an effective date of 1-4 days later. Beginning with your second direct deposit of at least $5 from the same source, Central Bank of Kansas City (CBKC) will post the funds to your this app Visa Prepaid Card when we receive it, rather than on the effective date. This may result in your having access to the funds sooner. The date CBKC receives your direct deposit and the effective date are controlled by the originator. 3 Earned Wage Access requires employer participation.

Top Reviews

By happyCamperMe

Apperception

This service helps in so many ways it’s a blessing. As a single full time well paid mother is still a challenge with a household of her own. And money can be tight and this keeps money in my pockets for my family to survive and maintain during hard financial situations its life. I’m happy to work for a company that provides a service that understands life happens and bills and hungry kids waits for nothing lol so why wait 2wks if you don’t have to and now I never need to worry about finances being an issue ❤️ THANK YOU

By ceece2018

Benificial

My employer starting using over a year ago and this is such a great app. Whether you are low on cash or need to transfer cash to a family member ( in my case my college age daughter) or what’s really nice is the option to save money and pay bills. It’s super easy to navigate and the FAQ’s pretty much answer any dilemma. However during business hours the chat online option is available if you can’t figure out an issue. I love this App!!

By Crazyoccupation

Its saved me more than once!

this app has really helped me in paying for gas and rent as I’m starting out at a new workplace. I will say that setting up my account I ran into some problems with strange error messages, but once I got on the phone with their support they got the issue fixed right away. Since then I’ve had no problem and have been getting money out of my checks in advance.