GoHenry Youth Debit Card & App Software

Company Name: gohenry Ltd

About: goHenry helps young people learn how to earn, save and spend responsibly.

Headquarters: Lymington, Hampshire, United Kingdom.

GoHenry Youth Debit Card App Overview

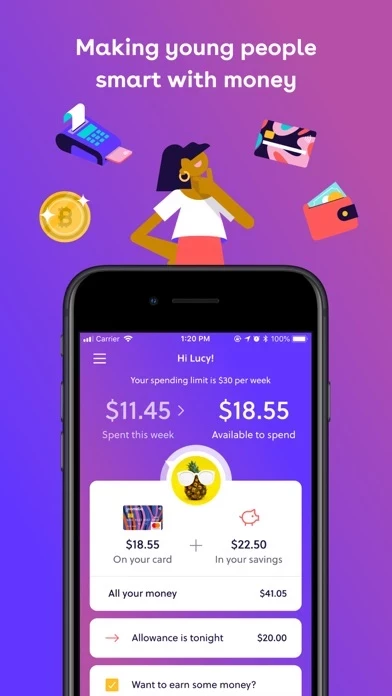

gohenry believes in empowering kids to learn, save money, and build confidence with hands-on experience managing their own budgets.

With over 1.4 million customers, gohenry helps teach kids from 6 to 18 how to spend, manage, and save their money.

The gohenry app for parents and kids makes it even easier and more convenient to manage their gohenry accounts.

The gohenry app helps parents and kids manage their accounts on the go.

Parents can set spending rules and limits, make automatic allowance payments, or assign paid chores to help their kids earn extra cash.

It’s an easy way for parents to teach kids financial responsibility and give them the independence to learn without the danger of accruing debt.

The gohenry card is issued by Community Federal Savings Bank, member FDIC, pursuant to license by MasterCard International.

Official Screenshots

GoHenry Youth Debit Card App Pricing Plans

| Duration | Amount (USD) |

|---|---|

| Billed Once | $10.00 |

| Monthly Subscription | $17.99 |

**Pricing data is based on average subscription prices reported by Justuseapp.com users..

Product Details and Description of

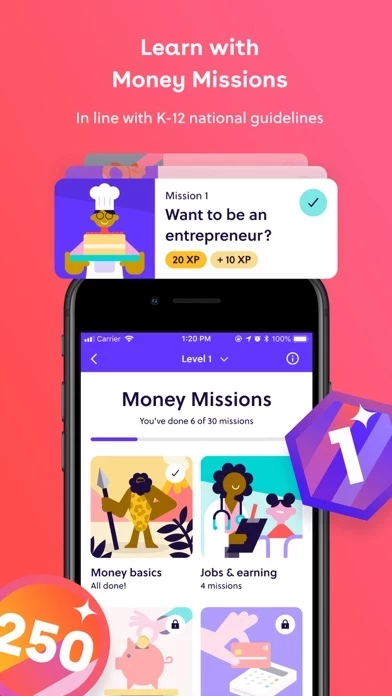

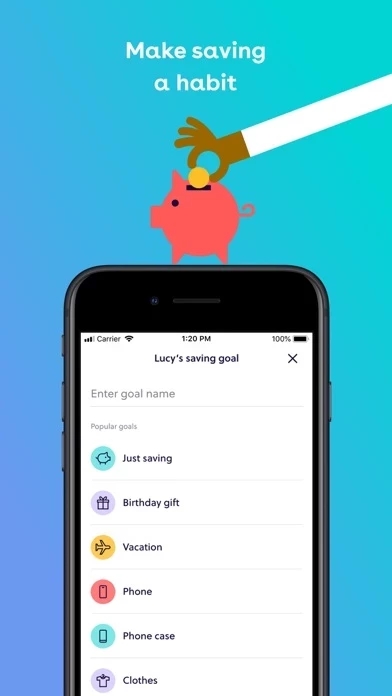

GoHenry gives your family all the tools you need to nurture money confidence. Designed for young people from 6-18, GoHenry offers a debit card with smart parental controls, plus a companion app with real-time notifications every time the card is used. They learn independence. You get peace of mind. With the GoHenry debit card and app, young people learn how to budget, earn money through chores and allowance, set savings goals, spend wisely, make donations to charity, and get real-world experience with money. Build real-world financial habits with Money Missions GoHenry’s in-app money lessons help young people learn about saving, investing, and more through interactive quizzes and videos in the GoHenry app. Conquering a new skill means earning points and badges, so they’ll stay motivated and feel accomplished. Designed for their safety The customizable GoHenry debit card is connected to an app offering plenty of parental controls. It’s an easy way for parents to teach young people financial responsibility and give them the independence to learn—without the danger of accruing debt. • Zero Liability Protection by Mastercard® • FDIC-insured accounts up to $250,000 • Real-time spending notifications • GoHenry blocks unsafe spending categories • Chip and PIN-protected transactions • Secure PIN recovery in the app • Bank-level encryption • Easily block and unblock cards 1.5 million members (and counting!) After using GoHenry, 92% of parents say their family is more confident about money. What can GoHenry do for yours? © GoHenry Inc. The GoHenry card is issued by Community Federal Savings Bank, member FDIC, pursuant to license by MasterCard International. https://www.gohenry.com/us/terms-and-conditions/

Top Reviews

By Lindzo214

It’s perfect!!

I absolutely love this app!! I looked into a couple others before I found gohenry and I’m so glad I found it. It works perfectly for me as a busy working mom. No having to remember to get cash to pay allowances. I use it as a motivation tool for many things from getting chores done to savings goals. Kids love it and it’s easy for them to use on their own phone. I really can’t think of a single bad thing to say about it. Its also a great introduction for kids on how to keep track of their money as it comes and goes and as a parent it is important to have control over their card and where they spend their money. I noticed they’ve been spending too much on video game stuff on Xbox online so I was able to restrict them from online spending for a while to encourage them to save their money or spend it more wisely. I was able to send extra money instantly to my son during his field trip after I forgot to give him money that morning. The features are great and customer service is good too.

By ms_bugg

Awesome idea! But...

This app definitely deserves 5 stars. It is an amazing idea and I’m glad to have this for my 12 yr old daughter who begged for a “credit card” in her words. This truly will help her become more responsible and teach accountability, plus makes it easy for me to stick to an allowance amount as well. I like how I can see what she sees from her point of view and control the account and her spending and limits. It allows them to have freedom, but freedom that is definitely appropriate for a child. I also love how easy they make it to add money and add a debit card to fund the account. The reason for the “But” is that I wish they allowed you to add both parents or link another parent profile seeing that my child has both a mom and a dad who would like to monitor. Also it would be nice if other people such as relatives, could have the option to send her money as well for things like birthdays or Christmas. Other than that, no complaints from what I’ve seen so far, but we shall see how this goes.

By The bored

Excited about this!

Just set it up and ordered my daughters card. Only flaw I see so far is that it needs daily tasks. Things that she needs to do every day like pick up her room and make her bed I’m going to have to keep track of every day to make sure she earned the allowance for that task at the end of the week. I hope to see an option for daily tasks at some point. My daughter is almost 12 and very excited to have her very own card. We tried cash allowances in the past and it never works out. Heard about this from a customer at work & really excited to see my daughter learn some responsibility!! Giving 5-stars as I don’t see a reason to judge it just yet, but definitely needs daily tasks!!!