- No overdraft fees and CoverDraft℠ service for temporary fee-free overdraft relief

- Ally eCheck Deposit℠ for mobile check deposit

- Transfer money, pay bills, and use Zelle® to pay anyone with a U.S. bank account

- Find nearby fee-free ATMs and cash back locations

- Card controls to manage debit card usage

- Manage CD interest disbursement and maturity options

- View and send secure messages, or chat with Ally Assist 24/7

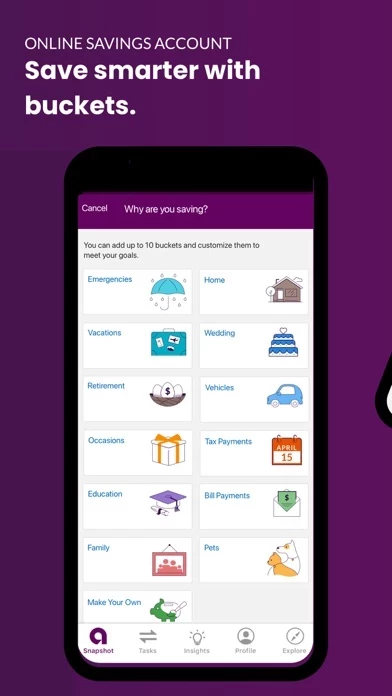

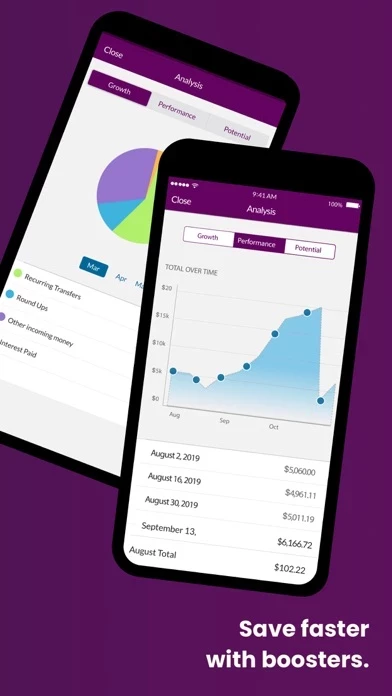

- Smart savings tools, including buckets to organize money, automatic recurring transfers, and round ups and Surprise Savings boosters

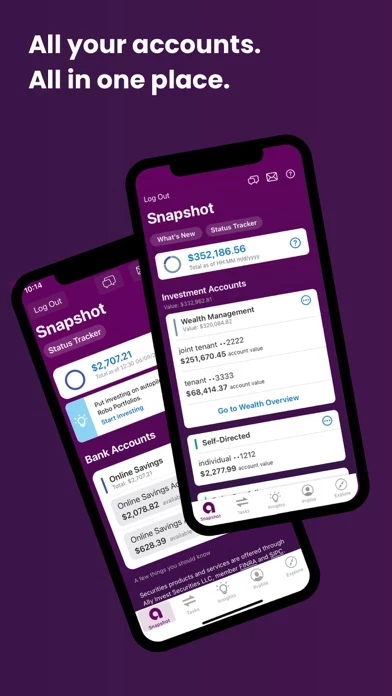

- Robo portfolios for automated investing with no advisory fees

- Self-directed trading with commission-free U.S. stock and ETF trades, ETF screener, and advanced charting tools

- Wealth management services with a dedicated advisor, tailored investment portfolio, and 360° view of finances

- Real-time updates and Autopay for home loan accounts

- Online & Mobile Security Guarantee for user protection

- Free app, compatible with iOS 14.0 or higher

- Deposit and mortgage products offered by Ally Bank, Member FDIC, Equal Housing Lender

- Securities offered through Ally Invest Securities LLC, member FINRA/SIPC

- Advisory products and services offered through Ally Invest Advisors Inc., a registered investment adviser

- Securities are NOT FDIC INSURED, NOT BANK GUARANTEED, and MAY LOSE VALUE

- CoverDraft℠ acts as a safety net and is not a line of credit or a guarantee

- Buckets and boosters are features of Ally Bank's Online Savings Account.