Empower Personal Dashboard™ Software

Company Name: Personal Capital Corporation

About: Personal Capital is the leading digital wealth management firm.

Headquarters: San Carlos, California, United States.

Empower Personal Dashboard Overview

What is Empower Personal Dashboard?

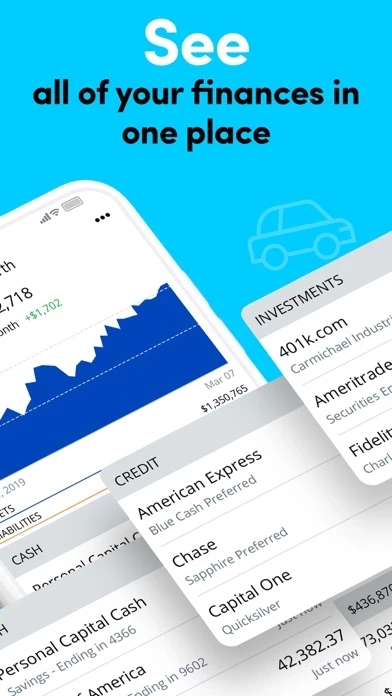

The Personal Capital Investing and Finance App is a portfolio tracker that allows users to monitor all their investments, retirement, and finances in one place. It offers professional-grade technology to help users take control of their finances. The app has won several awards, including "Best App for Investors" by CNBC in 2021 and "Best Financial App Award" for 2021 by Money Under 30.

Features

- Manage all your accounts in one secure place, including bank accounts, 401k, IRA, investments, stocks, and debt.

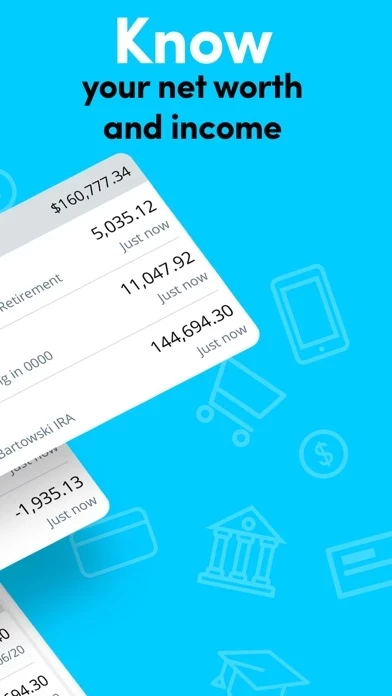

- Interactive cash flow tools to see your total income and expenses across all accounts.

- Investment Checkup tool to see how well your investments are performing and compare your portfolio allocation to the ideal target allocation.

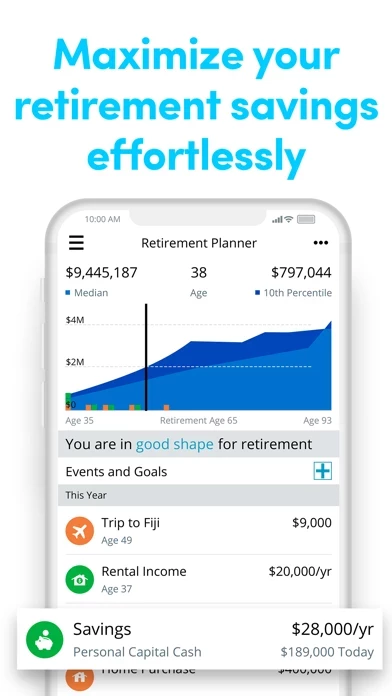

- Retirement Planner to build, manage, and forecast your retirement in one place.

- Personal Capital for Apple Watch to set a spending target and track it on the go.

- Personal information is not sold, and third-party sharing is limited.

- The app is free to use, and users can become investment clients to access financial advisors and additional services.

Official Screenshots

Product Details and Description of

Monitor all your investments, retirement, and finances with the only portfolio tracker you’ll ever need. The Personal Capital Investing and Finance App - this is the smart way to track and manage your personal finance. Now you can see all your accounts in one place—bank accounts, stocks, retirement funds, and your investments. Use our Retirement Planner tool or become an investment client to get access to our financial advisors. This is more than a portfolio tracker, this is professional-grade tech to help you take control of your finances. "Best App for Investors" - CNBC, 2021 "Best Financial App Award" for 2021 by Money Under 30 "Best for Portfolio Management" - for 2020 by Investopedia START NOW FOR FREE Join over 2.8 million people who use our free tools (as of 12/31/20). MANAGE ALL YOUR ACCOUNTS IN ONE SECURE PLACE With Personal Capital, you can see all of your accounts in one place. Manage your bank accounts, 401k, IRA, investments, stocks, and even debt, all on our dashboard. INTERACTIVE CASH FLOW TOOLS The Cash Flow graph allows you to see your total income and total expenses across all of your accounts, month over month. TRACK YOUR INVESTMENTS See how well your investments are performing – and how they could do even better – with the Investment Checkup tool. Compare your current portfolio allocation to the ideal target allocation designed to minimize risk and maximize returns to meet your financial goals. PLAN FOR RETIREMENT Build, manage, and forecast your retirement in one convenient place with your Retirement Planner. PERSONAL CAPITAL FOR APPLE WATCH Set a spending target and track it on the go. Quickly check your status by day, week, month, or year. Access your spending simply by checking the date. WE DO NOT SELL YOUR PERSONAL INFORMATION At Personal Capital, we keep your best interests in mind. This includes not selling your personal information. And if we share your information with third parties to help us deliver our services, we require that they don’t sell your personal information either. After all, nobody wants their contact information sold to telemarketers. Want to learn more about this? Please see our privacy policy at personalcapital.com/privacy-policy. All visuals are illustrative only. Featured individuals are paid spokespeople and not clients of PCAC and do not make any endorsements or recommendations about securities offerings or investment strategy. * For more information about Personal Capital's advisory services, including fees and full disclosures, visit personalcapital.com/wealth-management. © 2021 Personal Capital Corporation, a wholly owned subsidiary of Empower Holdings, LLC. All rights reserved.

Top Reviews

By BGP NC

Goodbye Quicken, Hello Personal Capital!

After 23 years of using Quicken, yesterday I said goodbye. Instead, after thorough online research, I signed up for the FREE Personal Capital service, which I can’t rate high enough for the ease with which I could add a large number of banking, investment and credit card accounts to my Personal Capital account, and the incredibly user-friendly interface and seamless aggregation of all of our financial accounts and data. The state of the art security features built-in to Personal Capital were the clincher for me. Quicken’s subscription model for a product that is buggy and has not kept up with the times (no viable IOS product offering, an inferior Quicken for Mac product, etc.) is no longer acceptable to me. I absolutely love the way it is so easy to keep completely up to date with our finances through the Personal Capital program, and how there is instantaneous syncing of the data in the desktop and IOS Personal Capital apps. While I will lose some functionality that was offered by my Quicken for Windows product, that is more than made up by the many advantages offered by Personal Capital. I highly recommend Personal Capital.

By Borrmu421

So far so great!

I have tried numerous personal finance applications, and settled on Mint for the longest time; only because my financial institutions weren't available through those other apps. Then I heard about Personal Capital and thought I'd give it a try, and so far so great! It syncs with my credit unions which is rare, and MUCH appreciated. I can link my investment accounts and get professional advice. After using other apps, I have to say that they seem more geared towards children. Mint is a little more robust, but Personal Capital seems to have it all. It's made for us grown-ups, and gives you all the tools necessary to manage your finances and help improve your financial well being. Not to be understated, is the fact that they have apps for phones, tablets and desktop interfaces. Most other apps only offer phone apps which can be annoying to interface with unless you're just checking something quick while on the go. Mint does have all 3 as well, I just don't like their implementation of the interface as much and the tools they offer. Keep up the great work, and hopefully a year from now I'll still feel as good as I do now.

By Gymna

Awesome App, could be even better

Love the app! My main reason for writing this review is to provide suggestions to developers to make the app even better than it already is. I will change my rating to 5 stars once I know that my comments have been acknowledged by the developer. love how you can categorize each transaction to keep track of your spending as well as set a monthly budget. However, currently there is no way to set a monthly budget for certain spending categories (e.g. you can set a total monthly budget of $2,500, but you can’t set separate category budgets for rent, restaurants, groceries, shopping, auto/transportation, etc.) It would also be helpful to be able to add budgets on a year-by-year basis in addition to month by month. For example, you want to set a travel budget of $6,000 per year but it wouldn’t make sense to just add $500 dollars to your monthly budget because you do most of your traveling at certain times of the year. Also, sometimes the app misclassifies account credits as debits, not sure what’s going on there. Overall far superior app than most of the other ones out there!