Simple - Mobile Banking Software

Company Name: Simple Finance

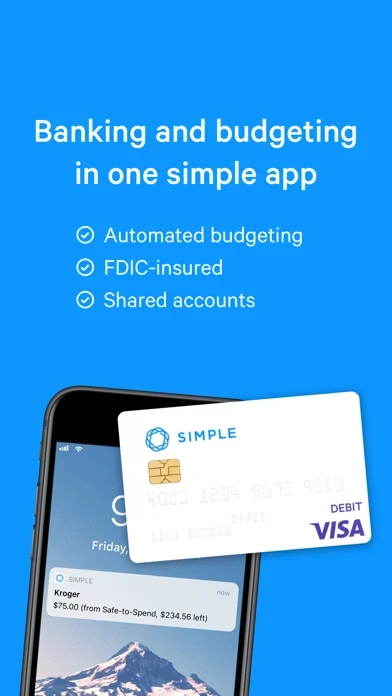

About: Simple is a web and mobile application that unifies various accounts into one accessible bank card..

Headquarters: Portland, Oregon, United States.

Simple Overview

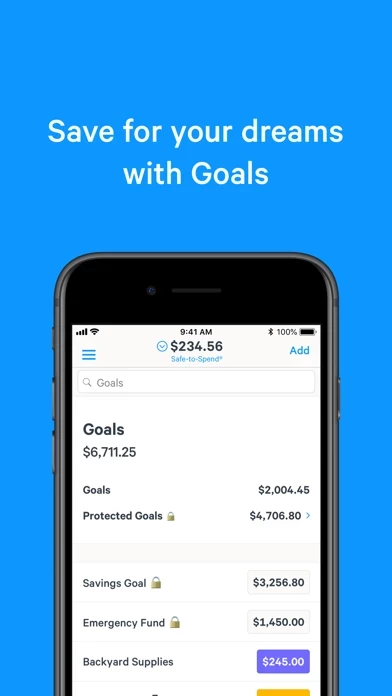

Your tax refund is your money, and the IRS has been hanging onto it all year! So when you finally get it back, put it to work! Commit to saving a portion of your return before you even receive it, and when it hits your account, it’ll automatically transfer into your Protected Goals Account to build your savings and earn interest.

Earn interest with whoever you're interested in: When it comes to shared bills and savings goals, two paychecks are better than one! Open a Simple Shared account to tackle budgeting and save money together.

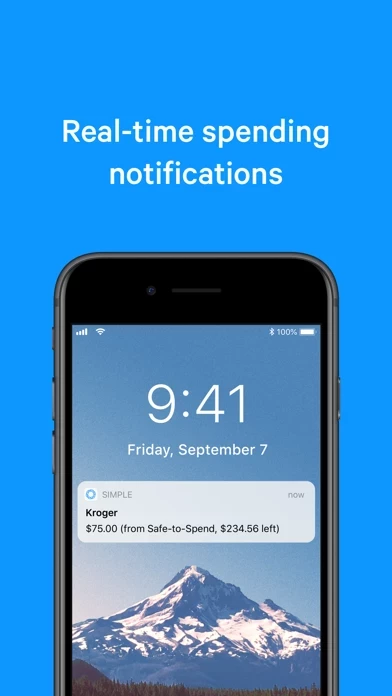

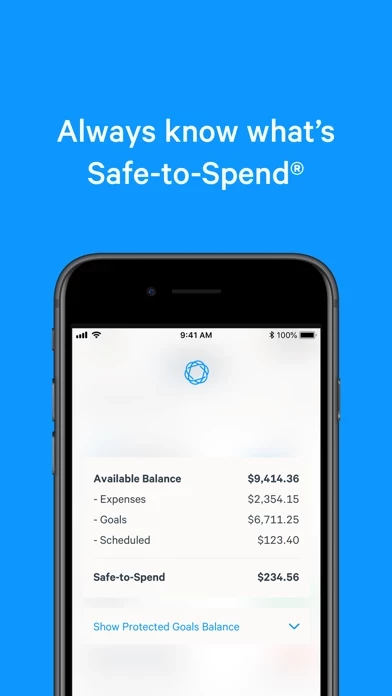

Spend money spontaneously, without derailing your budget or bills (or doing the math on the spot...). We take your account balance, subtract your Expenses and Goals, and tell you exactly how much money you have left over to spend on whatever you want.

Open a separate Protected Goals Account to keep money tucked away from spending while earning a competitive interest rate.

Every aspect of a Simple checking account is optimized for branchless online banking, budgeting, and saving, so you can track spending and manage your money wherever you happen to be.

Official Screenshots

Product Details and Description of

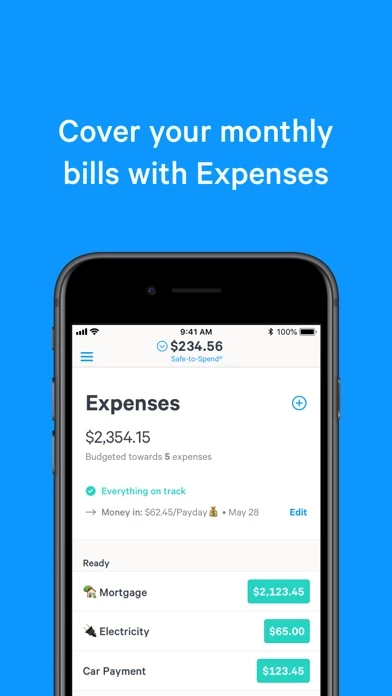

this app is one of the first mobile banking apps that has helped customers budget and save since 2012. Budget and save with no hidden bank fees, with balances in Protected Goals Accounts earning a competitive interest rate. Every aspect of a this app checking account is optimized for branchless online banking, budgeting, and saving, so you can track spending and manage your money wherever you happen to be. this app is personal finance made easy. Without setting foot in a branch (or a bank stuffed into an ill-fitting mobile app), you have access to: - Built-in budgeting and saving tools - Visa® Debit Card - Certificates of Deposit - Photo Check Deposit - FDIC-Insurance up to the legal limit - Direct Deposit - External Account Linking - Instant Transfers to Other this app Customers - Third-Party Payment services like Square, Venmo, and Paypal - Block your card in the app if it's been lost or stolen this app Goals Use Goals for saving money: Stash away money for the unexpected, or automate saving for things you want. From a trip to Italy to a new bike. Open a separate Protected Goals Account to keep money tucked away from spending while earning a competitive interest rate. this app Expenses Set up your Expenses one time and going forward, we'll do the rest. When you pay your rent, your Expense is already saving money for next month's bill. Yep, it's our job now. (You can even split Expenses with a partner when using a Shared Account). No-Penalty Certificate of Deposit Put your savings to work for you! this app’s No-Penalty CDs let you lock in a rate that guarantees growth for your savings—so you’ll know exactly how much your deposit will earn. And a No-Penalty CD gives you peace of mind when stashing your cash. Safe-to-Spend® Spend money spontaneously, without derailing your budget or bills (or doing the math on the spot...). We take your account balance, subtract your Expenses and Goals, and tell you exactly how much money you have left over to spend on whatever you want. (Buy the shoes!) Shared Accounts Earn interest with whoever you're interested in: When it comes to shared bills and savings goals, two paychecks are better than one! Open a this app Shared account to tackle budgeting and save money together. Round-up Rules Start saving money effortlessly with Round-up Rules. Whenever you make a purchase, what you spend will be rounded up to the next whole dollar amount, and when those round-ups reach or exceed $5, that balance will be tucked away into your Protected Goals Account. It’s like a digital change jar...one that adds up to real money in the bank. Tax Refund Your tax refund is your money, and the IRS has been hanging onto it all year! So when you finally get it back, put it to work! Commit to saving a portion of your return before you even receive it, and when it hits your account, it’ll automatically transfer into your Protected Goals Account to build your savings and earn interest. Banking Services provided by BBVA USA, Member FDIC. The this app Visa® Card is issued by BBVA USA pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted.

Top Reviews

By Scdundas

Great Customer Service

I have been using this app for about three years now. I haven’t had any major issues during that time. I once woke up to find I had some fraudulent charges on my account , I blocked my card and sent a message and and got a response super quick, that asked if I had access to funds until my new card came and had me call when I was at an atm so they could briefly unblock my card long enough for me to withdraw cash. This was a weekend so it took until Monday to get my new card. I love that when I sent a message I can attach the transactions in question to speed up the response, within 4 hours they had returned the money to my account, I have never had such a fast resolution to these kinds of issues with any other bank. this app has also added features that are super helpful, the new budgeting feature works much better than the goals for regular bills. It automatically sets money aside for my bills (insurance, rent, phone etc.) and when those come due it spends from those budgeting categories. I always know how much money I have available to spend but rarely look at my full account balance but I always know that the important things are already covered without me having to think about it. I love this app and I tell people about it all the time. A lot of people have a hard time giving up a traditional bank, but they don’t know what they’re missing.

By sxklass

Nothing but amazing

I read alot of the comments and I don't really write reviews about apps but after reading the comments I felt I needed to write one, for the next set of bankers looking at a online banking account. I love this app I have had little to no trouble with the customer service team, the bank experience and the app itself. this app is one of my most go to bank. I get some of my paycheck deposit into the account and it works just like and somethings better than your regular bank. I do think this app bank is probably the best online banking out there. If I have a problem I just send a message through the app to the customer service team and they would get back to me within 24hours. 99% of the time they will solve the Issue and I am happy. I never had any troubles using the bank card anywhere or using it with my Apple Pay. Of course with online banking you give up the freedom to just deposit cold hard cash into the account but once your pass that, this app is easily the best. Plus the saving tools are a great use.

By Turbo-Dash

Kira The Superhero

I usually don’t leave reviews however I would like to share my experience with this app. It was great the entire time until I wasn’t able to get any help with my account. Kira from this app was amazing and without her help i would still be having trouble with my account due to another department having to review my account, however after speaking with Kira she owned the problem and made it her duty to help me get my account situated. She went above and beyond by reaching out to that department all through the day to make sure someone from the other department reached out to me and resolved my issue which has been going on for over 3 weeks and until today I was not able to get any help and it’s just amazing that when an employee decides to go above and beyond for you it reminds you that good people who care about other people’s lives are still out there! Kira you’re Amazing and I thank you again for you all you’ve done!!! P.S. Promote Kira and have her train and share her skills with the rest of the this app team!!!