Payrollguru Overview

What is Payrollguru?

Payroll Guru is an app that calculates paychecks with net pay amount and applicable taxes from gross wages. It has been updated for year 2022 payroll taxes and calculations. The app allows for both salary and hourly calculations of paychecks. It also has unlimited profiles, customizable deductions, and calculates payroll taxes for all 50 states and District of Columbia.

Features

- Calculates paychecks with net pay amount and applicable taxes from gross wages

- Updated for year 2022 payroll taxes and calculations

- Allows for both salary and hourly calculations of paychecks

- Unlimited profiles to cover every employee or a group of similarly taxed employees

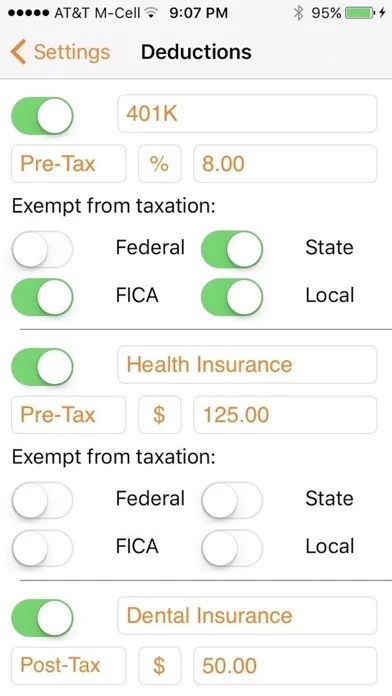

- Customizable deductions with up to 8 pre-tax or post-tax deductions

- Calculates payroll taxes for all 50 states and District of Columbia

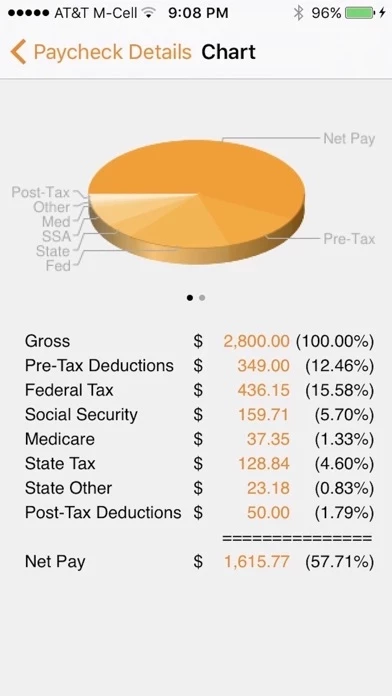

- Provides a pie chart showing the percentage distribution of gross pay

- Allows for emailing of paycheck details to an employee, employer, or payroll service provider

- Useful for self-employed persons, employers, and employees for financial planning and budgeting

- Can be used to compare net paycheck amounts in different states

- Helps estimate net and gross paycheck amounts in a particular payroll situation for small business owners and payroll service providers.

Official Screenshots

Product Details and Description of

Payroll Guru calculates paychecks with net pay amount and applicable taxes from gross wages. *** Payroll guru app updated for year 2022 payroll taxes and calculations. ** Salary and Hourly calculations of paycheck ----------------------------------------- Important Note: For Salary calculation just enter Gross Pay Amount in the appropriate field, do not enter anything else. For Hourly calculation please enter rate and hours (OT, DT) and the Gross Pay amount will be automatically calculated! ----------------------------------------- Unlimited profiles ----------------------------------------- Payroll Guru app allows for unlimited number of profiles to cover every employee or a group of similarly taxed employees. Profiles can be saved and edited and include state, marital status, pay period, allowances and deductions information. 8 pre-tax or post-tax deductions ----------------------------------------- this app app allows up to 8 pre-tax and/or post-tax deductions, which are setup as a fixed amount deduction or a % of gross pay. Deductions are customizable and can differ from one profile to another. The deductions can be modified to accommodate various taxing scenarios. For example for 401K deduction - select pretax and turn ON Federal and State switches to exclude it from being taxed on federal and state levels. Once you enter all information and include year-to-date gross paid wages, Payroll Guru will calculate your net paycheck amount and will show you the appropraite taxes. Payroll Guru calculates the following taxes: - Federal WIthholding, - Social Security, - Medicare, - State Withholding, - State Unemployment (where applicable), - State Disability Insurance (where applicable). Calculated paychecks can be viewed as a pie chart showing the percentage distribution of your gross pay. Paycheck details can be emailed to an employee, employer or a payroll service provider. this app app is a must have for any self-employed person or employer in the US to calculate paychecks and verify accuracy of issued paychecks. this app app will also be useful to any employee looking to improve financial planning, budget spending and estimate impact of personal changes (i.e. marital status, number of dependents) on net take home amount. Employees can also use Payroll Guru app to compare net paycheck amounts (after tax) in different states. This will be useful for employees considering job or relocation to a different state. For small business owners and payroll service providers this app will help estimate net and gross paycheck amounts in a particular payroll situation, and will provide a pretty accurate assessment of applicable payroll taxes. this app app calculates payroll taxes for all 50 states and District of Columbia. If you have any improvement suggestions or would like to report a problem please email us directly at support@this app.mobi. We also appreciate your positive feedback and reviews. Thank you for using Payroll Guru app. Enjoy it!

Top Reviews

By Pruff60plus1

Finally! An Update!

I've been using this app for the past couple of years. The last update was in December of 2013! Like holy cow! It shouldn't of taken this long for an update. A yearly update would even satisfy me, but none the less it does the job for me and gets pretty close to what my paychecks are. They're not completely 100% accurate but its usually no more than either a couple dollars higher or lower. But all in all, glad to see this app is still supported!

By Afjbfrnde

Great app for small employer

I pay my nanny each week using this app. Makes calculating withholding easy! Thanks!

By WillTonia

This is the app.

This is a great app and works seamlessly across all platforms. I love it.