ONE – Mobile Banking Software

Company Name: One Finance, Inc.

About: One is a provider of banking services intended to make banking experience better.

Headquarters: San Francisco, California, United States.

ONE Overview

What is ONE?

The ONE app is a financial technology app that offers banking services and a debit card provided by Coastal Community Bank, Member FDIC, under license by Mastercard® International. The app allows users to earn 2% cash back on purchases at Walmart, gas stations, and drugstores for the first 12 months, as well as 1.00% APY interest on savings balances, including card round-ups. Users can also get paid up to 2 days early, have overdraft protection up to $200, and earn 1.00% APY on savings balances up to $25,000. The app offers enhanced security and convenience features, such as adding the card to a digital wallet for secure, touch-free payments, and instantly locking the card to prevent purchases.

Features

- No monthly fee and no minimum balance requirement

- Earn 2% cash back on purchases at Walmart, gas stations, and drugstores for the first 12 months

- Earn 1.00% APY interest on savings balances, including card round-ups

- Get paid up to 2 days early

- Overdraft protection up to $200

- Boost earning potential with 1.00% APY on savings balances up to $25,000

- Add card to a digital wallet for secure, touch-free payments

- Instantly lock the card to prevent purchases

- FDIC-insured up to $250,000 per depositor

- Bank-level security and encryption

- New customers can receive a $25 cash bonus with eligible direct deposits, totaling at least $500 in a 31-day period

- Receive a $10 cash bonus after the first purchase of $10 or more

- Annual Percentage Yield effective as of 9/15/2022 and subject to change

- Direct deposit may be available up to 2 days in advance, but depends on when the employer sends paycheck data

- Additional terms and conditions apply, which can be found on the ONE app website or by calling (855) 830-6200.

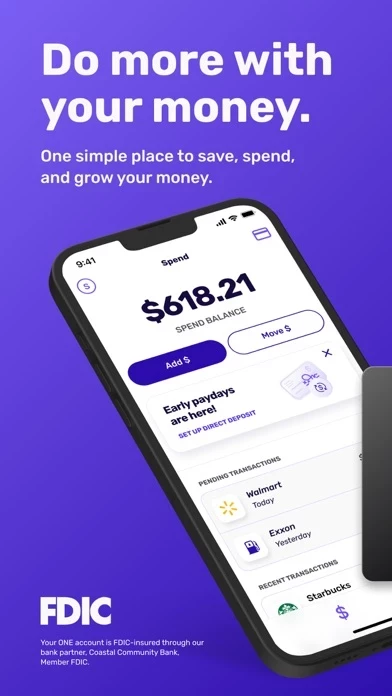

Official Screenshots

Product Details and Description of

No monthly fee, no minimum balance. Download the app and create an account to start earning 2% cash back* and enjoy savings rates higher than the national average.^ Open an account for free today–with no impact to your credit score. Banking services and this app card provided by Coastal Community Bank, Member FDIC, under license by Mastercard® International. Deposits are insured up to $250,000 per depositor. EARN WHILE YOU SPEND, EARN WHILE YOU SAVE • Get 2% cash back on all purchases at Walmart, gas stations, and drugstores for the first 12 months.* • Earn 1.00% APY interest on savings balances, including card round-ups.^ GET MORE FROM YOUR PAYCHECK • Get paid up to 2 days early.+ • Overdraft protection up to $200.** • Boost your earning potential with 1.00% APY on savings balances up to $25,000.^ ENHANCED SECURITY & CONVENIENCE • Add your card to a digital wallet for secure, convenient, and touch-free payments. • Instantly lock your card to prevent purchases. • FDIC-insured up to $250,000 per depositor. • Bank-level security and encryption. *Earn 2% cash back, up to $50, on purchases at Walmart as well as gas and drugstore purchases for the first 12 months. Cash back paid when earned. **With eligible direct deposits totaling at least $500 in the previous 31 days. ‡New customers can receive a $25 cash bonus with eligible direct deposits, totaling at least $500 in a 31-day period. Receive a $10 cash bonus after first purchase of $10 or more. Bonuses paid within 3 business days. ^Annual Percentage Yield effective as of 9/15/2022 and subject to change. 1.00% APY on balances up to $5,000 or $25,000 with eligible direct deposits totaling at least $500 in the previous 31 days. FDIC average National Deposit Rate for savings accounts as of 8/15/2022. https://www.fdic.gov/resources/bankers/national-rates/ +Direct deposit may be available up to 2 days in advance, but depends on when employer sends paycheck data. Additional terms may apply. To see full account and promotion terms and conditions, visit www.this app.app/terms or call (855) 830-6200. this app is a financial technology company, not a bank.

Top Reviews

By Nyccoo2

Easy to use and the pockets make it!

I was a little hesitant to try a new banking app out, but ever since downloading it I have found that it is so easy to use, works well with other banks, make financing/saving clear, has great interest rates, makes sharing money fun with pockets, and has an intuitive user interface that really allows you to see how your money is working for you. Really well done and I’m so happy I made the switch!

By fiv2izoblu

It’s like I designed the One app myself...for me

I can track my spending, saving, and borrowing in this app place. Better yet, I can create whatever new pockets I want for spending or saving, and I can name them whatever I want! Plus I can share any of them with my sister or any other this app member. So flexible! The this app app saves me so much time and makes it easy to manage my money and meet my goals.

By NicholeIW

Finally a bank that gets it!

This is the first bank Ive ever had where there weren't insane fees or tons of fine print around a checking, savings, sharing and borrowing account. Opening up my account took zero time and I got my card in less than a few days. Super easy to use, super high APY on savings, and I know Im getting the best support!