indi – Smart Banking Software

Company Name: numo LLC

About: Numo is a fintech incubator that identifies opportunities and builds fintech products.

Headquarters: Pittsburgh, Pennsylvania, United States.

indi Overview

What is indi?

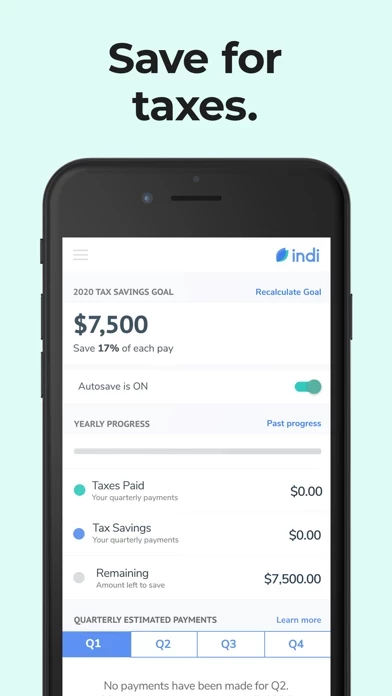

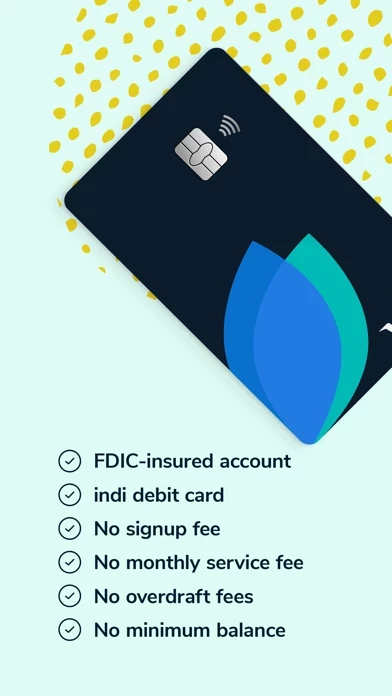

indi is a mobile banking app designed for independent workers, including self-employed individuals, freelancers, and independent contractors. It is an FDIC-insured account with a debit card and features that help users bank smarter, save for taxes, and maximize expense deductions. The app offers a single account that lets users visualize their balance as two categories - Okay to Spend and Tax Savings. Users can set up direct deposit to start funding their indi account and designate a percentage of each deposit to Tax Savings. The app also offers receipt capture, tax payment reminders, intelligent tips, and real-time notifications.

Features

- indi debit card for purchases

- Autosave for taxes

- Receipt capture

- No monthly fees

- Smart tips

- FDIC-insured

- Supported by PNC Bank

- Personalized tax savings goal

- Two balance categories - Okay to Spend and Tax Savings

- Access to all money anytime

- Withdraw cash fee-free at over 18,000 ATMs in the PNC network

- Deposit cash at retailers nationwide.

Official Screenshots

indi Pricing Plans

| Duration | Amount (USD) |

|---|---|

| Billed Once | $100.00 |

**Pricing data is based on average subscription prices reported by Justuseapp.com users..

Product Details and Description of

Whether you’re self-employed, a freelancer, an independent contractor, or working a side gig, this app is designed for you. this app is an FDIC-insured account² with a debit card³ and mobile banking app built for independent workers. Use this app to bank smarter, save for taxes, and maximize expense deductions—all in one account, right in your pocket. No signup fee. No monthly service fee. No overdraft fees. No minimum balance requirement. ---------- TAXES, SIMPLIFIED Income taxes are not automatically withheld for most 1099 workers. this app is here to help you be better prepared come tax time. EVERYTHING IN ONE ACCOUNT. this app is a single account that lets you visualize your balance as two categories—Okay to Spend and Tax Savings.⁴ GET A PERSONALIZED TAX SAVINGS GOAL. Tell us about your income, and we’ll calculate an estimated amount you should save to cover your federal and state taxes.⁴ SAVE FOR TAXES, AUTOMATICALLY. Set up direct deposit to start funding your this app account. As you get paid, this app can designate a percent of each deposit to Tax Savings.⁴ ACCESS ALL YOUR MONEY, ANYTIME. The money reflected in Tax Savings is available anytime. If you dip in, this app will alert you and increase the percent that you designate moving forward. ---------- FEATURES this app CARD Use your this app debit debit card for purchases—work or personal. Categorize deductible expenses as soon as you swipe. AUTOSAVE FOR TAXES Set up this app to designate a percent of each deposit to help you reach your Tax Savings Goal.⁴ RECEIPT CAPTURE Capture and upload receipts directly to this app. NO MONTHLY FEES Enjoy no signup fee, no monthly service fee, no minimum balance requirement, and no overdraft fees. SMART TIPS Rely on this app for tax payment reminders, intelligent tips, and real-time notifications. ---------- BANK WITH CONFIDENCE FDIC-INSURED All this app accounts are FDIC-insured up to the maximum amount permitted by law. SUPPORTED BY PNC BANK Withdraw cash fee-free at over 18,000 ATMs in the PNC network. Deposit cash at retailers nationwide.⁵ ---------- 1. A supported mobile device is needed to use this mobile app. Standard message and data rates may apply. 2. this app is a prepaid account. Your funds will be held at PNC Bank, National Association and are eligible for FDIC insurance, subject to FDIC insurance coverage limits. 3. The this app prepaid debit card is issued by PNC Bank, National Association. 4. this app's Tax Savings Goal feature is not a substitute for individual tax planning or for legal, financial, or tax advice. This feature is intended only as a tool to provide a basic sense of your potential tax savings needs. Because this app will not know everything about your finances or your personal situation, your Tax Savings Goal may be more or less than your actual tax liability. The Tax Savings Goal does not account for local taxes. Using funds designated as Tax Savings for other spending may leave too little money to pay your taxes. 5. this app cardholders can withdraw cash at any ATM. Cash deposit locations are limited to PNC ATMS; and Visa® ReadyLink merchants (for Visa cardholders) or Mastercard® rePower merchants (for Mastercard cardholders); merchants may charge a fee for this service. Visa is a registered trademark of Visa International Service Association and used under license. Mastercard is a registered trademark of Mastercard International Incorporated. this app is a registered mark of numo llc, a subsidiary of The PNC Financial Services Group, Inc. PNC and PNC Bank are registered marks of The PNC Financial Services Group, Inc. ©2021 The PNC Financial Services Group, Inc. All rights reserved. PNC Bank, National Association. Member FDIC.

Top Reviews

By mark👻👻👻

Account closure

Stop closing our accounts

By Cusiwndhehshwiahshwgdgw

Help

Help me out review my this app account please

By chichilarga

Me párese una buena aplicación

Tiene buenos métodos de uso