Lili - Small Business Finances Software

Company Name: Lili Financial Services LTD

About: Lili is the all-in-one banking app designed for freelance workers.

Headquarters: New York, New York, United States.

Lili Overview

What is Lili?

Lili is a mobile banking app designed for small business owners, providing a suite of optimized tools including a checking account with tax-saver technology, accounting software, invoicing software, and 1% APY savings. Lili is a financial technology company, not a bank, and banking services are provided by Choice Financial Group, Member FDIC. The app is only available for Sole Proprietors and Single-Member LLCs eligible.

Features

- Visa Business Debit Card

- Business Cashback Rewards

- No minimum deposit required

- No hidden fees

- 1.00% APY on Savings

- Fee-Free Overdraft up to $200

- Connect to all your marketplaces and get paid up to 2 days earlier

- Mobile Check Deposit

- Cash Deposit at 90k participating retailers

- Fee-Free ATM withdrawals at 38k locations

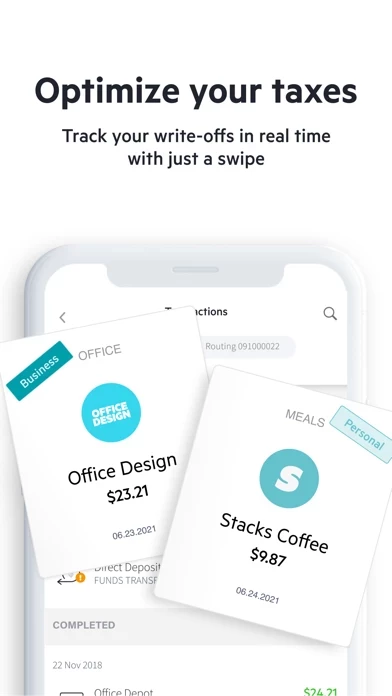

- Write-Off Tracker

- Tax Bucket

- Estimated Taxes Calculator

- Schedule C Generator

- Built-in invoicing software

- Scan & Save your receipts

- Automatically generated quarterly business reports

- Transaction Categorization

- Lili Academy with a full library of tips, tricks, and resources, exclusive webinars and community events, promos and discounts from partners, and curated newsletter and business-related content

- Lili Pro subscription required for some features

Official Screenshots

Lili Pricing Plans

| Duration | Amount (USD) |

|---|---|

| Billed Once | $4.99 |

**Pricing data is based on average subscription prices reported by Justuseapp.com users..

Product Details and Description of

Named one of the 50 Most Innovative Companies in the World 2022 by FastCompany, this app brings you banking designed for your small business. this app customers gain access to a suite of optimized tools including a checking account with tax-saver technology, accounting software, invoicing software, and 1% APY savings. this app is the all-in-one mobile banking app designed to save time, money, and energy for anyone who runs a business on their own. Only available for Sole Proprietors and Single-Member LLCs eligible. this app is a financial technology company, not a bank. Banking services provided by Choice Financial Group, Member FDIC CHECKING ACCOUNT - Visa Business Debit Card - Business Cashback Rewards* - No minimum deposit required - No hidden fees - 1.00% APY on Savings* - Fee-Free Overdraft up to $200* - Connect to all your marketplaces and get paid up to 2 days earlier - Mobile Check Deposit - Cash Deposit at 90k participating retailers - Fee-Free ATM withdrawals at 38k locations TAX OPTIMIZER TOOLS - Write-Off Tracker - Tax Bucket - Estimated Taxes Calculator - Schedule C Generator* DIY ACCOUNTING - Built-in invoicing software* - Scan & Save your receipts - Automatically generated quarterly business reports - Transaction Categorization this app ACADEMY - Full library of tips, tricks and resources - Exclusive webinars and community events - Promos and discounts from our partners - Curated newsletter and business-related content *Only available with this app Pro ** The Annual Percentage Yield (“APY”) for the this app Savings Account is variable and may change at any time.

Top Reviews

By mkkieb

Comparable to Chime - better then “Prepaid Debits” !!!

I’ve Been using “Chime” for about 4 months and love it and just got my “this app” card in the mail. Immediately it linked to my Apple Pay and was able to deposit. Something chime is unable to do. Chime will let you deposit but not instantly takes 2-3 Business days. But this app went instantly so I’m very happy about that! Used it at a couple stores and was able to itemize what I bought into categories, since I own a business it’ll be extremely helpful to instantly be able to see when I spent things personally vs for the company! A definite plus! So far I’m extremely happy, can’t complain! To top it off there covered and backed by a bigger bank so your money is absolutely insured up to $250,000!! That’s awesome, that’s just like any normal bank... WITHOUT the headache of going into a bank and giving them this and that info sitting and waiting for a half hour, talking to someone, waiting for your debit to print and an hour later you Can finally leave with your account. So I can honestly say I 100% (so far .. will update in a month) would recommend this card to anyone. Especially just to have another account for savings or personal spending! Grab yours now!

By moehope

#1 freelancers mobile banking

All in one for self employed individuals, small business owners, independent contractors, etc; ! Has pretty much every option or capabilities you need as well as the options and different necessary features that will make income tax time much easier and just better all around. And not just for Income tax season this makes banking easier to keep up with spending, expenses, and purchases work related or not so easy and it’s like a checkbook that balances itself and will keep your hard earned money calculated on what’s going out and coming in and also can track your spending which I know is something I definitely do need to always do but this app does it for me. I have found anything it can’t do! As a matter of fact I’m learning more and more that it can do every day

By Lorianna R.

Lili Made My Life Easier

I absolutely LOVE this app. My boyfriend and I run our own businesses so when he found this app I immediately jumped to getting it! I didn’t want to go the traditional route with getting a business bank account at Wells Fargo or Bank of America so this saved me all the hassle and it was SUPER quick to set up. I also have my own business debit card that they send you and anytime I make a business transaction I’m instantly able to categorize it as a work expense in the app as well as see my yearly tax savings! It feels good finally having my personal income and business income separated! Highly recommend this for someone who is running a small business and just needs something quick and efficient to operate their business expenses!