Grain: The Digital Credit Card Software

Company Name: Grain Technology, Inc.

About: Grain uses AI to transform your existing debit card into a "crebit" card by incorporating revolving

credit into your checking account.

Headquarters: San Francisco, California, United States.

Grain Overview

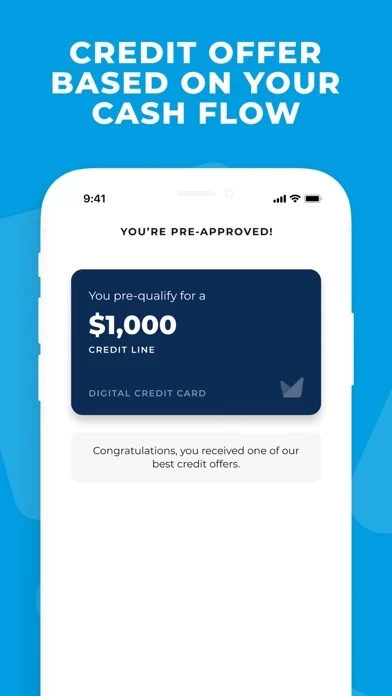

What is Grain? Grain is a financial app that provides a line of credit to your existing checking account without checking your credit score or issuing a physical card. It offers pre-approval in minutes, credit reporting to all three credit bureaus, personalized credit tips, and security measures to protect your data.

Features

- Pre-approval in minutes without a credit check

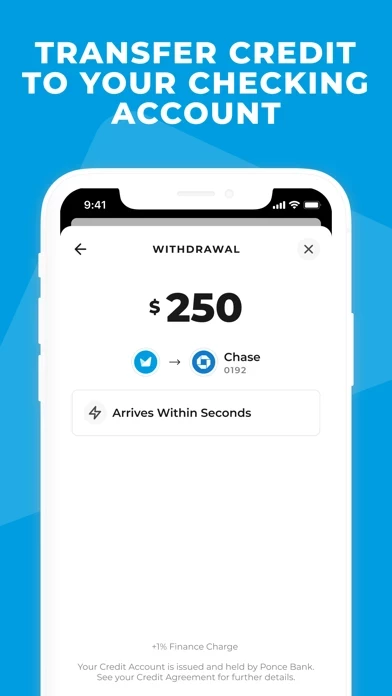

- Instant transfer of credit to your linked checking account

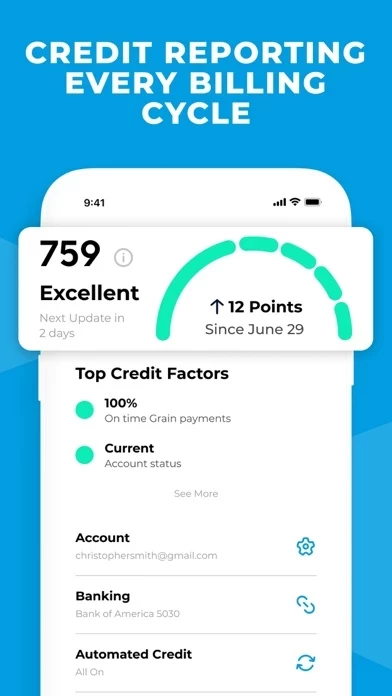

- Credit reporting to all three credit bureaus

- 15% APR and 1% finance charge on credit advances

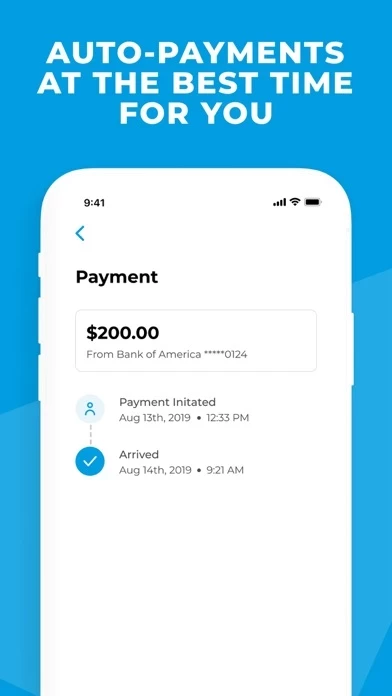

- Smarter auto-pay to avoid late and overdraft fees

- Personalized credit tips to improve your credit score

- 256 bit bank-level encryption and FDIC insurance for data protection

- Customer support available through the Grain Help Line and online support page

- Terms of Service and Privacy Policy available on the Grain website.

Official Screenshots

Grain Pricing Plans

| Duration | Amount (USD) |

|---|---|

| Billed Once | $60.00 |

**Pricing data is based on average subscription prices reported by Justuseapp.com users..

Product Details and Description of

this app provides a line of credit to your existing checking account, without checking your credit score or issuing a physical card. • Get pre-approved in minutes - link your primary checking account and get access to credit in minutes. No credit check. • Use credit in seconds - transfer credit to your linked checking account in an instant and use it as cash, from your debit, or any way you’d like. • Credit reporting - every month, we report your account activity to all three credit bureaus. • Fees - 15% APR and 1% finance charge on credit advances. Some applicants may be charged a one-time Sign-up Fee and a Monthly Service Fee. • Smarter auto-pay - monthly minimum payments are made for you at the best time during your billing cycle to avoid late and overdraft fees. • Personalized credit tips - adjust your habits and improve your credit score through actionable recommendations. • Security taken seriously - we protect your data with 256 bit bank-level encryption and we are FDIC insured. * Credit offer dependent on cash flow in linked checking account. Offer may require a security deposit. See your Credit Agreement for further details this app is headquartered at: 505 14th St Suite 900 Oakland, CA 94612 this app Help Line: 1 (833) 755-0809 Customer Support: https://trygrain.com/support/ Terms of Service: https://trygrain.com/termsofservice/ Privacy Policy: https://trygrain.com/privacypolicy/

Top Reviews

By germaindiop

Best thing I ever experienced in my life

I don’t even know where to start on this review. I’ve been trying to work with these folks for the past few weeks, but I wasn’t able to because I live in WA. The company was only working with 5 states at that time and now they’re going nationwide. I got approved in a matter of seconds for actually a real credit account. I highly recommend this for people who trying to work on their credit score because many banks won’t work with you with a 600 or lower unless you apply for the secured credit card. These folks are giving people like me a chance with a real credit card which is going to be your regular daily basis debit card. UNBELIEVABLE! I did have some technical issues when trying to connect my bank info, because I applied with a different email address the first time. I called customer service and it was fixed in less than 5 minutes. It was a black dude on the phone, did an awesome job man. After you get approved for a line a credit, people please make sure you’re responsible of your account and make payments on time. Stuff like this ain’t easy to find. My name is Germain by the way. This company deserves some LIKES, SHARE, THUMBS UP, and GOOD REVIEWS. ❤️❤️❤️

By rsuchil

Thank you to everyone who made this possible

I honestly love the app and what it is truly all about. They have given people the opportunity the build their credit in a way that is safe and easy to understand. I have never been MORE excited to build my credit and this app is 100% the reason why. One thing, when you do a credit withdrawal and they become pending on the main screen, I’m not sure if it’s a bug but when I click to see details it just keeps loading. Just wanting to give some experience from a customers point of view! The withdrawal goes through and I receive an email. It’s only after the withdraw is made that I can’t see the details. Thank you again Rudy

By mailomartu

Awesome.

Yes it’s real and yes it’s great. Pros: •Simple and fast application process. •Very much a real deal- it’s not a scam. •No hard credit inquiry. •Conveniently have money deposited DIRECTLY into your checkings account. Yes you read that correctly- money goes from this app directly into your linked account. No having to carry another card and worry about losing it. •App is simple and very easy to navigate. •Set up auto bill pay and I think you MAY pay less interest than if you don’t have it setup. •Really great and quick when it comes to responding to any questions/concerns. Cons: • It can take up to two days (maybe three or four?) to either receive a deposit or post a payment. Obviously plan if you’ll need some money well ahead of when you think you’re going to need it. Overall it’s a great app, and I’m really liking it. Should be common sense to not run up a balance that you can’t afford to pay off just like any other credit card. Utilization rate is still a thing even if you don’t have a tangible card. 9/10 recommend