Douugh Software

Company Name: Douugh

About: A smart bank account, helping people live financially healthier.

Headquarters: Sydney, New South Wales, Australia.

Douugh Overview

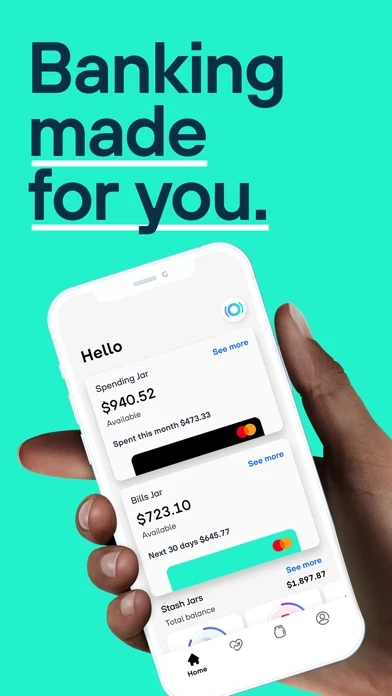

What is Douugh? Douugh is a financial technology company that offers an intelligent bank account to help users manage and grow their money on autopilot. The app helps users spend, save, and invest smarter to reach their financial goals. Douugh aims to change the user's relationship with money for the better and create healthier financial habits.

Features

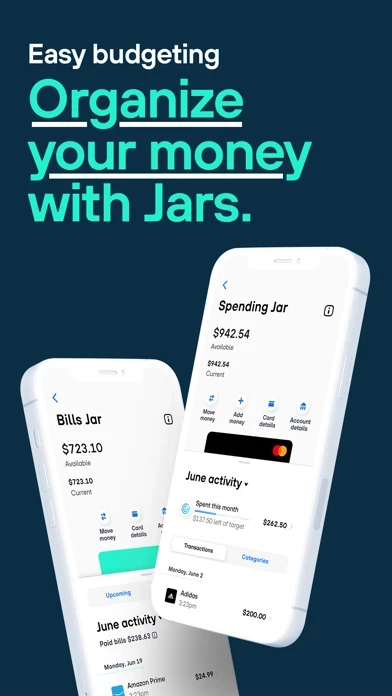

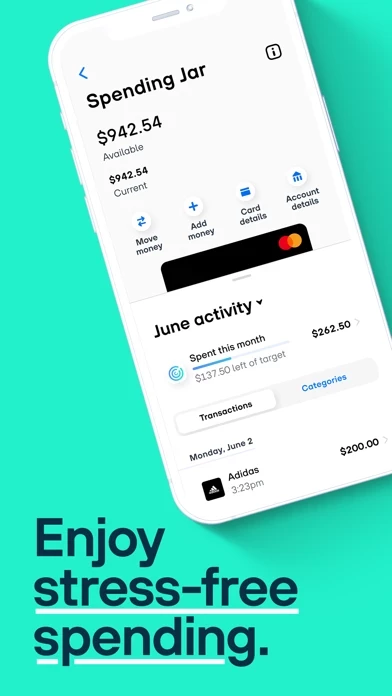

- Spend smarter with a dedicated Spending Jar to manage everyday spending and bills

- Organize savings with Stash Jars and automated savings to help reach short-term goals

- Prepare for emergencies with a Rainy Day Jar

- Effortless investing for the long-term with smart investment portfolios managed by experts

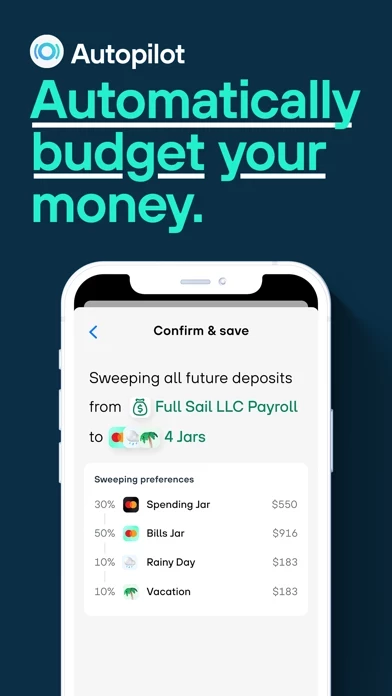

- Autopilot technology organizes and manages money every payday

- Free to download and easy to create an account in just 2 minutes.

Official Screenshots

Product Details and Description of

The smarter bank account this app is not a traditional bank, we're a financial technology company that helps you live financially healthier, by managing and growing your money on autopilot. One app that manages it all! this app's intelligent bank account takes the stress and hassle out of managing your money - helping you spend, save and invest smarter to reach your goals. We’re changing your relationship with money for the better while helping you create healthier financial habits. The this app bank account and debit card are issued by Choice Financial Group; Member FDIC. this app helps you pay off debt, spend smarter, save more, and actively build wealth. Create your this app account in 2 minutes and have a full bank account from your phone without having to leave whatever comfortable position you’re in! With this app, you can: Spend All you need to spend smarter and take control of your spending! * Manage your everyday spending and bills like a pro. * With a dedicated Spending Jar to manage your checking account * A separate Bills Jar to manage and pay your bills and subscriptions * Have confidence knowing your money is organized and you’re on track to reach your financial goals Save Easily achieve your saving goals. * Organize your savings with Stash Jars - to budget for your short-term goals. * We make savings a priority every payday - with automated savings to help you reach your goals. * We'll make sure you’re prepared for life emergencies with your Rainy Day Jar. Invest Effortless investing for the long-term. * Reach your future goals with our smart investment portfolios. * Managed by experts and tailored to your goal and risk appetite. * Create as many goals and portfolios as you need. * Grow your money to reach your goals. Automate Put your money on Autopilot to fast-track your financial goals * Every payday our autopilot technology organizes and manages your money for you. * Autopilot is at the epicenter of living a financially healthier and stress-free life! * Automatically manages and grows your money around the clock. You’re the reason we've created a financial wellness app. We'd love you to join everyone already using and benefiting from this app. Help us shape the future of banking and make the world financially healthier. Be part of our awesome community - give us feedback, discuss/share product ideas, and test new features. We’re building the future of banking, and our journey has only just begun. Try this app today - it’s free to download.

Top Reviews

By DarthRatee

Love This Bank !!!

All I can say is wow this is an awesome concept and applying for an account was easy as pie I love the bills jar and spending targets it is just like simple bank but upgraded I just they add a way to edit your address and offer a mail a check feature in the near future but other than that everything is perfect I can’t wait to start using my new debit card

By SlimnSexy216

I love this bank!!!!

I needed a bank that offered everything... early pay, budgeting, better ways to save, Apple Pay.... they have all that and more. Once they are compatible with plaid, I think I’ll close all my other accounts because I won’t need them. Thank you this app for being the bank of my dreams😍😍😍😍

By fpetrone625

5 stars!!

Amazing app! Has really help me get organized with my money, allowing me to spend within my limits, set savings goals and track my bills. I also really like how they help me prioritize saving up for a rainy day. Really looking forward to when they introduce investing.