Titan Overview

What is Titan? Titan is an investment app that allows users to invest their money with fund managers across stocks, private real estate, and private credit. The app provides personalized portfolio recommendations, updates, and access to an investor relations team. Titan lowers barriers to access premier fund managers and offers lower minimums and no accreditation requirements. Users can diversify their portfolio with asset classes previously out of reach to the everyday investor. The app offers a personalized investing recommendation with the Titan Reco Engine™ and keeps users informed about their money and the world of money. Titan is easy to get started with and has low minimums and no direct performance fees.

Features

- Investment in stocks, private real estate, and private credit

- Lower barriers to access premier fund managers

- Lower minimums and no accreditation requirements

- Diversification across multiple asset classes

- Personalized investing recommendation with the Titan Reco Engine™

- Daily, weekly, and monthly updates on investments and the world of money

- 24/7 tracking of performance in the mobile app or on the web portal

- 8 content franchises to explore

- Easy to get started with low minimums and no direct performance fees

- Disclosures and important additional disclosures available on the website.

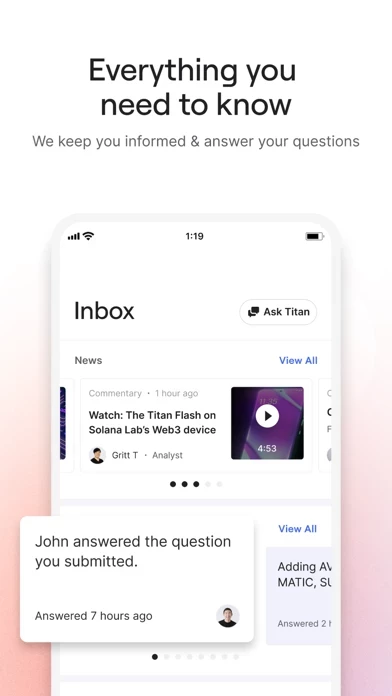

Official Screenshots

Product Details and Description of

this app lets you invest your money with fund managers across stocks, private real estate & private credit, all in one simple app. You’ll receive a personalized portfolio recommendation, consistent and digestible updates, and access to an entire investor relations team. Tell us your goals, this app handles the rest. Invest with iconic investment partners - We make it our job to find exceptional investment partners, and work with them to make their funds available to you. - this app lowers barriers to access premier fund managers to invest your money for you. Lower minimums and no accreditation requirements. Help diversify your portfolio with stocks, private real estate, and private credit - You can now build a balanced portfolio with asset classes previously out of reach to the everyday investor - ranging from ones targeting cash flow to long term appreciation. - Potentially reduce risk by spreading your investment across multiple asset classes that can lack correlation to one another. Don’t worry, we’ll show you how. Receive a personalized investing recommendation with the this app Reco Engine™ - We’ll ask you about your investing goals, financial situation, and comfort with risk to produce a recommendation that’s suitable for you today with a focus on your time horizon. - Take our team’s diversification recommendations across asset classes OR invest in funds/portfolios on an a la carte basis. Stay informed about your money and the world of money - Track performance 24/7 (or whenever you feel like it) in the mobile app or on our web portal. - Receive daily, weekly, and monthly updates on only the things that matter to you and the world of money. - Explore our 8 content franchises by reading, listening, or watching updates produced by your investment team. Easy to get started - Download the free mobile app or get started at this app.com. - Low minimums, no direct performance fees, and no accreditation requirements. - Set up takes minutes: Choose how much to invest, pick a portfolio or take our diversification recommendation, sit back, and we do the rest. $100 to get started. Zero direct performance fees. Disclosures this app Global Capital Management USA LLC ("this app") is a U.S. Securities and Exchange Commission (SEC) registered investment adviser and subsidiary of this app Global Capital Management, Inc. Certain Registered Investment Company (“RIC”) products are offered by third-party fund families and investment companies on this app’s platform as one of many potential investment options available to this app’s clients, that may or may not be recommended based on an individual client’s investment objectives and risk tolerance. Before investing in RIC products you should consult the specific supplemental information available for each product on www.this app.com. Information regarding third-party RIC products has been prepared exclusively by the relevant third-party RIC product provider, and not this app, and thus this app cannot guarantee the accuracy and completeness of the material. All investments involve risk and the past performance of a security or financial product does not guarantee future results or returns. Keep in mind that while diversification may help spread risk, it does not assure a profit or protect against loss. There is always the potential of losing money when you invest in securities or other financial products. Investors should consider their investment objectives and risks carefully before investing. The price of a given security may increase or decrease based on market conditions and customers may lose money, including their original investment and principal. Please visit www.this app.com/disclosures for important additional disclosures. Carlyle Tactical Private Credit Fund (“CTAC”) is a RIC managed by Carlyle Global Credit. Please review the CTAC Summary of Risk Factors, as well as the CTAC prospectus for a full list of risks associated with investing in CTAC before making any investment decision.

Top Reviews

By llamabill

BEST Way to invest hands down

I’m a Finance major, I totally understand how the stock market works and how to research a company. I was doing it on my own when I first started to invest but realized that I did not have the resources it takes or the time to effectively and responsibly manage a portfolio of companies. Then I was introduced to this app and immediately moved all of my money over to them once I heard about their long term oriented strategy to investing. I also love that they do all the research for me and then succinctly summarize what is taking place in each company. They also analyze macroeconomic trends and present their ideas and research in easy to understand videos and infographics. No matter you knowledge or background in investing their goal for you is to grow! I’ve also worked at several investment firms myself and the level of customer service that this app exhibits to their clients is unparalleled in the industry. They are quick to reply and answer questions and make the experience feel tailored to you, no matter your background or knowledge on how investing works. This is SO RARE for the finance industry. Overall - this app is one of my favorite apps to recommend to friends that are actually serious about investing for the long term instead of gambling their money on Robinhood. I cannot recommend this company - or this app - any higher.

By Christian Farley 23

Great Service - Always improving

Clay and the this app team seem to really be onto something. I won’t harp on the returns because they speak for themselves, but I am also very impressed with their client engagement. I have seen multiple improvements implemented that (I’m sure not just me) I specificaly asked about/recommended. I do wish you had the ability to get a little more technical with your own data, (e.g. look at cost/gains by lot or look at performance for specific time periods. Would also be cool to be able to compare this app to indexes/etfs/tickers of your choice)... but I also appreciate that the simplicity is part of the point. I would, and do, 1000% recommend this app to anyone who has the means to invest, and will continue to increase my holdings with them for the forseeable (and not so forseeable) future!

By DGP2020

Most Intelligent Research / Best Management / Amazing UI

this app is my favorite source of research and investment manager. this app provides all of the benefits of an actively managed and concentrated value oriented investment portfolio that also values growth. They leverage hedge fund data in ways that regular way ETFs would if they weren’t afraid to diverge from broader indices and the standard heard mentality that comes with them. Management is thoughtful, organized, and transparent about why they make their investment decisions. And best of all, they speak in understandable terms for people who could but don’t have time to read hundreds of pages of equity research. It’s also nice that there are options for different hedge preferences to align with each investor’s risk tolerance. Keep it up guys, this is my favorite investment and puts ETFs to shame. This is the future of investing.