Empower, Prudential Retirement Software

Company Name: Prudential

About: Leveraging its heritage of life insurance and asset management expertise, Prudential is focused on

helping people. Revenue is ranging 498M.

Headquarters: Newark, New Jersey, United States.

Empower Prudential Retirement Overview

What is Empower Prudential Retirement? The Empower, Prudential Retirement app is a mobile application that allows users to enroll in their employer's 401(k) or 403(b) plan, manage their retirement savings, track their progress, and access personalized financial wellness tips and tools. The app is available in English and Spanish and is accessible for all, meeting WCAG 2.1 guidelines.

Features

- Enroll with ease: Users can enroll in their employer's 401(k) or 403(b) plan using the app.

- Access the app in your preferred language: The app is available in English and Spanish.

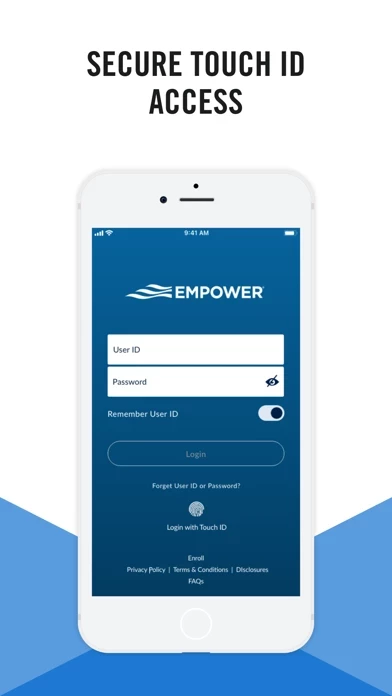

- Enjoy secure, convenient access: Users can log in with their fingerprint or facial recognition and enable two-step authentication for added security. The app is also accessible for all, meeting WCAG 2.1 guidelines.

- Track your progress: Users can track fund performance, see their account balance and personal performance, and view values by contribution type and investments.

- Manage your money: Users can view or change contributions, transfer between funds, adjust investment allocations, get investment help, and learn about their options if they change jobs or leave their employer.

- Stay in the know: Users can access personalized financial wellness tips and tools designed to help them achieve their goals and get need-to-know updates and notifications.

- Supports specific plan types: The app currently only supports customers enrolled in 401(k) plans, 403(b) plans, or Defined Benefit Cash Balance plans.

- Legal documents in English: Contractual and other legal documents, other agreements, and policy maintenance information will be in English. Additional materials may also be in English.

- Retirement products and services provided by Prudential: Retirement products and services are provided by Prudential Retirement Insurance and Annuity Company (PRIAC), Hartford, CT, or its affiliates. PRIAC is a Prudential Financial company.

Official Screenshots

Product Details and Description of

Effective April 1, 2022, Empower officially acquired the full-service retirement business of Prudential. For more details, review the important information associated with the acquisition by going to https://docs.empower-retirement.com/Empower/PRU/Empower-Transition-Disclosure-Participant.pdf The Prudential Retirement® app is now the Empower, Prudential Retirement app. If your plan was part of the sale from Prudential Retirement to Empower, please use this app. Retirement planning at your fingertips You can take control of your financial future – anywhere, any time. Enroll in your 401(k) or 403(b) to easily manage your money, track your savings progress, access insights and tips designed to help you achieve financial wellness, and much more. Empower, Prudential Retirement mobile app is available in English and Spanish. Key Features: Enroll with ease • Use the app to enroll in your employer's 401(k) or 403(b) plan Access the app in your preferred language • Available in English • Disponible en Español Enjoy secure, convenient access • Log in with your fingerprint or facial recognition • Enable two-step authentication for added security • Accessible for all (meets WCAG 2.1 guidelines) Track your progress • Track fund performance • See your account balance and personal performance • View values by contribution type and investments Manage your money • View or change contributions* • Transfer between funds • Adjust investment allocations • Get investment help • If you change jobs or leave your employer, you have choices about what to do with your retirement savings. Learn about your options in the app. *If applicable to your plan Stay in the know • Access personalized financial wellness tips and tools designed to help you achieve your goals • Get need-to-know updates and notifications Getting started: If you haven’t already, visit www.prudential.com/online/retirement to register your account and start making the most of all the tools and resources available to you. Please note, the app currently only supports customers enrolled in 401(k) plans, 403(b) plans, or Defined Benefit Cash Balance plans. If you are a participant in a NonQual-only plan or Defined Benefit Retiree Plan, or own other Prudential products (such as an annuity or life insurance policy), you will not be able to access your account via the app. We hope to expand the accessibility of our app to include additional Prudential account types soon. Contractual and other legal documents, other agreements, and policy maintenance information will be in English. Additional materials may also be in English. Information provided in a language other than English is for explanatory purposes only and shall not be construed to modify or change the terms of these documents, agreements, and other materials, which shall be legally interpreted solely in their English versions. Stay tuned We’re rolling out some exciting new features and enhancements with our upcoming releases, all aimed at increasing your ability to plan and manage your retirement. Having issues using our app? Please reach out to us at [email protected]. Retirement products and services are provided by Prudential Retirement Insurance and Annuity Company (PRIAC), Hartford, CT, or its affiliates. PRIAC is a Prudential Financial company. © 2022 Great-West Life & Annuity Insurance Company. All product names, logos, and brands are property of their respective owners. “EMPOWER”, “EMPOWER RETIREMENT”, all associated logos, and product names are trademarks of Great-West Life & Annuity Insurance Company. Prudential and all associated logos are registered trademarks owned by The Prudential Insurance Company of America and are used under license.

Top Reviews

By Enrique567

Improved app experience

I’d been using the browser version for years and just noticed that they have a mobile app. The app is clean and well organized. Many of the main features that I use it for (performance, investment types, etc) are all available. Looks like you recently overhauled the app and I am going to use the app much more. Thanks for helping me with my retirement goals and I hope more people find it useful too!

By BraveDave68

Much Better

I did not find this app very useful when it first came out. I recently revisited it and was pleasantly surprised functionality added. First, Face ID was added, which made it much faster to access than a web browser. When it first came out all you could do was review your balance. Now you can change your contribution percentage, review and make changes to your investments and read articles. Now a useful app!

By Chris12592

Good for monitoring, not changes

The app is fine for looking at your balances, but the only change you can make to the contribution amount. What would be useful to me Is the ability to change funds, change allocation amounts, etc.. I would also like to have access to the fund descriptions and performance history. Links to current financial market news would also be interesting.