Empower: Cash Advance & Credit Software

Company Name: Empower Finance

About: Empower aims to help millennials manage their finances through its mobile app for iOS and Android.

Headquarters: San Francisco, California, United States.

Empower Overview

What is Empower?

Empower is a financial technology company that aims to help more people access affordable credit, build their credit history, and rewrite their financial story. The app offers various features such as cash advance up to $250, a revolving line of credit up to $1,000, early paycheck deposit up to 2 days faster, up to 10% cashback, free ATM withdrawals, and spend tracking.

Features

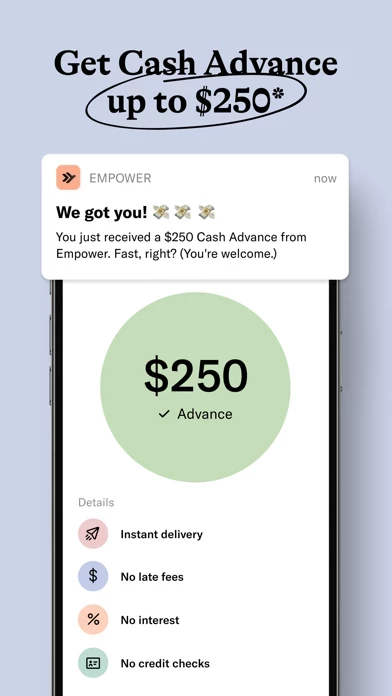

- Cash advance up to $250 with no interest, no late fees, and no credit checks

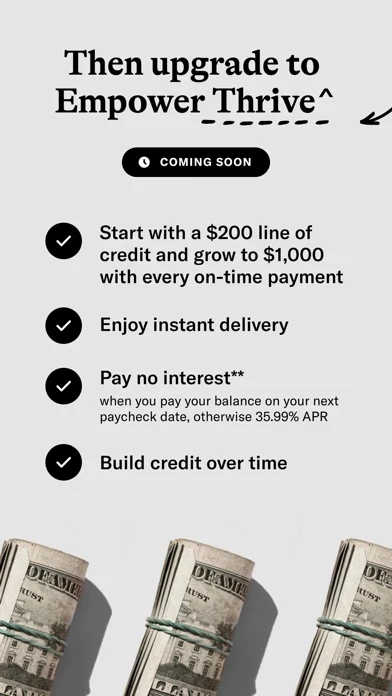

- Revolving line of credit up to $1,000 with instant delivery and 0% APR (when paid on next paycheck date, otherwise 35.99% APR)

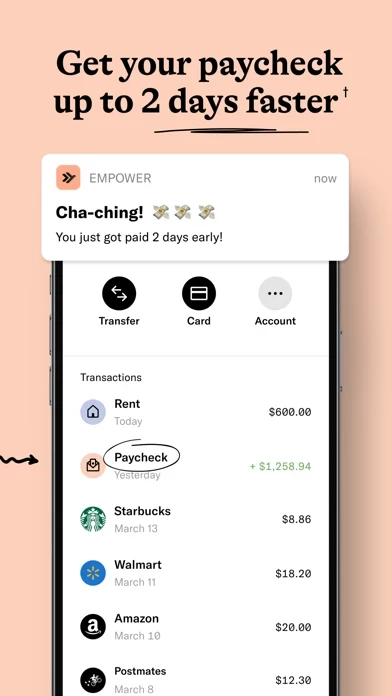

- Early paycheck deposit up to 2 days faster than most banks

- Up to 10% cashback on purchases with the Empower Card

- Free ATM withdrawals at over 37,000 MoneyPass ATMs across the US

- Spend tracking to monitor finances and receive 24/7 alerts

- Auto-recurring monthly subscription fee of $8 after the 14-day free trial concludes for first-time customers, and immediately for customers returning for a second or subsequent subscription

- Eligibility requirements apply for cash advance and revolving line of credit

- Empower Thrive line of credit restricts access to Empower Cash Advance until the line of credit is closed and eligibility requirements for cash advance are met

- Annual Percentage Rate is subject to change and is 0% APR when paid on next paycheck date, otherwise 35.99% APR

- Early access to paycheck deposit funds depends on the timing of the employer's submission of deposits

- Cashback deals on Empower Card purchases vary and must be selected in the app, and will be applied automatically when the final transaction posts.

Official Screenshots

Empower Pricing Plans

| Duration | Amount (USD) |

|---|---|

| Billed Once | $8.14 |

| Monthly Subscription | $10.67 |

**Pricing data is based on average subscription prices reported by Justuseapp.com users..

Product Details and Description of

Think the credit system is stacked against you? So do we. this app is on a mission to help more people access affordable credit, build their credit history, and rewrite their financial story. No credit score or security deposit to qualify. (this app is a financial technology company, not a bank. Banking services provided by nbkc bank, Member FDIC. this app Thrive provided by FinWise Bank, Member FDIC.) GET CASH ADVANCE UP TO $250* Tight on cash and tired of asking friends to cover you? this app will float you up to $250 when you need it most. Instant delivery available. No interest, no late fees, no credit checks. Just pay us back when you get your next paycheck. BUILD UP TO $1,000 OVER TIME WITH AN this app THRIVE REVOLVING LINE OF CREDIT^ (COMING SOON!) Start with a $200 revolving line of credit and grow to $1,000 with every on-time payment. Enjoy instant delivery and 0% APR** (when you pay your balance on your next paycheck date, otherwise 35.99% APR). Building credit just got a whole lot easier. GET YOUR PAYCHECK UP TO 2 DAYS FASTER† Wish payday came sooner? Wish no more. With the this app Card, you can get paid up to 2 days earlier than most banks. GET UP TO 10% CASHBACK† Perks of a credit card but with a debit card. With the this app Card, save money on the places where you shop already, like restaurants, grocery stores, gas stations, and more. No overdraft fees. GET FREE ATM WITHDRAWALS Enjoy convenient access with the this app Card to over 37,000 MoneyPass ATMs across the US. Use them as often as you want, whenever you want, and never get charged a single dime for taking out cash. TRACK YOUR SPEND Take control of your finances by monitoring your spend against weekly or monthly limits by category. We’ll send you 24/7 alerts to coach you on how to do better. – this app charges an auto-recurring monthly subscription fee of $8 (a) after the 14-day free trial concludes for first-time customers, and (b) immediately for customers returning for a second or subsequent subscription. Cancel anytime. * Eligibility requirements apply. Free instant delivery is available for eligible customers with an activated this app Card. ^ Eligibility requirements apply. Opening an this app Thrive line of credit restricts access to this app Cash Advance, with access restricted until the this app Thrive line of credit is closed and you meet the eligibility requirements for this app Cash Advance. Instant delivery is available for a 5% fee of the draw amount on the line of credit. We report your payments to the credit bureaus. Pay on time and keep utilization low for the best potential benefit. Many factors impact your credit score, and while making on-time payments and keeping utilization low may improve your score, there is no guarantee this will improve your score. ** The Annual Percentage Rate is subject to change. An this app Thrive line of credit is subject to credit approval. There are no costs to open an this app Thrive line of credit. If you choose to pay your draw in full on your next paycheck date, your rate will be 0% APR; if you miss your payment, you will accrue interest at 35.99% APR and may incur late fees. If you choose to pay your draw on a date other than your next paycheck date, your rate will be 35.99% APR or as otherwise required by state law. † Early access to paycheck deposit funds depends on the timing of the employer's submission of deposits. We generally post such deposits on the day they are received which may be up to 2 days earlier than the employer's scheduled payment date. Cashback deals on this app Card purchases, including categories, merchants, and percentages, will vary and must be selected in the app. Cashback will be applied automatically when the final transaction posts, which may be up to a week after the qualifying purchase.

Top Reviews

By cmoniiieyeeyuy

Almost Perfect

I very rarely write reviews, but for this app I’m going to make an exception. I’ve been searching for a budgeting and savings app for a while now, and I’ve tried competitors like mint and even gave a couple paid offerings a shot. Honestly, this app is far better than the competition. It includes all the same features you’ve come to expect in a budgeting app such as financial advice and linking accounts, but it does it better. One good example of its superior customer experience is the feature to add and remove specific accounts from your financial institution (For instance, if you have a savings account connected to your chase checking account that you’ve never touched, it’s not going to be around to irritate you and take up space.) This app even lets you link your investment institutions and lets you see how your securities are doing right in the app! My only gripe is that for whatever reason I’m having trouble connecting my Robinhood account. If anyone from customer service sees this review, I’d be very grateful for some assistance. : )

By Mechbi

I LOVE this app!

Initially I had some trouble connecting my bank but as soon as I got everything set up it’s AMAZING. I love being able to look at my savings and checking account balances as well as my credit card statement all at the same time. Everything you need is on the main screen so there’s no unnecessary scrolling through multiple pages. This app allows you to set budgets, for example how much you want to allow yourself to spend every month and by week on different items and overall. They make a cool graph so you can very easily see what you’re buying and keep track of how much you’ve spent & how much you have left to spend based on the budget you set for yourself. I can’t say enough good things about this app, it’s amazing I love it so much, it’s making keeping track of my money so much easier.

By carkur

LOVE this app

I never write app reviews, but this is exactly the app I needed. I’ve fought a long time with Quicken and hated it but saw no other option. This saved my budget and helped me get out of credit card debt fast. I’m especially thankful for the auto save portion because my employer doesn’t do percentages and I’ve just been putting a flat amount into my savings monthly. This posed a challenge as I am a part time hourly worker with great schedule variance. This was the solution I needed! The only thing I wish is that I could have more than one auto save option. It seems that isn’t the case at the moment. I’d like to be able to save for two things at once! Hopefully this will be a possibility in the future. I recommend this app to everyone who wants to manage their money easily and well.