Current: The Future of Banking Software

Company Name: Finco Services, Inc.

About: Fo-Sho is a peer-to-peer insurtech that is powered by technology to bring affordable short-term

insurance to South African markets.

Headquarters: Gauteng, NA - South Africa, South Africa.

Current Overview

What is Current?

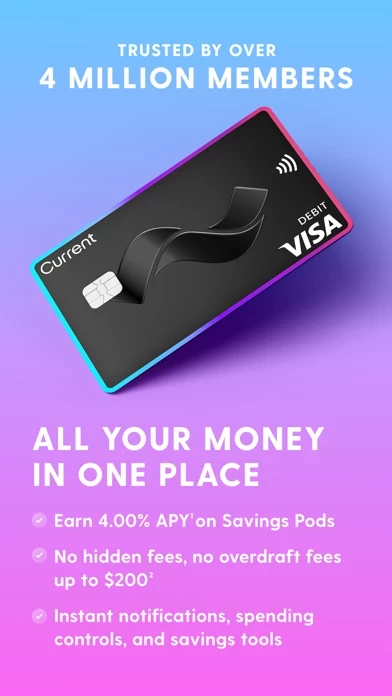

Current is a financial technology company that offers mobile banking services and a Visa debit card to help users manage their money better. The app provides various features such as savings, fee-free cash withdrawals, faster direct deposits, rewards, spending notifications, instant money transfers, privacy controls, and 24/7 support. Current also offers a teen account with parental controls and money management tools.

Features

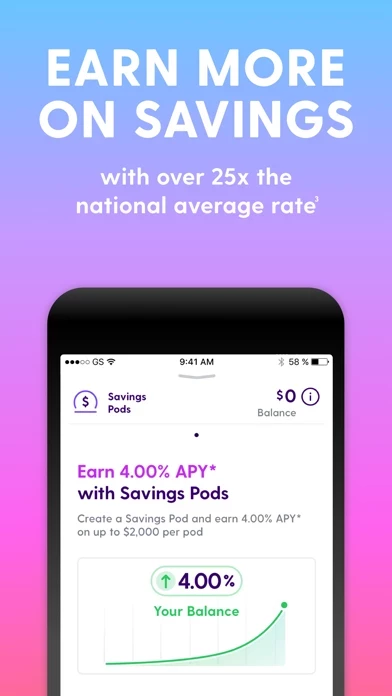

- Earn 4.00% APY on Savings with Pods

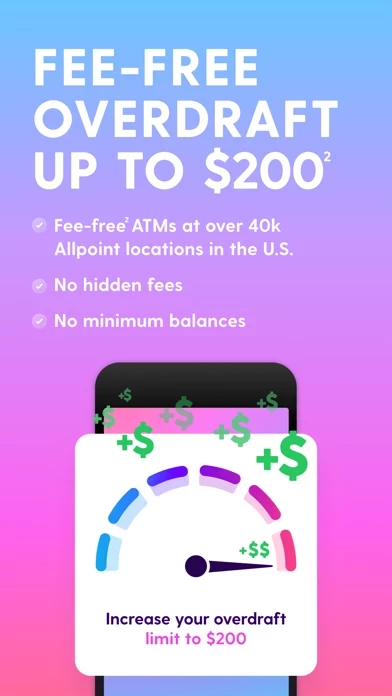

- Overdraft up to $200 without overdraft fees

- Fee-free cash withdrawals from 40,000 Allpoint ATMs in the U.S.

- Payday comes up to 2 days faster with direct deposit

- Get up to 15x the points and cash back on swipes

- Get a sleek black Current card

- Instant money transfers with Current Pay

- Get instant gas hold removals so your funds are available right away

- Privacy controls to protect your information

- Block your card in the app

- 24/7 support & chat in the app

- Savings Pods teach teens to set savings goals

- Instant money transfers from parent to teen

- Spending notifications and set automated allowance payments

- Money management tools that help teens budget money

- Parental controls let you pause the card directly in the app, set spending limits, and block merchants

- No annual fee and no minimum requirement to open any account

- Teen accounts must be linked to a parent's account through the app.

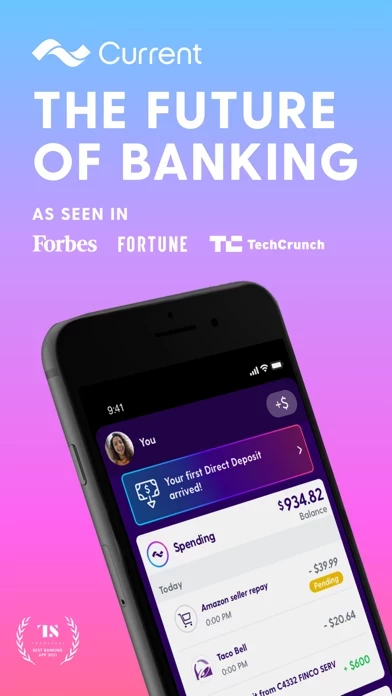

Official Screenshots

Current Pricing Plans

| Duration | Amount (USD) |

|---|---|

| Billed Once | $4.99 |

| Monthly Subscription | $4.99 |

**Pricing data is based on average subscription prices reported by Justuseapp.com users..

Product Details and Description of

this app is the future of banking. Spend, save, and manage your money better with our mobile banking app and Visa debit card designed to make the most of what you've got. this app is a financial technology company, not a bank. Banking services provided by Choice Financial Group; Member FDIC. Join over 4 million members that trust this app & sign up today. INDIVIDUAL this app ACCOUNT BENEFITS SAVE: Earn 4.00% APY¹ on Savings with Pods SKIP THE FEES: Overdraft up to $200 without overdraft fees & get fee-free cash withdrawals from 40,000 Allpoint ATMs in the U.S.² GET PAID: Payday comes up to 2 days faster with direct deposit.⁴ GET REWARDED: Get up to 15x the points and cash back on swipes.⁵ SPEND: Get a sleek black this app card⁶, spending notifications and insights, and instant money transfers with this app Pay.⁷ ACCESS YOUR $$$: Get instant gas hold removals so your funds are available right away. STAY SAFE: Get privacy controls to protect your information, and block your card in the app. GET HELP: 24/7 support & chat in the app. TEEN ACCOUNT BENEFITS SAVE: Savings Pods teach teens to set savings goals.¹ SPEND: Get instant money transfers⁸ from parent to teen, spending notifications, and set automated allowance payments. BUDGET: Explore money management tools that help teens budget money. STAY SAFE: Parental controls let you pause the card directly in the app, set spending limits, and block merchants. Sign up for an Individual this app Account & Teen Account for no annual fee. No minimum requirement to open any account. Teen accounts must be linked to a parent's account through the app. Start using your account right away when you activate your virtual debit card. ¹ The Annual Percentage Yield ("APY") for this app Interest is variable and may change at any time. The disclosed APY is effective as of January 1, 2022. No minimum balance required. Must have $0.01 in savings pods to earn this app Interest on up to $2000 in deposits per Savings Pod up to $6000 total. Please refer to this app Interest Terms and Conditions. https://this app.com/lp/savings-with-interest ² Out-of-network and International cash withdrawal fees apply. Additional third-party fees from the ATM owner may apply. Please refer to Overdrive™ Features Terms and Conditions. Learn more at cdn.this app.com/choice_account_agreement.pdf ³ 25x rate calculated using the FDIC average National Deposit Rate for savings accounts of 0.13 https://www.fdic.gov/resources/bankers/national-rates ⁴ Faster access to funds is based on comparison of traditional banking policies and deposit of paper checks from employers and government agencies versus deposits made electronically. Direct deposit and earlier availability of funds is subject to timing of payer's submission of deposits. ⁵ Earning rates over 1x are only available on Individual this app Accounts at participating merchants. ⁶ Banking services provided by Visa® Debit Card issued by Choice Financial Group, Member FDIC, pursuant to a license from Visa U.S.A. Inc and can be used everywhere Visa debit cards are accepted. ⁷ It is possible that technical issues may cause delays, but this is not to be expected.

Top Reviews

By candismalli

Very helpful for my teen

This is helping my teen learn the value of money and budgeting. It is also wonderful to know when he is on school trips away from me that I can quickly transfer $ to his card within minutes if something unexpected comes up and not have to give him a bunch of what if cash- he goes on a lot of out of town contests! He used to ask me for certain things not realizing costs and now he compares prices and it is helping him to be a better spender and saver! I am able to set his weekly allowance and if needed I can transfer $ into his account immediately. One thing to note is that you need to have $ transferred from your bank into your parent this app account ahead of time because it does take several days for it to clear. Once the $ is in your parent account though you can transfer to your child’s account as needed within minutes. Also if your child “owes” you $ for something it can be transferred from their account back to yours! I love that my son can have his card and not have to carry cash especially on those trips he takes with school.

By Juiicy La'Noire

Dope. Also love the color scheme.

I love this app so far. At first I was skeptical when I first signed up only because I didn’t know if my money from my direct deposit was going to be loaded on my card on time or not since I was switching from another bank. Customer service is only available on weekdays from 9am-6pm which would be inconvenient if you stumbled across an issue on the weekend. Anyway I kept calling and they kept saying they don’t know anything until payday but eventually my money was loaded two days earlier on my regular white card. My premium black card didn’t even arrive yet but was still able to use all the benefits! Also I love the color scheme lol. I love pink I think it’s dope to have a colorful bank card instead of the boring originals out there. I would actually prefer to use the regular white card white then colorful outer rings over the premium black one. But that’s just me. If you want to chose a direct deposit card and don’t want a real bank for personal reasons. I suggest this app! They’re dope.

By Lovepink 45

Best thing ever for kids that love video games and teens!

I have two teenage daughters and a 10 year old with autism . I started with just getting a card for my oldest because she’s 16 and driving and it ma easy way for her to have her own money but then I got my other two kids one because they play all those internet games and I hate giving them my credit card because they save the card and buy all kinds of stuff. So now they have their own card and they have to earn money for it . Rolblox is expensive . 😫. They can use it for stuff at the store and everything and I don’t have to worry about reoccurring charges all the time . Only thing I would change is that it takes like 2-3 days sometimes for it to go through so if they needed money fast than u have to keep money on your account just in case . But it’s not so bad . Other than that I totally love the card and my sister and friend got the same thing for their kids . Great idea wish I would have thought of it :)