M1: Investing & Banking Software

Company Name: M1 Finance LLC

About: Invest for free in a custom portfolio

Headquarters: Chicago, Illinois, United States.

M1 Overview

What is M1? M1 is a finance super app that allows users to build and manage their wealth from an automated and intuitive platform. With over $5B in assets and hundreds of thousands of investors, M1 is an award-winning experience that offers long-term investing, automated finances, and exclusive features and perks for M1

Features

- Automated and intuitive platform for building and managing wealth

- Smart Transfers for automating finances and long-term investing

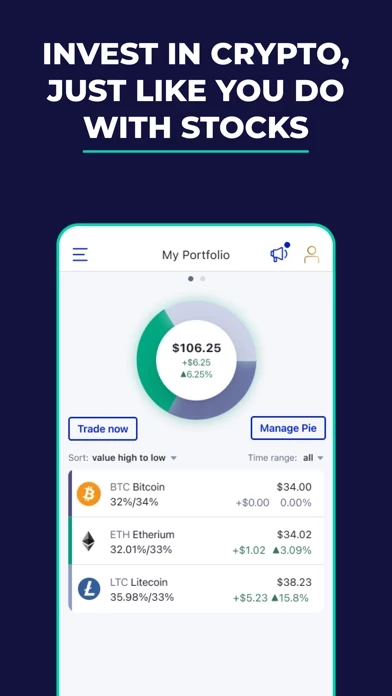

- Investing in cryptocurrencies, including BTC and ETH

- Individual, joint, trust, or custodial account options

- Traditional, SEP, or Roth IRA or rollover a 401(k) options

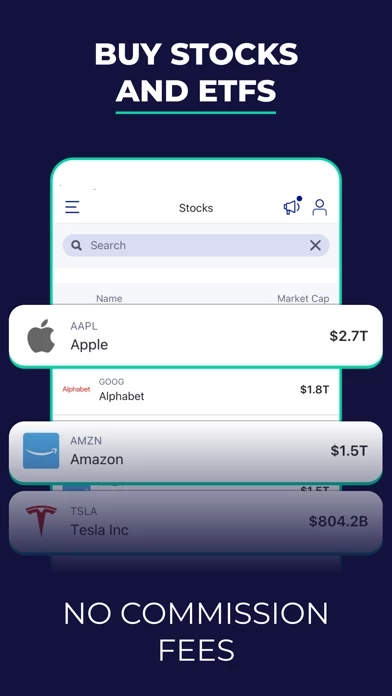

- Intuitive Pies interface for choosing stocks and ETFs

- Pre-built Expert Pies for investing according to values, risk tolerance, retirement plans, and more

- Fractional shares for investing as little as one dollar

- One-click rebalancing for ensuring investments match goals

- M1 Plus membership for exclusive features and perks

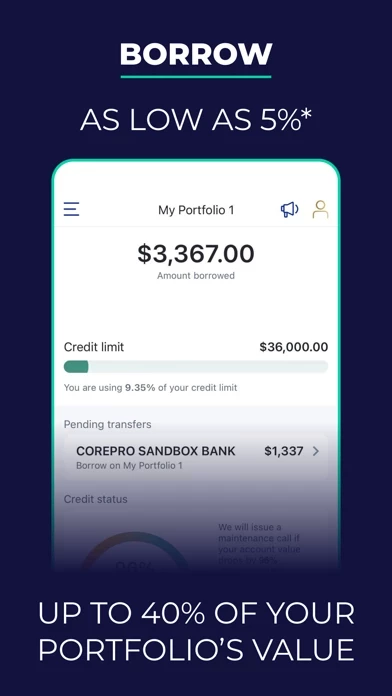

- Borrow against investments with rates from 5%-6.5%

- M1 Spend checking accounts with 2.50% APY and 1% cash back for M1 Plus members

- Owner's Rewards Card for earning cash back on eligible M1 Invest portfolio purchases and everywhere else

- Account protection with SIPC and FDIC insurance

- Must be 18+ and US resident to open an account

- Brokerage products and services are not FDIC insured, not bank guaranteed, and may lose value

- Investing in cryptocurrency comes with significant risk. Cryptocurrencies are not FDIC or SIPC insured.

Official Screenshots

Product Details and Description of

this app: THE FINANCE SUPER APP. Build and manage your wealth from the convenience of an automated, intuitive platform. Hundreds of thousands of investors trust this app with over $5B in assets. See for yourself why this app is an award-winning experience. Plan long-term investing quickly and automate your finances with Smart Transfers: custom rules that move your money how you want. CRYPTO this app Finance now offers investing in cryptocurrencies, including BTC and ETH. You can now make Crypto part of your long-term investing strategy, invest automatically in custom pies, commission-free. INVEST Invest with an individual, joint, trust, or custodial account. Or open a Traditional, SEP, or Roth IRA or rollover a 401(k). Choose stocks and ETFs with an intuitive Pies interface; let our automated tools handle the buying and selling. Pre-built Expert Pies help you invest according to your values, risk tolerance, retirement plans, and more. Fractional shares let you invest as little as one dollar for more power and flexibility. One-click rebalancing makes sure your investments match your goals. With this app Plus, get exclusive features and perks throughout your account for just $125 a year, after your three-month free trial. BORROW Borrow against your investments easily with rates from 5%-6.5%*. Access funds in minutes for more liquidity without selling off your securities. Funds available in minutes in this app Spend or this app Invest accounts, available in 1-2 business days in external banks. SPEND Get 2.50% APY† on your checking balance (62x the national average) and 1% cash back** on eligible this app Debit card purchases when you're an this app Plus member. THE OWNER'S REWARDS CARD Earn 2.5%-10% cash back*** when you spend at select brands in an eligible this app Invest portfolio, and 1.5% cash back everywhere else. With this app Plus, we'll waive the $95/year annual fee. You can automatically reinvest your rewards money to build wealth-even as you spend it. this app. YOURS TO BUILD. ACCOUNT PROTECTION this app Finance LLC, Member of SIPC. Securities in your account protected up to $500,000. For details, see www.sipc.org. --- this app Spend checking accounts may be insured up to $250,000 by the FDIC. Additional DISCLOSURES For full list of fees visit this app Fee Schedule at https://this app.com/legal/disclosures/misc-fees/ See important disclosures in the final screenshot above or visit https://this app.com/legal/disclosures/ this app refers to this app Holdings Inc., and its affiliates. this app Holdings is a technology company offering a range of financial products and services through its wholly-owned, separate but affiliated operating subsidiaries, this app Finance LLC and this app Spend LLC. Must be 18+ and US resident to open an account. this app Plus is an annual membership that confers benefits for products and services offered by this app Finance LLC and this app Spend LLC, each a separate, affiliated, and wholly-owned operating subsidiary of this app Holdings Inc. "this app" refers to this app Holdings Inc., and its affiliates. Brokerage products and services are not FDIC insured, not bank guaranteed, and may lose value. this app Finance LLC, Member FINRA / SIPC. Investing in cryptocurrency comes with significant risk. Cryptocurrencies are not FDIC or SIPC insured. For relevant disclosures and risks, visit this app.com/crypto-disclosures All product and company names are trademarks™ or registered® trademarks of their respective holders. Use of them does not imply any affiliation with or endorsement by them. © Copyright 2022 this app Holdings Inc. App distributed by: this app Finance LLC; 200 N LaSalle St., Ste. 800; Chicago, IL 60601; United States

Top Reviews

By moldy912

Great Free Alternative for easy Investing

this app is awesome: completely free, quick deposits unlike Robinhood, and partial shares which very few brokers do. I can make my own ETF essentially. I love the concept of pies, the app shows them very interactively and intuitively, and it's fun to make your own mix of stocks. I was using Robinhood, Schwab, and Betterment, but will now be doing this app instead of Betterment. This will avoid the management fees and give me almost any choice of fund, which betterment doesn't allow for accounts less than $100k. I'll still keep Robinhood because I like the interface and the feeling of owning whole stocks, but I'll be using it less and less. Schwab same kind of thing, it's convenient but there are fewer free ETFs, and no free stocks. I would highly recommend this app, so far it's great and I will be putting most of my money into it.

By Tennisaddict4life

Does job well!

The app works just as it should. The concept of pies took a little bit of time to get used to as I constructed my first portfolio, but once figured out, it gives the user great flexibility in creating a portfolio. One feature that would be nice is to see what stocks are duplicated in multiple pies as you put together a portfolio. Regarding this app: The ability to purchase fractional shares allows even small investors to have a diversified portfolio and add to it with regularity, and the ability to do it for free is a great benefit to today’s budding and experienced investors. Here are a couple things I wish this app would add to their service: First, allow for recurring individual orders and second give the customer the ability to turn off the auto rebalancing feature for new investments.

By Haduca

Another option please

I really like this app Finance, primarily because it’s free and that I can purchase partial shares. It deserves 5 stars on those reasons alone. However, I would like to see another way to purchase shares besides the way it allocates deposited funds based on the percentages given on pies. I’d like to allocate funds freely, automatically of course on the same basis it does currently: weekly, monthly that sort of thing, but with dollar value options. For example, I’d like to put in 100 dollars a week into Apple and 50 dollars to Disney, and differing amounts on my other stocks. The purchased shares won’t be based on a pie, but rather a predetermined amount. The pie method limits my ability to continuously add funds into stocks that have risen significantly, and making its weight heavy on the pie. Even if my determined weight for the stock on my pie is exceeded, I would like to continue purchasing shares for that stock. The predetermined dollar amount to purchase s shares for the stock will eliminate the pie limitation. I would still like to see a pie of my stocks, but I don’t want the percentages on the pie to limit my purchasing ability. Please let me know if this will ever become an option in the future.