Albert: Banking on you Software

Company Name: Albert Corporation

About: Athabasca Basin Development is an investment company committed to building and investing in

successful businesses

Headquarters: Prince Albert, Saskatchewan, Canada.

Albert Overview

What is Albert?

Albert is a financial app that offers banking, saving, investing, and budgeting solutions. It has a team of money experts to guide users and an Albert debit card that gives cash back. The app allows users to set up direct deposit and access their paycheck up to 2 days earlier. Albert is not a bank, but it offers banking services through Sutton Bank, Member FDIC. The app has more than 10 million users and offers a Genius team of real human experts to answer any financial questions.

Features

- Banking services provided by Sutton Bank, Member FDIC

- Albert Savings accounts held at FDIC-insured banks

- Albert Mastercard® debit card issued by Sutton Bank, Member FDIC

- Cash withdrawal fees apply to ATM withdrawals

- Genius team of real human experts to answer financial questions

- Early access to direct deposit funds

- Spot advance up to $250 from next paycheck with no interest, no late fees, and no credit check

- No mandatory repayment timeframe for spot advance

- Total processing fees for spot advance range from $0 to $6.99 depending on the method

- Automatic savings feature that tracks income and spending to find dollars to save

- Cash bonuses for saving

- Guided investing with stocks and themed ETFs

- Custom portfolio built for financial goals

- Security technology to protect sensitive information

- FDIC-insured Albert Cash and Albert Savings accounts

- SIPC protection for securities customers of Albert Securities LLC

- Advisory services offered through Albert Investments, LLC

- Investments are risky and past performance is no guarantee of future returns.

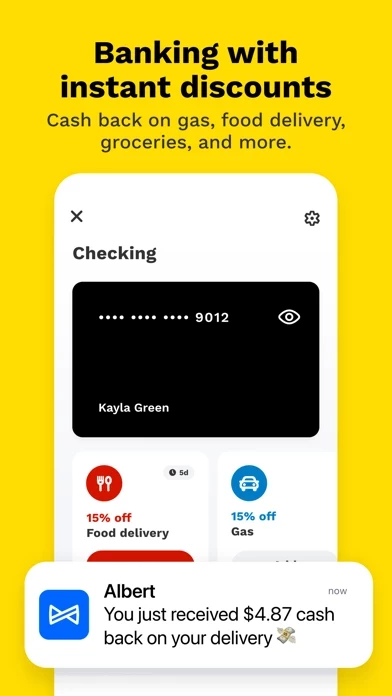

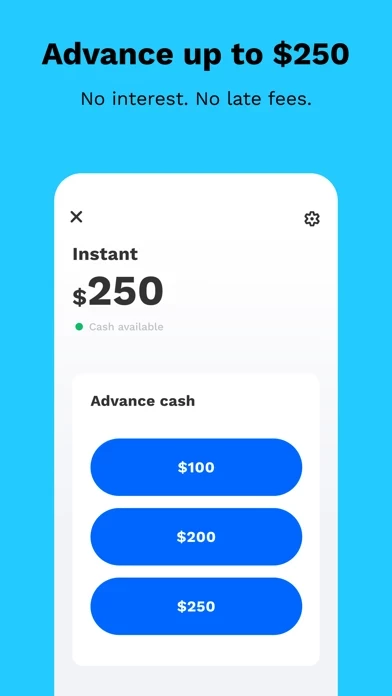

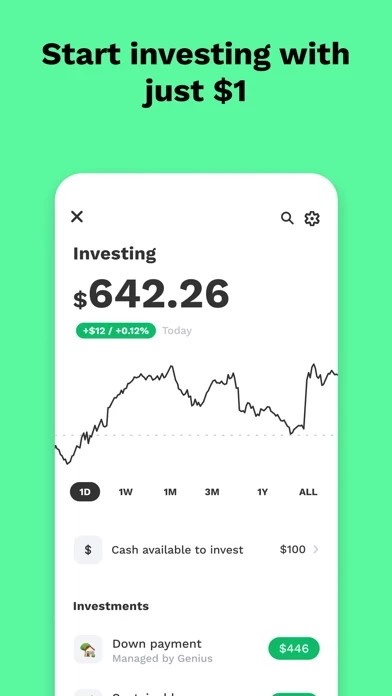

Official Screenshots

Albert Pricing Plans

| Duration | Amount (USD) |

|---|---|

| Billed Once | $22.50 |

| Weekly Subscription | $72.60 |

| Monthly Subscription | $76.50 |

**Pricing data is based on average subscription prices reported by Justuseapp.com users..

Product Details and Description of

WE’RE BANKING ON YOU At this app, we want you to win. So we built a better banking, saving, investing, and budgeting solution — with a Genius team of money experts to guide you. And an this app debit card that gives you cash back. Set up direct deposit and your paycheck becomes available up to 2 days earlier. Then save, manage, and invest it in the app. this app is not a bank. See disclosures below for details. EVERYONE NEEDS A GENIUS IN THEIR LIFE Our Genius team of real human experts are here to answer everything, from the toughest to the simplest to the most embarrassing questions. That means budgeting, credit cards, student loans — even buying a home. More than 10 million people trust us. GET UP TO $250 this app can spot you up to $250 from your next paycheck. No late fees, no interest, no credit check. No mandatory repayment timeframe. Repay us when you get paid or when you can afford it. Download the app to see what you qualify for. Details below: • No interest: no interest charged ever. • Repayment period: no mandatory minimum or maximum repayment timeframe. Repay us when you get paid or when you can afford it. • Total processing fees: for up to $250 advance, total processing fees are either (i) $0 per advance when you advance to your this app debit card with direct deposit; or (ii) $0 per advance via ACH; or (iii) $3.99 per advance to your this app debit card without direct deposit; or (iv)$6.99 per advance to a non-this app debit card. Tips are optional and aren’t used to determine any advance limits. SAVE SMARTER this app tracks your income and spending to find dollars you can save, automatically. Plus get cash bonuses just for saving. If you need the money you’ve set aside, withdraw it any time. GUIDED INVESTING Invest your money with Genius. Buy stocks and themed ETFs like companies supporting a sustainable world. Plus, let Genius create your custom portfolio built for your financial goals. Start with just $1. SECURITY • this app uses cutting-edge security technology to protect your sensitive information. • this app Cash and this app Savings accounts are FDIC-insured. Should the member bank holding your balance fail, you'll be insured for up to $250,000 of your money in the account. • this app Securities is a Member of SIPC, which protects securities customers of its members up to $500,000 (including $250,000 for claims for cash). Explanatory brochure available upon request or at www.sipc.org. DISCLOSURES this app is not a bank. Banking services provided by Sutton Bank, Member FDIC. this app Savings accounts are held for your benefit at FDIC-insured banks, including Coastal Community Bank and Wells Fargo, N.A. The this app Mastercard® debit card is issued by Sutton Bank, Member FDIC, pursuant to a license by Mastercard. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated. Cash withdrawal fees apply to ATM withdrawals. Bonus and cash back programs subject to terms. Early access to direct deposit funds may vary depending on the payer’s deposit timing. See app for details. Securities products and services offered to self-directed investors through this app Securities LLC, Member FINRA/SIPC. View important disclosures at albrt.co/disclosures Advisory services offered through this app Investments, LLC. Investments are risky: you could lose money, and past performance is no guarantee of future returns. For more information, see our Form ADV Part II and our Terms of Use at this app.com.

Top Reviews

By Unique_Martha

Great app

I love this app, helps to save money and this app genius keeps track of your spendings. Confusing at first, Once you are familiar with what means what and how to work along with this app Genius. Just be curious and look around and be familiar of the app. They Work great with keeping up just answering your question the team goes beyond with great skills. Ask any personal questions and Be patient. Wait for your questions to be answered, and they will get right with you as soon as possible. they are more then likely Busy with other people. So be Patient. this app genius is FDIC Safe insured savings account. When you sign up with genius you choose to pay what you think is fair, with a minimum fee of $4 per month or $6 per month. You choose what is fair. You can also go to There this app Website, to see how this app genius Works. Feel free to have the confidence to save with this app. As much as they have Savings, they also have Investing options. Need help with buying a Home or Renting ask Away and they will Organize and help you with that. Paying to much for your bills? Ask away. For those who think it is a bad app i strongly Disagree. Sorry for miss understanding Just weren’t Curious enough. Look up information. Give it a try! 👌🏽 make a great choice, you wont regret it. Thank you this app Genius.

By fendjdbd

Wow!

Let me just start off by saying I was skeptical about this app at first because of linking my bank account, but given that I live on my own and just moved to a new state, I needed to budget my paychecks properly as I was carelessly spending before. I downloaded this app with the intention to get my finances under control but didn’t realize all the benefits. So i downloaded it and payed the monthly fee, and it set up a savings account (rainy day fund) then forgot about it and deleted the app. THREE MONTHS LATER I’m checking my banking app and see that this app had taken $10 out of my account then looked a little more and had seen they had been periodically taking money out. At first I was lied “WHOA HOLD UP WHAT IS THIS??” So I downloaded this app again and checked it and it had SAVED UP ALMOST $300!! I was honestly so happy. As someone who had been living paycheck to paycheck and worried if I was gonna be able to pay rent every month because of my careless spending, this app has SAVED ME so much financial anxiety. I even created another savings account in the app for a car AND IT PREDICTS WHEN ILL ACHIEVE THAT GOAL! You can set up “smart savings” for any of the savings account which will take out what you can afford to save, which is a lifesaver! Safe to say I’ll be using this app probably FOREVER!

By Jessljgdadfhj

Amazing app

I was always too lazy to go to the bank or an ATM to withdraw cash to save for various things (vacations, emergencies, Christmas), and I didn’t want to create an actual savings account that would lump it all together, so I constantly had NO money saved because I didn’t have the discipline to not spend all that I had in checking. this app is AMAZING! It lets me create as many folders as I want, for whatever I want. They have “smart savings,” where they automatically will save a certain amount of money for you each week and spread it across your folders, based on the priority you’ve given them. Then, you can also add funds as you’d like. Best of all, you can withdraw money whenever you need, without any fees. It does take a couple of days to post to your bank account, but that is the ONE, single thing about the app that I don’t love, and I can completely understand why it can’t be immediate. Love love love this app. I talk about “my this app” to friends and family at least a couple times each week, and they know exactly what I’m talking about. And you can choose how much to pay for the monthly subscription, so if you’re super tight on money like I was when I first got the app, you can give just $5/month and have all of these great benefits.