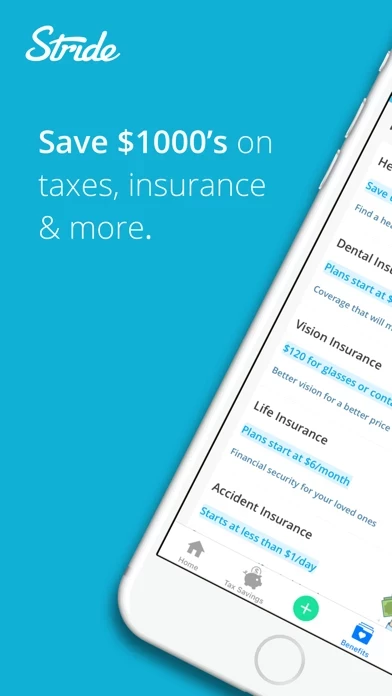

Stride: Mileage & Tax Tracker Software

Company Name: Stride Health, Inc.

About: Benefits for independent workers.

Headquarters: San Francisco, California, United States.

Stride Overview

What is Stride?

Stride is a free mileage and expense tracking tax app designed for people who work for themselves. It helps users save thousands on their tax bill by automatically maximizing mileage deductions, importing expenses, finding money-saving write-offs, and making filing a breeze. Stride is suitable for various professionals, including rideshare drivers, delivery drivers, entertainers, creative professionals, food service professionals, business consultants, sales agents, real estate agents, home service professionals, caregivers, medical professionals, cleaners, and many more.

Features

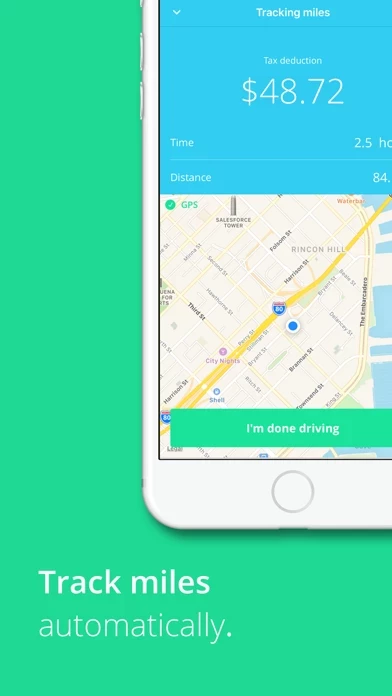

- Automatically maximizes mileage deductions and captures them in an IRS-ready standard mileage log format

- Automated GPS mileage tracking

- Reminders to ensure users never miss out on miles

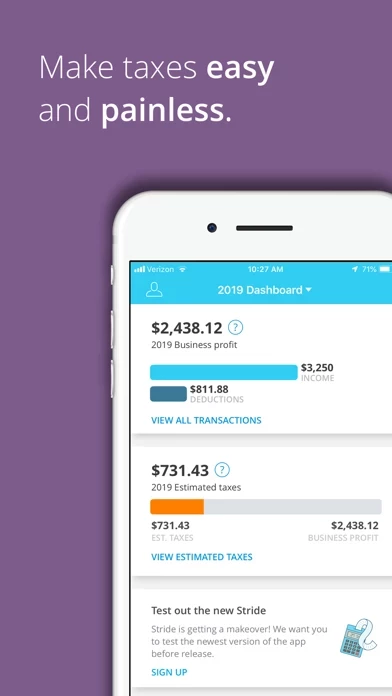

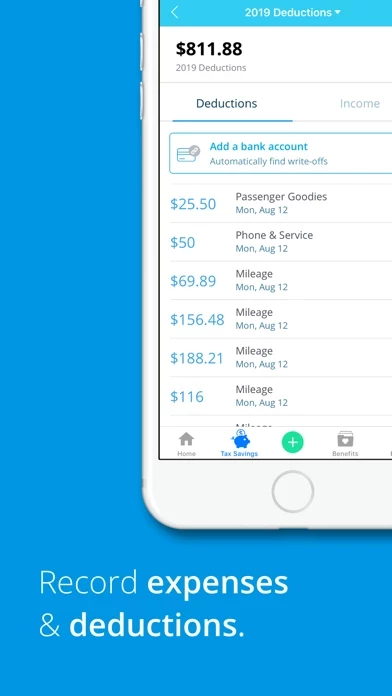

- Finds all the expenses and deductions based on the work users do

- In-app guidance on what expenses can be deducted and how to best track them

- Bank integration to easily import expenses

- Prepares everything needed to file in IRS-ready reports

- Support with all filing methods: e-file, tax filing software, accountant

- Provides all the information needed to audit-proof taxes

- Suitable for various professionals who work for themselves.

Official Screenshots

Product Details and Description of

this app is the FREE mileage and expense tracking tax app that helps you save thousands on your tax bill, all year round. It automatically maximizes your mileage deductions, imports expenses, helps you find money-saving write-offs and makes filing a breeze. Built and designed for people who work for themselves, this app helps you discover business expenses you can claim as an independent worker and makes filing a breeze. Most people save $4,000 or more at tax time by using this app! this app helps you: + Save big on taxes + Track miles automatically + Log expenses like car washes and your cell phone bill + Take the hassle out of filing ================================= Automatically maximize mileage deductions ================================= Just press Start when you leave the house and this app will automatically maximize your mileage deductions and capture them in an IRS-ready standard mileage log format. this app users get $625 back for every 1,000 miles they drive! + Automated GPS mileage tracking + Reminders to make sure you never miss out on miles + IRS-ready mileage logs to audit-proof your deduction ================================= Find money-saving write-offs ================================= We find all the expenses and deductions based on the work you do. On average, this app finds users $200 worth of write offs each week. + In-app guidance on what expenses you can deduct and how to best track + Bank integration to easily import expenses ================================= Get an IRS-ready tax report for easy filing ================================= We prepare everything you need to file in IRS-Ready reports. this app users cut their tax bill in half on average (56%). Gather all the information needed to file in an IRS-ready report Support with all filing methods: e-file, tax filing software, accountant Have all the information you need to audit-proof your taxes -------------------------------------- this app is great for: Rideshare drivers Delivery drivers Entertainers Creative professionals Food service professionals Business consultants Sales agents Real estate agents Home service professionals Caregivers Medical professionals Cleaners And many more!

Top Reviews

By Pp62912

Best tool ever!

Part time ridesharing driver, I use it to keep mileage of when I’m out on the road and any expenses for my part time business. Used the data I plugged into this app for my 2017 taxes. this app simplified the tax deduction process. One con was that I had to add all the mileage together from the log. I think the app should give that option. And the only thing I need this app to do is also keep track of personal and commute miles for when I’m working my full time job or not doing ridesharing. I still keep track of them on the app but should have a selection button to tell it it’s for personal or commuting mile so the app doesn’t track the deduction amount. Other than that, awesome app and tool! Saves me a lot of time and money! Thanks!

By cindishka

Easy and exceptional!

Super easy to enter info i.e.: Missed starting a trip and adding ride mileage? It's super easy to add after the fact. Easy To record tax deductible purchases and it tells you what is and is not a deduction. Going on a tax deductible trip? Just press the plus sign and the app does the rest! Driving and forgot to start the app? It reminds you to do so. Finished driving and forgot to turn app off? It reminds you to do that too! So, so easy and accurate! This will save you THOUSANDS come tax time. Also, exceptional customer service and clear communication. Just look at the replies to comments in the reviews here and you see how quick and clear their communication is. HIGHLY RECOMMEND.

By Amir1581

A few requests.

Is there a way to enable or configure the app so that miles are also on display without having to click and open the trips to find out. I am having to individually click on each mile link to find out how many miles I drive for each day since only the dollar amount is displayed. Also. Everytime I scroll down and click a link and get back out it goes back to a default spot. This makes it hard to scroll down to the next item to open. Once I get out of one link it should stay in the same spot so I don't have to scroll back all the way down to the next link.