Oportun - Save, borrow, budget Software

Company Name: Hello Digit, Inc

About: Digit analyzes your spending and automatically saves the perfect amount every day.

Headquarters: San Francisco, California, United States.

Oportun Overview

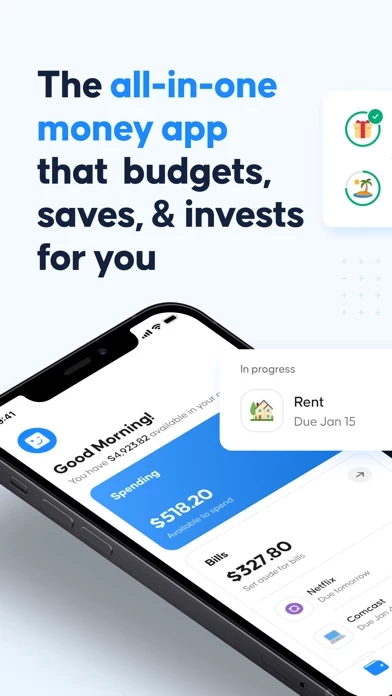

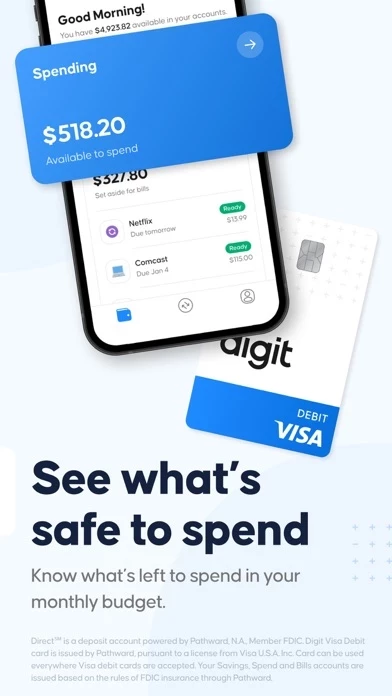

What is Oportun? Digit is a smart bank account that helps users budget for spending, bills, savings, and investing. It guides users' money where they need it most and plans for today, tomorrow, and way, way later. Digit budgets for users so spending, bills, savings, and investments all work together. It also offers a Digit Visa Debit Card that keeps users' money safe and looks good doing it.

Features

- Set up direct deposit to get paid up to 2 days early

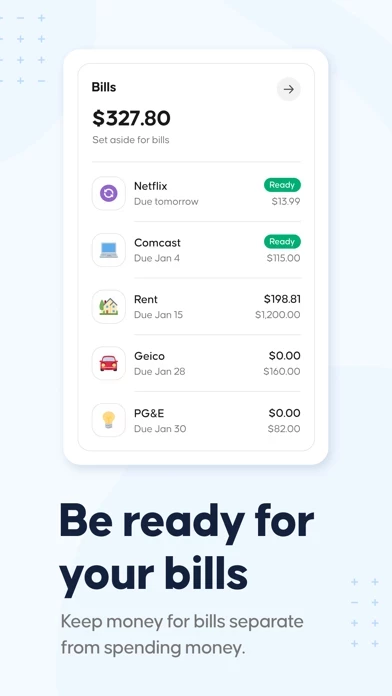

- Add expenses and let Digit budget for bills

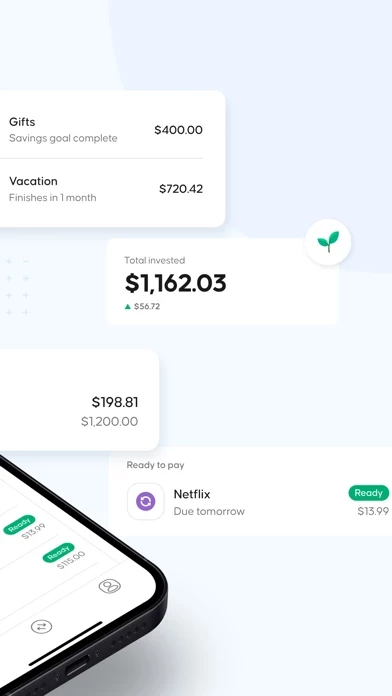

- Tell Digit your saving or investing goals and it saves a little every day to help users reach them

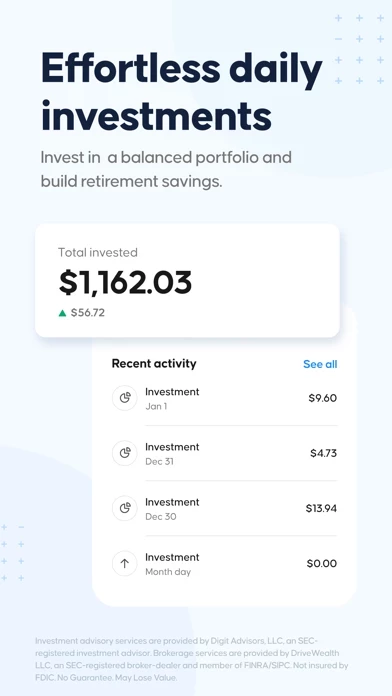

- Effortless investing with long-term investing or Roth or Traditional IRAs

- Digit Visa Debit Card with no ATM fees, card locking, and daily updates

- Digit is free for 6 months and then just $5/month.

Official Screenshots

Product Details and Description of

You deserve a smart bank account that helps you get better with money. Digit budgets for spending, bills, savings, and investing by smartly guiding your money where you need it most. It’s easy to get started: 1. Set up direct deposit to get paid up to 2 days early* 2. Add expenses (things like rent, internet, cable, etc.) 3. Tell Digit your saving or investing goals Digit does the rest, planning for today, tomorrow, and way, way later. Digit budgets for you so spending, bills, savings, and investments all work together. KNOW HOW MUCH TO SPEND No more mental math. Digit tells you how much is available to spend, so you can make smarter spending decisions daily. SMART BUDGETING FOR BILLS Skip the spreadsheets and let Digit budget for you. Digit calculates the right amounts to slowly budget into a dedicated Bills account, so you’re in a good place when it’s time to send a payment. SAVE MONEY WITHOUT THINKING ABOUT IT Digit saves a little every day, so you don’t have to. You can add an unlimited amount of savings goals and Digit will help you reach them all. EFFORTLESS INVESTING** Interested in investing? It’s easy to get started with Digit. Digit knows your spending habits, bills, and how much you’re saving. That info helps Digit calculate how much is right to invest for your situation. There are two ways to invest with Digit: Long-term investing Open a long-term investing account and Digit will help you invest effortlessly. Digit matches you with a balanced portfolio of stocks and bonds that are designed to grow over time. Roth or Traditional IRAs Just like saving up for goals, Digit finds small amounts each day that you won’t feel. You won’t notice it today, but your tomorrow self will thank you very much. DIGIT VISA® DEBIT CARD The Digit Visa Debit Card keeps your money safe and looks good doing it. No ATM fees*** Use your app to find 55,000+ Allpoint ATMs and get cash without paying a fee. Card locking Lose your card? No biggie. Lock your card with a tap in the app. Daily updates Get daily balance updates and notifications about your account. PUT DIGIT TO WORK Digit is free for 6 months and then just $5/month. -------------------------------- Digit is now part of this app. Direct℠ is a deposit account powered by Pathward, N.A., Member FDIC. Digit Visa Debit card is issued by Pathward, pursuant to a license from Visa U.S.A. Inc. Card can be used everywhere Visa debit cards are accepted. *Availability of this feature depends on when we receive your direct deposit instructions from your employer. **Investment advisory services for US-based users with Invest and/or Retire goals are provided by Digit Advisors, LLC, an SEC-registered investment advisor. Brokerage services are provided to clients of Digit Advisors, LLC by DriveWealth LLC, an SEC-registered broker-dealer and member of FINRA/SIPC. Investment accounts are: (i) not insured by FDIC; (ii) not a deposit or other obligation of, or guaranteed by Digit, its affiliates, or another depository institution; (iii) subject to investment risks, including possible loss of the principal amount invested. SIPC protects securities and cash in your Digit Investment and Retirement accounts up to $500,000. For details please see www.sipc.org. ***A fee may apply at ATMs outside the Allpoint network.

Top Reviews

By Stupendous_Weeaboo

Great App!

This app is awesome! The part where is scans your account and saves for you is phenomenal, but you can also manually move funds as well, which is great! In doing so it makes saving mindless and easy while also letting me organize my funds for any large purchases or financial obligations with ease. Withdrawing from digit is simple and easy! You can do it two ways, the first takes a couple days for the money to hit your account after withdraw and that is free of charge, which is awesome! The second, if you need the money ASAP takes only a couple minutes to hit your account, but cost you a dollar. In my mind it’s a dollar... who cares, the total value you receive from the app vastly exceeds the 1 dollar charge for that option or the 3 dollar subscription. Made a whoopsie and over drew? No problem, digit has your back, turn on the overdraft protection in the app (even if you never overdraw your account, it’s a good option to have on), and if it happens digit automatically withdraws from your rainy day fund to cover down on the overdraft, no excess fees. Over all, the app is designed to help you out in as many ways as possible, with financial goals, bigger ticket purchases, financial obligations (rent, mortgage, car payment, etc). High 5 to the developers, you guys a really taking a step in a great direction to help people, keep up the great work!

By TranTracy

Great habit to have when you’re a college student

I’ve been using Digit for a year or so now and I really love it. I have the credit card paying feature on and it’s pretty great. It is like a nice little extra payment to my credit card bills on top of what I already pay. I also love the texts that I get every morning about my account balance because it helps me be more aware of my spending and budget. I love just being able to open the account and be happy that I saved $x without even realizing it. Even if they take little amounts daily, when it accrues, it can be a nice fund to have when you least expect it. I think a lot of these new reviews that give one star are pretty unfair. Most of them seem like communication issues with their bank because I’ve never had much issues. Also, I think $2.99 is fair for the service they do. People can’t expect everything in life to be free. If what you’re saving is not or barely $3 a month, then I think that’s a personal finance issue that you should be focusing on, not the app charging “unfairly” but that’s my opinion. The only thing I would say could use improvement is if they can update my checking account balance closer to real time because sometimes it’s delayed and shows either yesterday’s balance or something.

By Non traditional

Pleasantly Surprised

I have only been using Digit since last month and it has already saved almost $350 from my checking account! I would see the withdrawals from my checking account, but otherwise I put the app out of mind. I decided to check the balance today and was pleasantly surprised with the amount saved already! The savings is the best feature about this app, but there are two more impressive features worth noting. First, it sends me a text every day telling me good morning and most of the time it’s in a different language. How fun! The text also tells me how much money was in my checking account the day before, and how much is in there that day. It includes a link to view recent checking account activity, but I have not used that feature as of yet. Second, Digit has a low balance protection feature and I set mine at $25. This means that Digit will not take any money out of my checking account if my balance is less than $25. But I found something else out yesterday. Digit also transfers money from the app to my checking account if my checking account balance drops below $25! Love it!