EarnIn: Make Every Day Payday Software

Company Name: Activehours Inc.

About: Earnin gives people access to their pay directly from their smartphones, whenever they need it

Headquarters: Palo Alto, California, United States.

EarnIn Overview

What is EarnIn?

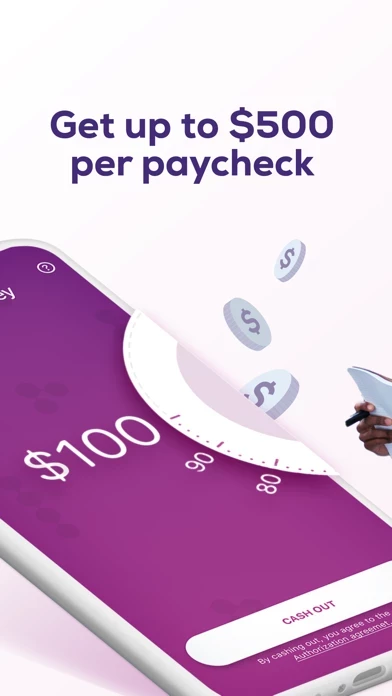

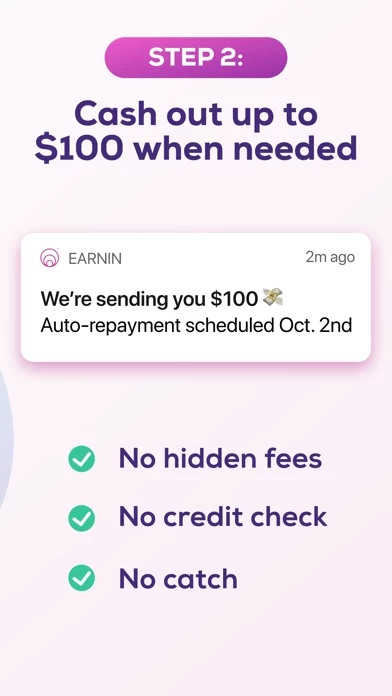

Earnin is a mobile app that allows users to access up to $100 per day or $500 per paycheck in advance of their payday. The app is designed to provide a smarter and faster alternative to cash advances or loans, without any interest, credit checks, or surprises. Users can easily cash out their earnings, track their balance, plan for upcoming payments, and save money using the Tip Yourself feature. The app is backed by 24/7 support and does not require any legal right to repayment.

Features

- Access up to $100 per day or $500 per paycheck in advance of payday

- No interest, credit checks, or surprises

- Add bank and debit card details and submit employer info to verify earnings

- Cash out and receive money in minutes

- Deposit money in Bank of America, Wells Fargo, Capital One, TD Bank, Chase, Navy Federal Credit Union, PNC Bank, USAA Bank, and more

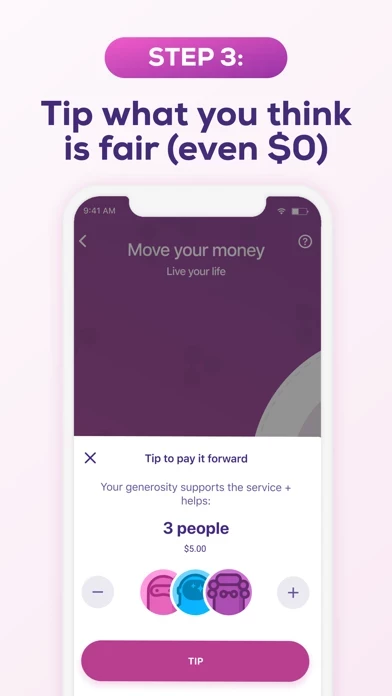

- Save money using the Tip Yourself feature

- Track balance and receive Balance Shield Alerts when bank balance runs low

- Plan for upcoming payments using the Earnin Financial Calendar

- Backed by 24/7 support

- No legal right to repayment

- No minimum or maximum repayment time frame

- Earnin does not sell personal data to third parties.

Official Screenshots

Product Details and Description of

this app is a simple way to get paid early—and live life on your terms. Access up to $100/day or $500/paycheck. Think of it as instant cash you can use before payday to cover anything you need. ‡ Using a cash advance or loan to borrow money can be confusing, misleading, and costly. With this app, you can tap into money you’re already earning—for free.[1] Unexpected bill or upcoming rent? We got you. Plus there’s no interest, no credit checks, and no surprises.‡ Accessing your paycheck in advance is easy. HERE’S HOW IT WORKS: 1. Add your bank and debit card details, then submit your employer info. 2. We’ll verify everything, including the hours you work. 3. Cash out up to $100 per day (up to $500 per pay period). 4. On payday, we'll debit your account for the money you’ve cashed out + any optional tips. 5. Keep cashing out to get paid early—whenever you need. — GET INSTANT CASH Access earnings from your pay in minutes without waiting for payday.[1] By taking advantage of the money you’re already earning, you get a smarter (and faster) alternative to a cash advance or loan. DEPOSITED IN YOUR ACCOUNT Quickly receive your hard-earned cash ahead of payday. We work with Bank of America, Wells Fargo, Capital One, TD Bank, Chase, Navy Federal Credit Union, PNC Bank, USAA Bank, and more. SO YOU CAN SAVE MORE Whereas cash advances and loans are packed with high interest and headaches, this app is designed to work with you for more peace of mind. You can even save a portion of your earnings, using the Tip Yourself feature, to reach your next financial goal even sooner.[3] TRACK YOUR BALANCE Balance Shield Alerts send you notifications whenever your bank balance runs low.[4] PLAN FOR WHAT’S AHEAD The this app Financial Calendar also lets you know ahead of time when you have recurring payments coming up to help you avoid a low balance. BACKED BY 24/7 SUPPORT Questions about getting instant cash from your paycheck in advance? Our Live Chat team is available 24/7, 365 days a year. --- this app has no legal right to repayment. For more information please see this app’s terms and conditions: this app.com/TOS. this app is not affiliated with Chime, Dave, Albert, Brigit, CashNetUSA, Empower, Klover, MoneyLion, Cleo, Cash App, Daily Pay, Google Pay or Credit Karma. this app is not a payday loan, a personal loan, or an app to borrow money. There's no interest or APR to cash out from your paycheck. this app does not require a minimum or maximum repayment time frame. It's simply your money, when you want it. Join this app today, and start making any day payday.‡ this app does not sell your personal data to third parties. Learn more about our privacy policy: this app.com/tos. --- Disclaimers: [1] Fees may apply to use Lightning Speed. Lightning Speed may not be available to all Community Members. Cash Outs may take up to thirty minutes, actual transfer speeds will depend on your bank connection.‡ [2] Tipping options will vary between tools.‡ [3] Tip Yourself Account funds are held with Evolve Bank & Trust, member FDIC and FDIC insured up to $250,000. Tip Yourself is a 0% Annual Percentage Yield and $0 monthly fee service. Your Tip Yourself Account and any Tip Jars are not Savings Accounts.‡ [4] Balance Shield Cash Outs are subject to your available earnings and daily/pay period Max.‡ ‡ Subject to your available earnings and daily pay period max. this app does not charge interest on Cash Outs. Restrictions and/or third party fees may apply. For more info and for our privacy policy, visit this app.com/privacyandterms.

Top Reviews

By trip_a

Very impressed

Me and my husband are a young couple in our 20s he works at Fred Meyer‘s for minimum-wage we get paid every Thursday I have to met I was Little bit on the skeptical side and wondering how much this would truly cost but I literally just set it up in about 12 minutes with the help of customer service chat which was extremely helpful and after 12 minutes of setting it up I borrowed $50 for my nail appointment so I don’t have to cancel it before me and my husband go visit his family it was in my bank in less than a minute and they honest to God let you choose the fee yourself they give you an option from no tip to upwards so you’re super tight you can Little but the tips of what keeps the community going in makes this possible are used to take cash advances from the bank on almost 2 dollars to the dollar this is an answer to prayers for people that have to have a few extra dollars for us he gets paid tomorrow we leave this weekend the only nail appointment I could get was for today on a Wednesday 24 hours before his payday this app was a lifesaver and the people who made it absolutely are putting people first so whatever you do never use the cash advance service again download this app and use it instead do yourself a A favor stop letting cash advance companies and banks rip you off switch to this app and you’ll not regret it very happy customer from Brookings Oregon

By Deblue36

Awesome!

Okay. Let me start off by saying THANK YOU to the app developers, the ones who run this app and everyone involved in this process!! When I first downloaded this app, I was VERY skeptical to put in my banking information. I went on and took a chance when I got into a bind and I am so thankful I did! The app works by seeing your location and how many hours you are at your work address. I thought well, I can’t do that, I work in a different location EVERY day. It does connect to Tsheets and Brink, both of which my company does not use. They provide the option to upload timesheets! Once I screenshot my timesheet and upload it, my earnings are updated within 10 minutes! (I really appreciate YOU, the person who verifies these too!) I only use this in an emergency situation and it keeps people out of debt with check cashing companies which can really financially hurt anyone with the never ending cycle they get you into. Speaking of finance charges, YOU get to choose how much you want to ‘tip’. I ALWAYS tip, even if I’m running low. This service is ALWAYS here when I need it, they need to be paid for the time, efforts, and just for the simple fact they provided me with a service. Sometimes I do tip more because I know there are the people who take advantage of it and don’t tip anything. PLEASE TIP!! Keep this service going and at a low cost for EVERYONE!!! Thanks for an awesome job this app and helping us when needed!! ❤️

By tehBearClaw

Running in circles

I have been trying to no avail to set up this app. For nearly 3 weeks they claimed they were unable to verify my bank account. Everything else had been able to verify. Then suddenly things changed and while my bank was verified, they were unable to verify my payday? What changed in that timeframe? They ask me to send screenshots and then claim that the account info doesn’t match what they have on their records...the same info that I typed in 3 weeks ago, for a bank account I’ve had for nearly 5 years. I then send more screenshots with carefully worded responses because there is clearly not a blanket solution to my issue. I the receive form responses or no response at all. I’ve worked in customer service and currently work in sales, if handled my accounts with such a laissez-faire attitude I wouldn’t have a job. Would love to use the app but it’s been nothing but an enormous headache thus far. UPDATE: about a week after my initial review, my problems were resolved. I have been using the app problem free for a couple months now and can say it is truly as good as it sounds. They give you the money, and it gets deducted when you get paid. I have a partial commission payscale, so being able to pad a light paycheck with money from my large check is godsend when the weeks don’t line up well for things like rent and student loans. I’m updating this to a 5 Star review.