BlockFi Software

Firmenname: BlockFi

Über: BlockFi is a secured non-bank lender that offers crypto-asset-backed USD loans to crypto-asset

owners.

Hauptsitz: Jersey City, New Jersey, United States.

BlockFi Übersicht

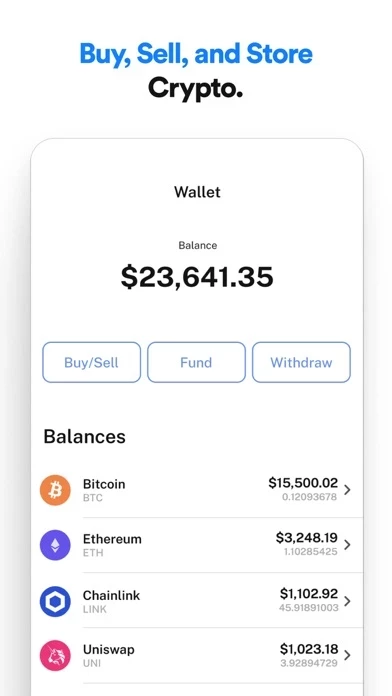

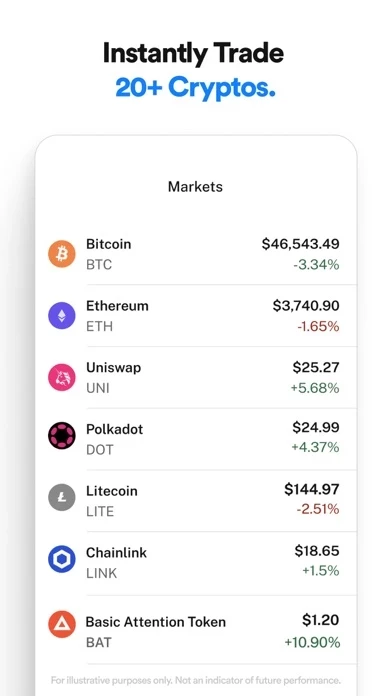

Buy or sell Bitcoin (BTC), Ethereum (ETH), Chainlink (LINK), Litecoin (LTC), and Paxos Gold (PAXG) instantly and immediately start earning interest in crypto on your new asset.

Earn up to 7.5% APY on cryptocurrencies and USD-backed stablecoins including Bitcoin (BTC), Ethereum (ETH), Chainlink (LINK), Litecoin (LTC), Paxos Gold (PAXG), Tether (USDT), USD Coin (USDC), Gemini Dollar (GUSD), and Paxos Standard (PAX).

Invite your friends to BlockFi and for every person that signs up using your referral code and transfers $100 or more into their BlockFi Interest Account (BIA), you and that friend will each earn $10 in BTC.

BlockFi lets you buy, trade, and earn up to 7.5% APY in crypto interest, and borrow cash while you hold your crypto.

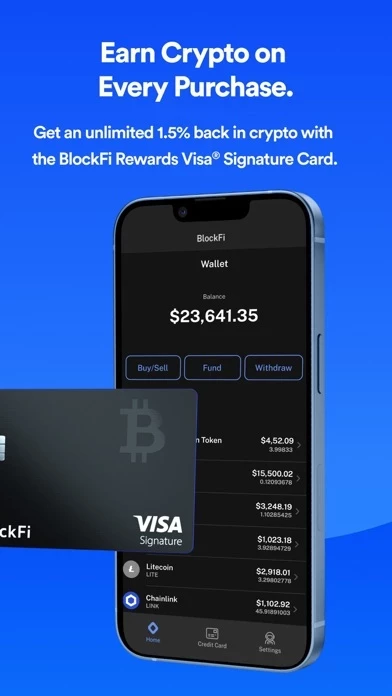

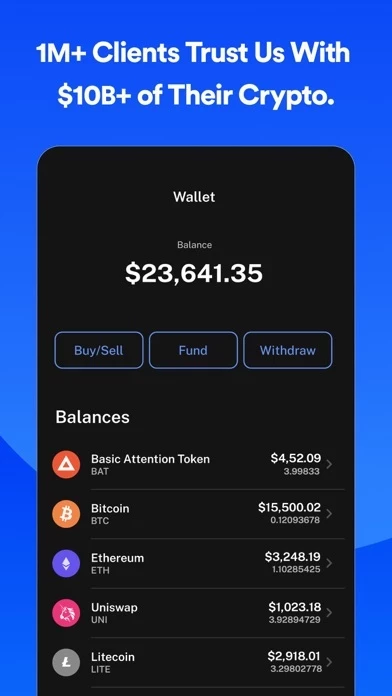

Offizielle Bildschirmfotos

Produkt einzelheiten und Beschreibung von

diese App is a trusted platform to easily build and manage your crypto portfolio Trusted by over 1 million clients in 80+ countries to build and manage their crypto portfolio. We make building wealth through crypto simple and approachable. Buy, sell, trade, and store the most popular digital currencies including Bitcoin, Ethereum, Litecoin, Pax Gold, as well as USD-based stablecoins USDC, USDT, GUSD, and PAX. BUY, SELL, and TRADE BITCOIN AND TOP DIGITAL ASSETS Sign up quickly & buy crypto with no minimum balance. diese App makes buying top cryptocurrencies like Bitcoin, Ethereum, Litecoin, and many more easy and fast. Just connect your bank account or transfer crypto in from another wallet and you’re ready to go. There are no hidden fees, no minimum balances, and you can get started in minutes. Trades are executed instantly with low fees. Set and forget wealth-building with Repeat Buys to easily implement a dollar-cost-averaging financial strategy. EARN UNLIMITED 1.5% BACK IN CRYPTO ON EVERY PURCHASE Introducing the diese App Rewards Visa® Signature Credit Card, the world’s first crypto rewards credit card¹. Earn rewards in BTC, ETH, or any other 15+ cryptos. No annual fee and no foreign transaction fees. See if you’re pre-approved with no impact to your credit score². Available to US residents in qualified states (NY is excluded). Must have a diese App account to apply. STORE & SAFEGUARD CRYPTO AND STABLECOINS WITH diese App WALLET diese App Wallet is a new non-interest-bearing account. This free account with no minimum balance means building a crypto portfolio on a trusted platform has never been easier. diese App Wallet is an easy and reliable way to buy, sell, store, and safeguard your crypto in one convenient place. We give you the tools you need to keep your account and crypto safeguarded with features like Allowlisting so assets can only be withdrawn to your approved addresses, and two-factor authentication to protect your login. EXPERT LEVEL SERVICE FOR ANY LEVEL OF EXPERTISE Whether you’re a crypto pro or just getting started, diese App’s customer service provides US-based phone support as well as 24/7 global help desk to assist with anything you need. BORROW USD AT RATES AS LOW AS 4.5% APR AGAINST YOUR PORTFOLIO You don’t have to sell your crypto to get cash. diese App lets you borrow funds against your crypto with rates as low as 4.5% APR so you can get a loan while you HODL your crypto. Our up to same-business-day loans provide cash without forcing you to liquidate your crypto or trigger taxable events. Finance a house or launch a new venture—whatever you need cash for— without selling your crypto. 1. Applying for the diese App Rewards Credit Card (“Card”) does not guarantee that you will be eligible to receive the Card. Geographic, regulatory, and underwriting restrictions will apply. Fees and terms are subject to change, and additional terms of service will apply to the Card. By applying for the Card, you agree to receive marketing communications pursuant to diese App’s Privacy Policy. 2. A soft credit pull happens before you’ve accepted the credit card offer. A hard credit pull occurs when you’ve accepted your credit card offer, which can have an impact on your credit score.

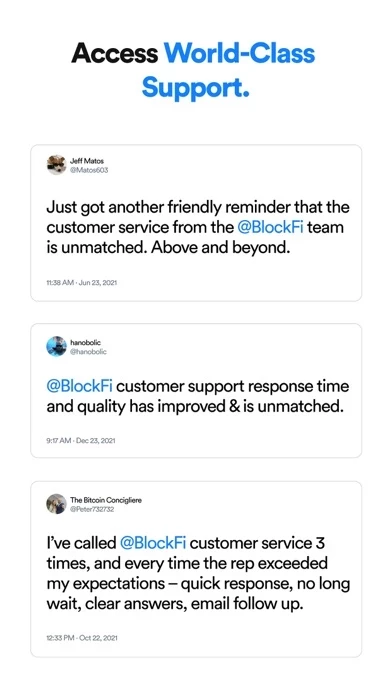

Oben Erfahrungen und Bewertung

durch mercuriosilber

Login issues

Every time I open the app I have to sign in?! Why? Touch or Face ID would be better