OPay-We are beyond Banking funktioniert nicht

Veröffentlicht von OPay Digital Services Limited on 2023-12-08 OPay - The first cashback wallet in Nigeria

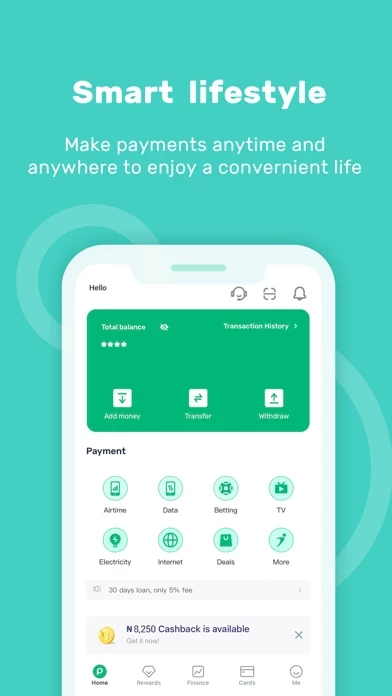

(A secure app that helps you make

convenient payment anywhere you are! )

MORE SERVICES

● Use Now Repay Later

CreditMe is an OPay wallet that allows customers to pay first and repay later.

Up to ₦100,000 credit free to use without any service fee.

Hast du auch Probleme? Wählen Sie unten die Probleme aus, die Sie haben, und helfen Sie uns, Feedback zur App zu geben.

In den letzten 24 Stunden gemeldete Probleme

Gemeldete Probleme: 0 Kommentare

No reports yet! Be the first to report an issue.

Habe ein probleme mit OPay-We are beyond Banking? Probleme melden

Einen Kommentar hinterlassen:

Häufige Probleme mit der OPay-We are beyond Banking app und wie man sie behebt.

Vollständige Anleitung zur Fehlerbehebung der OPay-We are beyond Banking app auf iOS- und Android-Geräten. Lösen Sie alle Probleme, Fehler, Verbindungsprobleme, Installationsprobleme und Abstürze der OPay-We are beyond Banking app.

Inhaltsverzeichnis:

- OPay-We are beyond Banking iPhone Probleme und Lösungen

- OPay-We are beyond Banking iOS App stürzt ab, funktioniert nicht, Fehler

- Netzwerkprobleme der OPay-We are beyond Banking iOS-App

- OPay-We are beyond Banking auf iOS hat einen schwarz/weißen Bildschirm

- OPay-We are beyond Banking Android App Probleme und Lösungen

Wir verstehen, dass einige Probleme einfach zu schwierig sind, um sie durch Online-Tutorials und Selbsthilfe zu lösen. Aus diesem Grund haben wir es einfach gemacht, mit dem Support-Team von OPay Digital Services Limited, den Entwicklern von OPay-We are beyond Banking in Kontakt zu treten..

Bestätigte E-Mail

Kontakt-E-Mail: [email protected]

Kontakt-E-Mail: [email protected]

26.67% Kontaktübereinstimmung

Developer: Seshra Innovation

E-Mail: [email protected]

Annual interest rate is from 36. 5% to 360%. Origination Fee: Range from ₦1,229 – ₦6,000 for one-time charge For example, 91-day loan payment terms have a processing fee of 41% and interest of 9. 1%. For the loan processed with principal amount of ₦3,000; the processing fee would be ₦1,229; the interest would be ₦273; the total amount due would be ₦4,502. The total amount due in the second month would be ₦1,495; the processing fee would be ₦405; the interest would be ₦90. The total amount due in the third month would be ₦1,495; the processing fee would be ₦405; the interest would be ₦90. The total amount due in the first month would be ₦1,512; the processing fee would be ₦419; the interest would be ₦93. Loan Products: Tenure: We will require your repayment from the 91st day to the 365th day*. Loan Amount: from ₦3,000 to ₦500,000. Interest Rate: With a minimum of 0. 1% to a maximum of 1% Our interest rate is calculated on a daily basis. Just search for a nearby merchant directly on the app and complete your daily transactions. ● The leading Mobile Payment platform in Nigeria, with over 8 million users. ● Get cashback when you pay for Airtime, bills and more. ● OPay attaches great importance to protecting users‘ information, wallets and privacy. At the end of the annual savings date, the amount of return you will get is: ₦50,000 x 15 / 100 = ₦7,500, that means you will get ₦57,500 back at the end of your saving tenure. OPay provides you with seamless, and most importantly: free and discounted services! CreditMe is an OPay wallet that allows customers to pay first and repay later. We have a dedicated support team available 24/7 for all your inquiries and complaints. Email: support@opay-inc. com or ng-support@opay-inc. Enjoy free OPay transfers! OWealth provides you with at least 15% rate of return per annum. (A secure app that helps you make convenient payment anywhere you are! Our 300,000 merchant network will offer these services. For Example: Let’s say you invest ₦50,000 for one year.