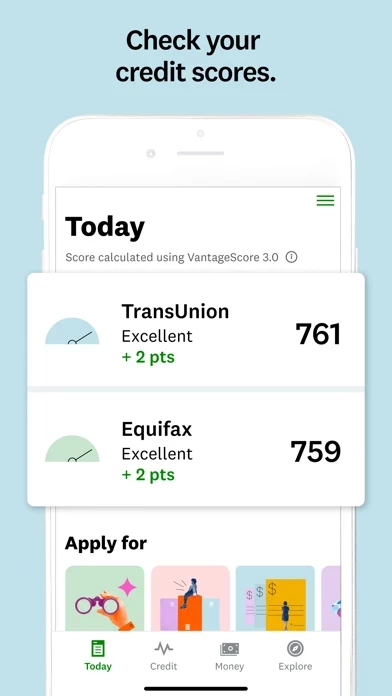

- Free credit score checking

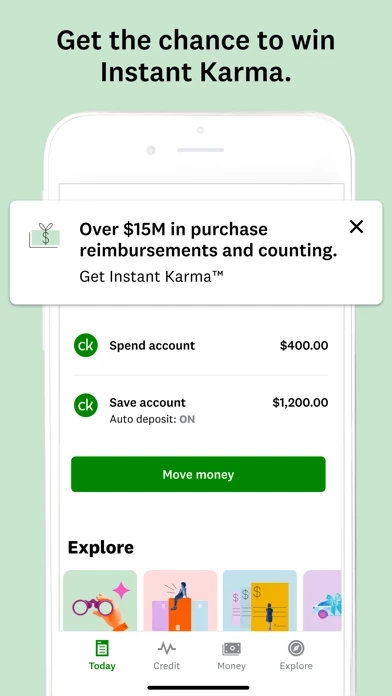

- Credit Karma Money Spend, a checking experience with Early Payday and a daily chance to win Instant Karma cash reimbursements for debit card purchases

- Credit Karma Money Save, an interest-bearing savings account with no fees and a monthly chance to win $20,000

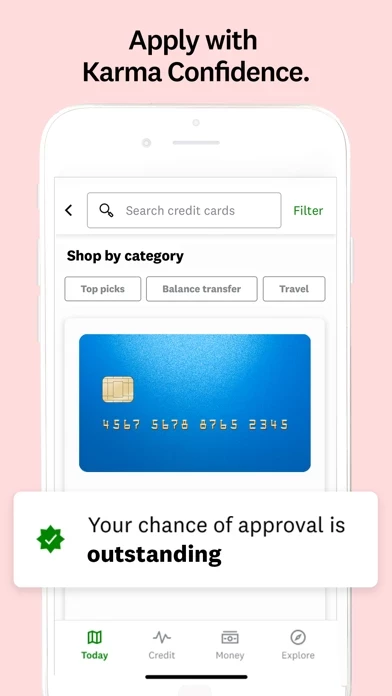

- Karma Confidence, personalized offers and insights to help users know their chances of approval for a personal loan or credit card before they apply

- Credit card browsing based on unique credit profile

- Auto savings and more, including tuning up auto loans, saving on insurance, seeing open recalls, and finding vehicle records

- Karma Drive, tracking safe driving score to see if users can unlock lower car insurance rates

- Home affordability calculator, personalized home loan offers, and mortgage pre-qualification letter

- Personal loan shopping, comparing personal loan offers to save on interest rates

- Relief Roadmap, connecting users to government stimulus programs, unemployment benefits, debt relief opportunities, loan options, and more

- Free ID monitoring to spot potential identity theft and get tips for keeping personal information safer

- Free credit monitoring to get credit alerts when important changes happen to Equifax or TransUnion credit reports.