Capital One Mobile Reviews

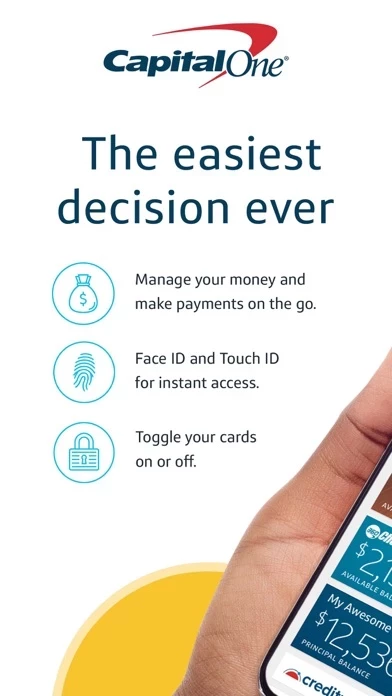

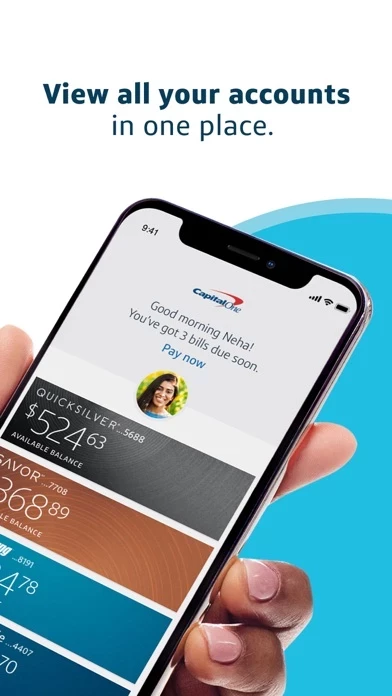

Published by Capital One on 2023-12-04 About: What’s on the Capital One Mobile app? All of your accounts, and so much

more.

Whether you’re out in the world or feeling right at home, you can

manage your money with ease:

- View balances and export statements

- Pay bills

and take care of loans

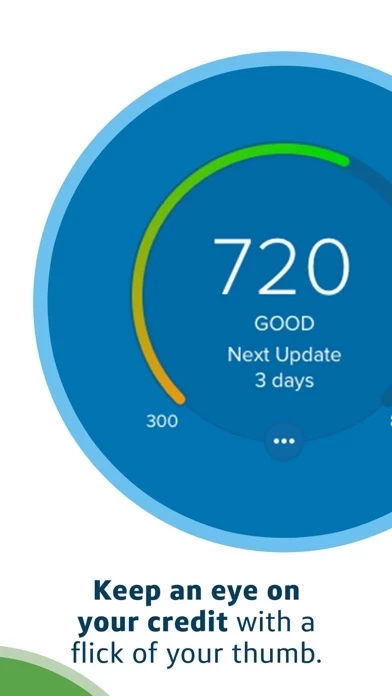

- Check in on your credit with CreditWise

- Activate a

credit or debit card when you need it

- Redeem rewards on the go

- Send and

receive money with friends and family using Zell.