How to Delete CARD.com Premium Banking

Published by Card Corporation on 2023-11-28We have made it super easy to delete CARD.com Premium Banking account and/or app.

Guide to Delete CARD.com Premium Banking

Things to note before removing CARD.com Premium Banking:

- The developer of CARD.com Premium Banking is Card Corporation and all inquiries must go to them.

- Under the GDPR, Residents of the European Union and United Kingdom have a "right to erasure" and can request any developer like Card Corporation holding their data to delete it. The law mandates that Card Corporation must comply within a month.

- American residents (California only - you can claim to reside here) are empowered by the CCPA to request that Card Corporation delete any data it has on you or risk incurring a fine (upto 7.5k usd).

- If you have an active subscription, it is recommended you unsubscribe before deleting your account or the app.

How to delete CARD.com Premium Banking account:

Generally, here are your options if you need your account deleted:

Option 1: Reach out to CARD.com Premium Banking via Justuseapp. Get all Contact details →

Option 2: Visit the CARD.com Premium Banking website directly Here →

Option 3: Contact CARD.com Premium Banking Support/ Customer Service:

- 90.91% Contact Match

- Developer: CARD.com

- E-Mail: [email protected]

- Website: Visit CARD.com Premium Banking Website

How to Delete CARD.com Premium Banking from your iPhone or Android.

Delete CARD.com Premium Banking from iPhone.

To delete CARD.com Premium Banking from your iPhone, Follow these steps:

- On your homescreen, Tap and hold CARD.com Premium Banking until it starts shaking.

- Once it starts to shake, you'll see an X Mark at the top of the app icon.

- Click on that X to delete the CARD.com Premium Banking app from your phone.

Method 2:

Go to Settings and click on General then click on "iPhone Storage". You will then scroll down to see the list of all the apps installed on your iPhone. Tap on the app you want to uninstall and delete the app.

For iOS 11 and above:

Go into your Settings and click on "General" and then click on iPhone Storage. You will see the option "Offload Unused Apps". Right next to it is the "Enable" option. Click on the "Enable" option and this will offload the apps that you don't use.

Delete CARD.com Premium Banking from Android

- First open the Google Play app, then press the hamburger menu icon on the top left corner.

- After doing these, go to "My Apps and Games" option, then go to the "Installed" option.

- You'll see a list of all your installed apps on your phone.

- Now choose CARD.com Premium Banking, then click on "uninstall".

- Also you can specifically search for the app you want to uninstall by searching for that app in the search bar then select and uninstall.

Have a Problem with CARD.com Premium Banking? Report Issue

Leave a comment:

Reviews & Common Issues: 4 Comments

By Candessa celino

11 months agoDelete my account please

By Nicolas Sistos Gomez

1 year agoI had mist spelled my Name Wrong that's going on my card G card.so I'll like to cancel that card

By Brittany Fuller

1 year agoMy account is closed I need it opened and a new card.

By Lakeshia ray

2 years agoLakeshia ray My number is 7858616053 I no longer have access to the Gmail and phone number hooked up to my card premium banking and I just received my new card in the mail and every time I call it it won't let me activate it I really need help getting my funds off my card transferred to a different bank account or send me a check please and thank you

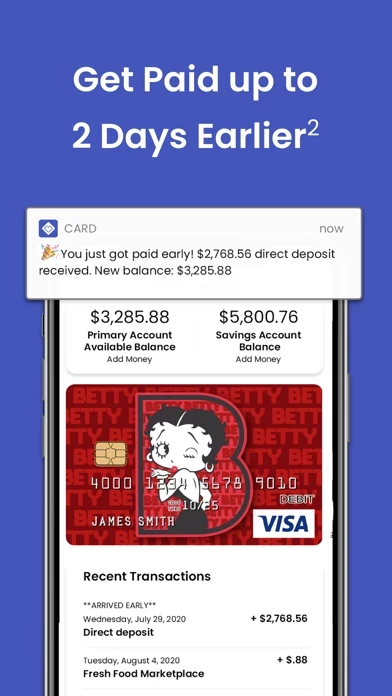

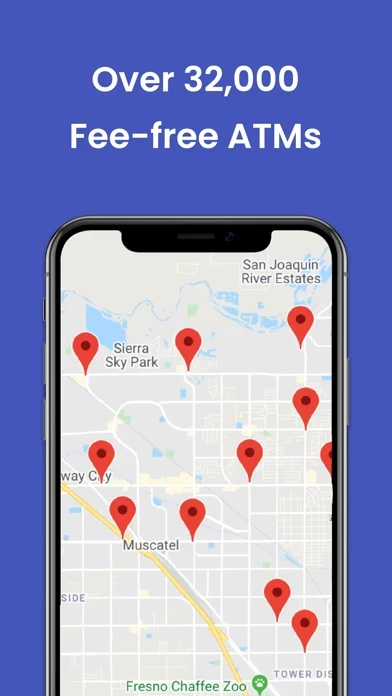

What is CARD.com Premium Banking?

CARD Premium Bank Account by MetaBank® offers all the premium banking features: 1. Get paid up to 2 days faster with QuickPay** 2. Optional overdraft protection*** 3. Optional savings account with round ups **** 4. Funds are FDIC insured through MetaBank ***** 5. Over 32,000 fee-free MoneyPass® ATMs 6. No minimum balance. No Credit Check. 7. Compatible with Apple Pay®, Google Pay®, Venmo®, CashApp® and more Plus, over 12,000 card designs for your debit card. All for $0 Monthly Fee*. The Card Premium Bank Account is a checking account established by, and the Premium Visa Debit card is issued by MetaBank, N.A., Member FDIC, pursuant to a license from Visa U.S.A. Inc, and can be used everywhere Visa debit cards are accepted. 1*. While this specific feature is available for free, certain other transaction fees and costs, terms, and conditions are associated with the use of this Account. See the Accountholder Agreement for more details. 2**. Faster access to funds is based on a...