How to Cancel Empower

Published by Empower Finance on 2024-01-04We have made it super easy to cancel Empower: Cash Advance & Credit subscription

at the root to avoid any and all mediums "Empower Finance" (the developer) uses to bill you.

Complete Guide to Canceling Empower: Cash Advance & Credit

A few things to note and do before cancelling:

- The developer of Empower is Empower Finance and all inquiries must go to them.

- Cancelling a subscription during a free trial may result in losing a free trial account.

- You must always cancel a subscription at least 24 hours before the trial period ends.

How easy is it to cancel or delete Empower?

It is Very Easy to Cancel a Empower subscription. (**Crowdsourced from Empower and Justuseapp users)

If you haven't rated Empower cancellation policy yet, Rate it here →.

Pricing Plans

**Gotten from publicly available data and the appstores.

Empower charges an auto-recurring monthly subscription fee of $8 (after the 14-day free trial concludes for first-time customers) and immediately for customers returning for a second or subsequent subscription.

Potential Savings

**Pricing data is based on average subscription prices reported by Justuseapp.com users..

| Duration | Amount (USD) |

|---|---|

| If Billed Once | $8.14 |

| Monthly Subscription | $10.67 |

How to Cancel Empower: Cash Advance & Credit Subscription on iPhone or iPad:

- Open Settings » ~Your name~ » and click "Subscriptions".

- Click the Empower (subscription) you want to review.

- Click Cancel.

How to Cancel Empower: Cash Advance & Credit Subscription on Android Device:

- Open your Google Play Store app.

- Click on Menu » "Subscriptions".

- Tap on Empower: Cash Advance & Credit (subscription you wish to cancel)

- Click "Cancel Subscription".

How do I remove my Card from Empower?

Removing card details from Empower if you subscribed directly is very tricky. Very few websites allow you to remove your card details. So you will have to make do with some few tricks before and after subscribing on websites in the future.

Before Signing up or Subscribing:

- Create an account on Justuseapp. signup here →

- Create upto 4 Virtual Debit Cards - this will act as a VPN for you bank account and prevent apps like Empower from billing you to eternity.

- Fund your Justuseapp Cards using your real card.

- Signup on Empower: Cash Advance & Credit or any other website using your Justuseapp card.

- Cancel the Empower subscription directly from your Justuseapp dashboard.

- To learn more how this all works, Visit here →.

How to Cancel Empower: Cash Advance & Credit Subscription on a Mac computer:

- Goto your Mac AppStore, Click ~Your name~ (bottom sidebar).

- Click "View Information" and sign in if asked to.

- Scroll down on the next page shown to you until you see the "Subscriptions" tab then click on "Manage".

- Click "Edit" beside the Empower: Cash Advance & Credit app and then click on "Cancel Subscription".

What to do if you Subscribed directly on Empower's Website:

- Reach out to Empower Finance here »»

- Visit Empower website: Click to visit .

- Login to your account.

- In the menu section, look for any of the following: "Billing", "Subscription", "Payment", "Manage account", "Settings".

- Click the link, then follow the prompts to cancel your subscription.

How to Cancel Empower: Cash Advance & Credit Subscription on Paypal:

To cancel your Empower subscription on PayPal, do the following:

- Login to www.paypal.com .

- Click "Settings" » "Payments".

- Next, click on "Manage Automatic Payments" in the Automatic Payments dashboard.

- You'll see a list of merchants you've subscribed to. Click on "Empower: Cash Advance & Credit" or "Empower Finance" to cancel.

How to delete Empower account:

- Reach out directly to Empower via Justuseapp. Get all Contact details →

- Send an email to [email protected] Click to email requesting that they delete your account.

Delete Empower: Cash Advance & Credit from iPhone:

- On your homescreen, Tap and hold Empower: Cash Advance & Credit until it starts shaking.

- Once it starts to shake, you'll see an X Mark at the top of the app icon.

- Click on that X to delete the Empower: Cash Advance & Credit app.

Delete Empower: Cash Advance & Credit from Android:

- Open your GooglePlay app and goto the menu.

- Click "My Apps and Games" » then "Installed".

- Choose Empower: Cash Advance & Credit, » then click "Uninstall".

Have a Problem with Empower: Cash Advance & Credit? Report Issue

Leave a comment:

Reviews & Common Issues: 3 Comments

By Julien forletta

2 years agoHello. I cancelled my subscription last week and you’re still taking a portion of my Paycheck . Why is this happening

By Rebecca Ames

3 years agoCancel my subscription and give me my money back

By Israel R Smith

3 years agoGive me back the goddamn money u stole from me u crooked bastards

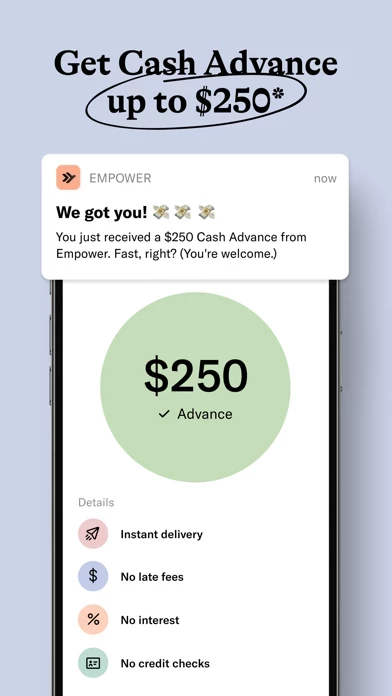

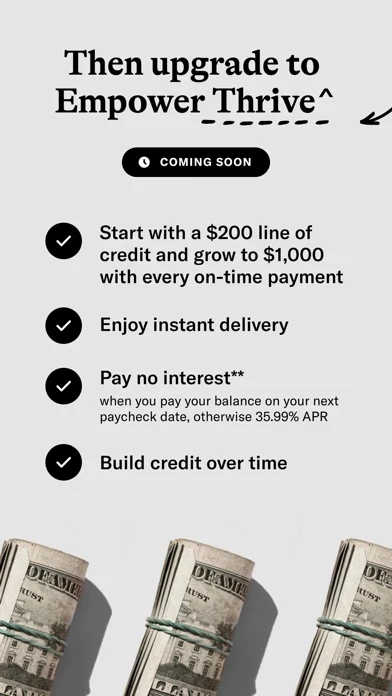

What is Empower: Cash Advance & Credit?

Think the credit system is stacked against you? So do we. this app is on a mission to help more people access affordable credit, build their credit history, and rewrite their financial story. No credit score or security deposit to qualify. (this app is a financial technology company, not a bank. Banking services provided by nbkc bank, Member FDIC. this app Thrive provided by FinWise Bank, Member FDIC.) GET CASH ADVANCE UP TO $250* Tight on cash and tired of asking friends to cover you? this app will float you up to $250 when you need it most. Instant delivery available. No interest, no late fees, no credit checks. Just pay us back when you get your next paycheck. BUILD UP TO $1,000 OVER TIME WITH AN this app THRIVE REVOLVING LINE OF CREDIT^ (COMING SOON!) Start with a $200 revolving line of credit and grow to $1,000 with every on-time payment. Enjoy instant delivery and 0% APR** (when you pay your balance on your next paycheck date, otherwise 35.99% APR). Building credit just got a whole lot easier. GET YOUR PAYCHECK UP TO 2 DAYS FASTER† Wish payday came sooner? Wish no more. With the this app Card, you can get paid up to 2 days earlier than most banks. GET UP TO 10% CASHBACK† Perks of a credit card but with a debit card. With the this app Card, save money on the places where you shop already, like restaurants, grocery stores, gas stations, and more. No overdraft fees. GET FREE ATM WITHDRAWALS Enjoy convenient access with the this app Card to over 37,000 MoneyPass ATMs acr...