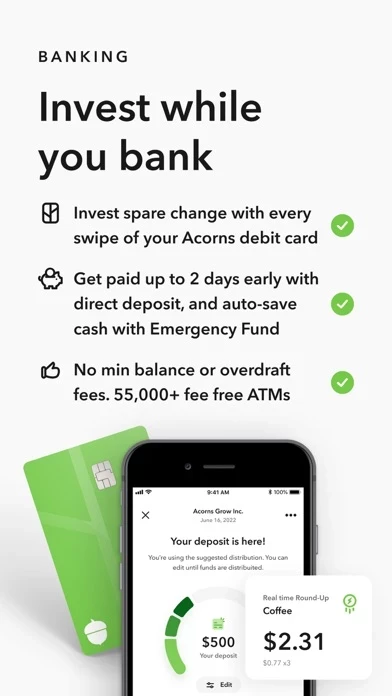

- Automatic Round-Ups®: Invest spare change from everyday purchases.

- Recurring Investments: Invest in the background of life with automatic investments.

- IRA plans: Save for retirement with SEP, Traditional, and Roth plans.

- Acorns Early: UTMA / UGMA investment account for kids.

- Acorns Checking: Checking account with a heavy metal debit card that invests when you spend.

- Emergency Fund: Set a goal and automatically save a piece of each paycheck.

- Rewards: Shop 15,000+ brands and receive bonus investments, search for jobs, and earn referral bonuses.

- Financial literacy content: Custom content to help users grow their knowledge.

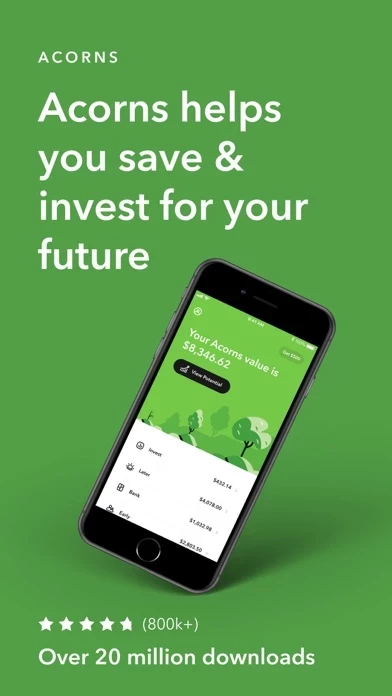

- Mission-led partner: Acorns aims to look after the financial best interests of the up-and-coming, beginning with micro-investing.

- Investing philosophy: Acorns believes in the power of compounding, diversification, and sticking with it for long-term growth.

- Backed by: Investors like Blackrock, CNBC, PayPal, Dwayne Johnson, Jennifer Lopez, Steve Harvey, and Ashton Kutcher.

- Security: Bank-level security and data encryption.

- Pricing: Acorns Personal for $3/month and Acorns Family for $5/month.